The Hidden History of Policy Theft & Skyrocketing Gold

As gold continues to rocket north with continuous all-time highs, some investors are still wondering, well… why?

The answer has less to do with gold’s consistent physical and monetary properties, and more to do with historical human –and hence policy—weakness, which makes this metal almost too easy to understand.

Let’s dig in.

Lead to Temptation

Some crimes are harder to see than the classic patterns of masked men robbing citizens at gunpoint.

Here, we examine the ironic yet hard truth that unmasked policy makers are deliberately and quietly robbing their citizens with embarrassing impunity.

This temptation toward sovereign sins hiding in plain sight is done without black cowboy hats or stuffing cash into a burlap bag while scared bystanders hold their hands in the air.

Instead, politicos, in neckties and blue suits, commit identical theft with far greater subtlety and destruction—smiling the entire time for re-election.

How?

Currency De-Valuation as Policy: History 101

The answer, as always, lies in the history and math of deliberate currency devaluation to pay down unfathomable sovereign debts by robbing from the people.

To see this clearly, let’s start with a little history.

As far back as the 1500s, Sir Thomas Gresham (from which “Gresham’s Law” originated) explained that whenever trusted money (i.e., gold) circulates at the same time as bad currency (i.e., paper/fiat “money”), some folks eventually figure out that it is better to save in gold and spend in fiat.

From Ancient Rome Onwards

These patterns go as far back as ancient Rome, when leaders—over their ears in debt from too many promises, wars and drunken spending—began to chip away at the silver in their Denarius coins, debasing their currency to “pay” down debt.

Eventually (over a period of about 250 years), this resulted in a Denarius with zero silver content.

Medieval Europe later followed this desperate playbook by replacing its gold money with copper money.

The French did a similar debasement in the 1780s, and it ended with a lot of rolling heads…

This is because real money eventually drives out bad currencies whenever a fiat system approaches its breaking point.

This cycle became an economic rule which the 18th century French economist, Adolphe Thiers, spelled out clearly and which history subsequently confirmed from the wheelbarrow money of Weimar Germany to similar currency/debt debacles in Zimbabwe and Venezuela.

In such contexts of extreme debt and debased currencies, no one wants to hold worthless paper money.

The desire for real money-gold-becomes a desperate and historical thirst.

Gone With the Wind

During the US Civil War, for example, the Confederate States of 1865 were on their last leg, as its Army of Northern Virginia bled out during the Petersburg siege.

The army’s commander, Robert E. Lee, was obviously worried about saving his dwindling troops, but in the waning hours of the Confederacy, the primary theme of the letters to his most trusted general, James Longstreet, centred around gold rather than cannons, artillery or horses.

Why?

Because without real money, even his most devoted soldiers could not be supplied.

Unfortunately, their fiscally over-stretched Confederate President, Jefferson Davis, had already debased the Confederate currency to pay debts which their rebel economy could not sustain.

Wages, salaries and savings could not keep up with inflation rates (currency debasement), which not even the cleverest liars in Richmond could hide or deny.

After failed policies of familiar financial repression and capital controls, the jig was up on the rebel currency, and gold mattered more than bullets…

But there was not enough gold to go around.

Not long after, the Confederacy, like so many other paper-currency nations before and since, was gone with the wind…

But Not the USD!?

Some, of course, will rightly say: “The US today is nothing like ancient Rome, Weimar Germany or the Rebel South of 1865!”

Well, yes and no…

The USA (and USD) is certainly stronger than 19th 19th-century Confederate currency, a 3rd-century Roman Denarius or the German Mark of 20th 20th-century Weimar.

But debt is still debt, and US debt is embarrassing…

And global debt is no less so…

Unfortunately, Gresham’s law, like Thiers’ rules, still apply as much today as yesterday. The death just takes a little longer for a world reserve currency…

What we are seeing today with the USD’s open decline and mis-reported inflationary decay is, in fact, nothing new to man, history or economic rules.

Inflation Is Theft

Take another forgotten truth-teller of the forgotten science of honest economics, the 18th century Irish/Frenchman, Richard Cantillon, from which the “Cantillon Effect” got its name.

The Cantillon Effect, like history, teaches us that inflation is not only a deliberate theft by policy makers, but also a wealth transfer from the masses to the elites—something familiar to anyone paying attention to US history…

Cantillon shows how new money (i.e., printed or mouse-clicked money) is not accidental nor class-blind.

New money always goes to (and enriches) the top 10% first before it later shafts the bottom 90% second.

That is, the elites, who already own stocks and real estate (90% of US stocks are held by the top 10%), are the first to benefit from the obvious inflation in stocks and real estate, which always follows money creation in lock-step.

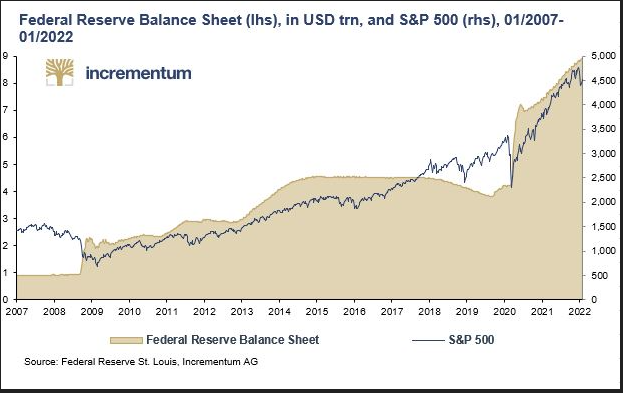

The TARP/QE-rescued Wall Street, for example, saw this first hand, when every new version of QE correlated 1:1 with a rise in a stock market drunk on the money printed post-GFC/2008.

In fact, commercial banks saw their greatest bonuses the very year that those same banks nearly broke the economy on a subprime mortgage scandal/scam.

But Main Street, temporarily quieted by stimmy checks, was slowly measuring their wages and savings accounts in dollars whose inherent purchasing power was melting by the day from the currency expansion which saved Wall Street while slowly gutting Main Street.

This inflation, of course, is an invisible theft, one which starts slowly and then comes all at once.

Dishonesty as Deliberate Policy

Average citizens feel themselves getting poorer while their leadership tells them inflation is only “transitory” or contained within “a 2-3% target range”—all of which is an open lie.

Actual (as opposed to “reported”) inflation is compounding at levels of at least 10% per year, which means the absolute purchasing power of the USD is dying at a similar rate.

US M2 money supply has expanded by 40% since 2020, which means the USD is effectively debasing at a similar rate.

This is precisely what policy makers in debt (from ancient Rome to modern DC) need to do in order to pay down debt with devalued money.

In other words, policy makers crush the currency—and hence the people—to sustain their debt and themselves.

But as clever thieves, policy-makers (central bankers, treasury secretaries and national leaders) do this slowly and with deliberate complexity, as well as with deliberate dishonesty, a fact which a more modern economist, Charles Goodhart, made clear in the 1970s.

That is, Goodhart was among the first to reveal that whenever sovereigns create inflation, growth or employment “targets” they are almost always, well: Lying.

And as we, and many others, have written with facts rather than drama, the tools, math, and tricks used to measure employment, inflation, growth, and even the definition of recession are all open lies to anyone willing to look under the hood of the creative math and writing coming out of DC, Brussels or London…

History Made Current

If we apply the admittedly simplified historical lessons and economic rules above to today’s current headlines, as to: 1) the decline of the dollar and 2) the undeniable rise in gold, we see our situation with almost eerie clarity: The more things change, the more they stay the same.

Just as Gresham and Thiers warned, central banks as well as informed investors have already begun to see the debasement of paper money.

They increasingly prefer real money – gold – over fiat toilet paper, even if that paper is the world’s reserve currency.

This explains the BRICS+ rise and open de-dollarization process away from the greenback and UST, which is no longer a slow-drip trend but a rapidly expanding direction.

This explains how the DXY has sunk below 100 since the US M2 expansion became desperate.

This explains why central banks have been net stacking gold and net selling USTs since 2014.

This explains why 20% of global oil sales are now occurring outside the US petrodollar.

This explains the open panic and disintegration on the COMEX and London exchanges, who are seeing net outflows of physical gold to satisfy counterparty thirst for the metal.

This explains why even the BIS has made gold a Tier-1 asset.

This explains why the IMF sees pure gold as fundamental to its otherwise impure CBDC initiatives.

This explains the three consecutive years of central bank gold stacking at record levels of above 1000 tons per annum since the USA weaponized the USD in 2022.

This explains why central banks now hold more gold than USTs on their balance sheets for the first time since 1996.

This explains why even Morgan Stanley must now openly confess/recommend a 20% gold allocation.

This explains why Judy Shelton wants to introduce a gold-backed UST.

This explains the desperation of the Genuis Act to create stablecoin demand for otherwise unloved USTs and USDs.

In short, and just as Gresham and Thiers warned centuries ago, the world is hoarding gold and turning away from bad money.

And just as history also warned, the USD is being openly devalued to pay down a debt crisis of their own making.

We’ve Seen this Movie/De-Valuation Before

But this, too, is nothing new for our clever thieves from above.

In 1933, FDR, by executive order, confiscated gold at $20/ounce and then, overnight, revalued it to $35/ounce, and in doing so, devalued the dollar by 69% in order to make its debt burden 69% less onerous.

In 1971, Nixon shamelessly welched on the USD and the world by removing its gold backing. Since then, the dollar has lost well over 90% of its purchasing power.

Honest vs. Dishonest Money

Such measures certainly made Uncle Sam’s appalling bar tab easier to repay, but only by gut-punching those trusting citizens who measure their wealth, savings, portfolio returns and retirement in USDs.

And that, ladies and gentlemen, is how policymakers attempt to stay in power– by quietly robbing their citizens of paper wealth, which in the end, is slowly no wealth at all.

And that too, fully explains the record highs and headlines in the current gold price, for gold is not rising due to speculative mania, it’s merely and honestly reflecting its relatively superior value over dishonest paper money—something gold has done throughout history.

As noted bluntly before, Gold is the lie detector for a broken financial system.

Or stated even more clearly: Gold is rising because corrupted fiat money is falling, yet again…

*********