How Will March CPI Affect Gold?

According to the U.S. Department of Labor, the Consumer Price Index (CPI) rose by 0.1 percent in March. Does it mean that inflation is rising, which would bring us closer to the next Fed hike? How can this data affect the gold market?

According to the U.S. Department of Labor, the Consumer Price Index (CPI) rose by 0.1 percent in March. Does it mean that inflation is rising, which would bring us closer to the next Fed hike? How can this data affect the gold market?

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in March, following a 0.2 percent decline in February. The core CPI, which excludes energy and food, rose 0.1 percent, following a 0.3 percent increase in February. It was the smallest increase since August 2015, which shows that the inflationary pressure is not building. The rise in the CPI was partially driven by a 0.9 percent increase in energy prices (the first jump in four months), which offset lower prices for groceries (the food index fell 0.2 percent).

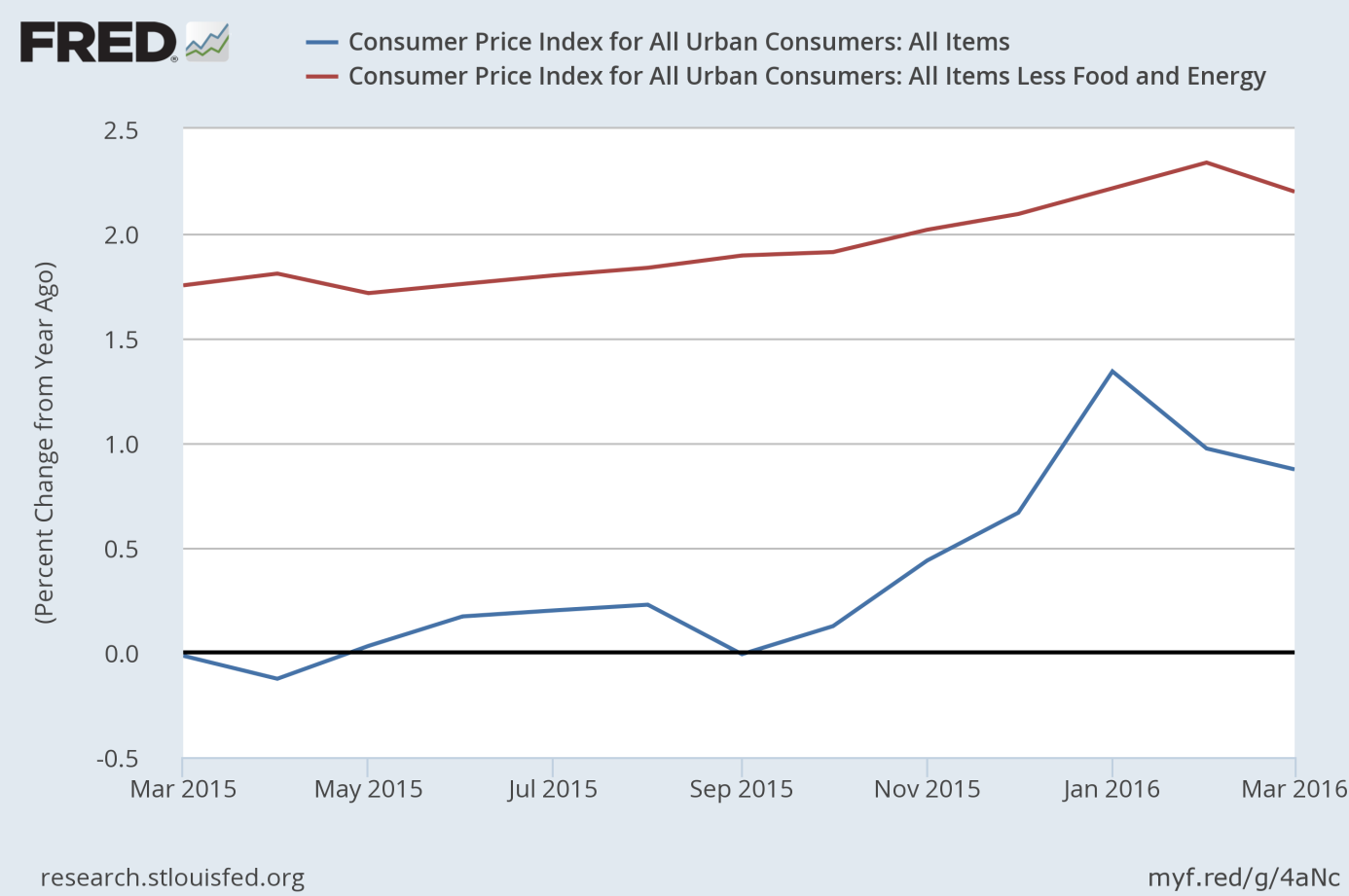

On an annual basis, the CPI rose 0.9 percent, while the core CPI increased 2.2 percent. Both indexes moved slightly less than in February (1.0 percent and 2.3 percent, respectively). It means that the recent inflation upswing (see the chart below) may not be sustainable.

Chart 1: CPI (blue line) and core CPI (red line) from March 2015 to March 2016.

It is worth pointing out that the inflationary pressure is softening despite the rise in energy prices. Producer prices also do not show any inflationary trends in the U.S. economy. Wholesale prices fell 0.1 percent in March (despite the big increase in gas prices) while core PPI was flat. In the past 12 months, the PPI declined 0.1 percent, while core prices rose only 0.9 percent.

How will the recent inflation number affect the gold market? Well, it is not easy to say. On the one hand, it may convince the Fed to prolong its waiting mode, as it suggests that price pressures remain muted. Given that the U.S. central bank would like to see inflation rise before it hikes interest rates again, the March report on the CPI should be positive for the price of gold.

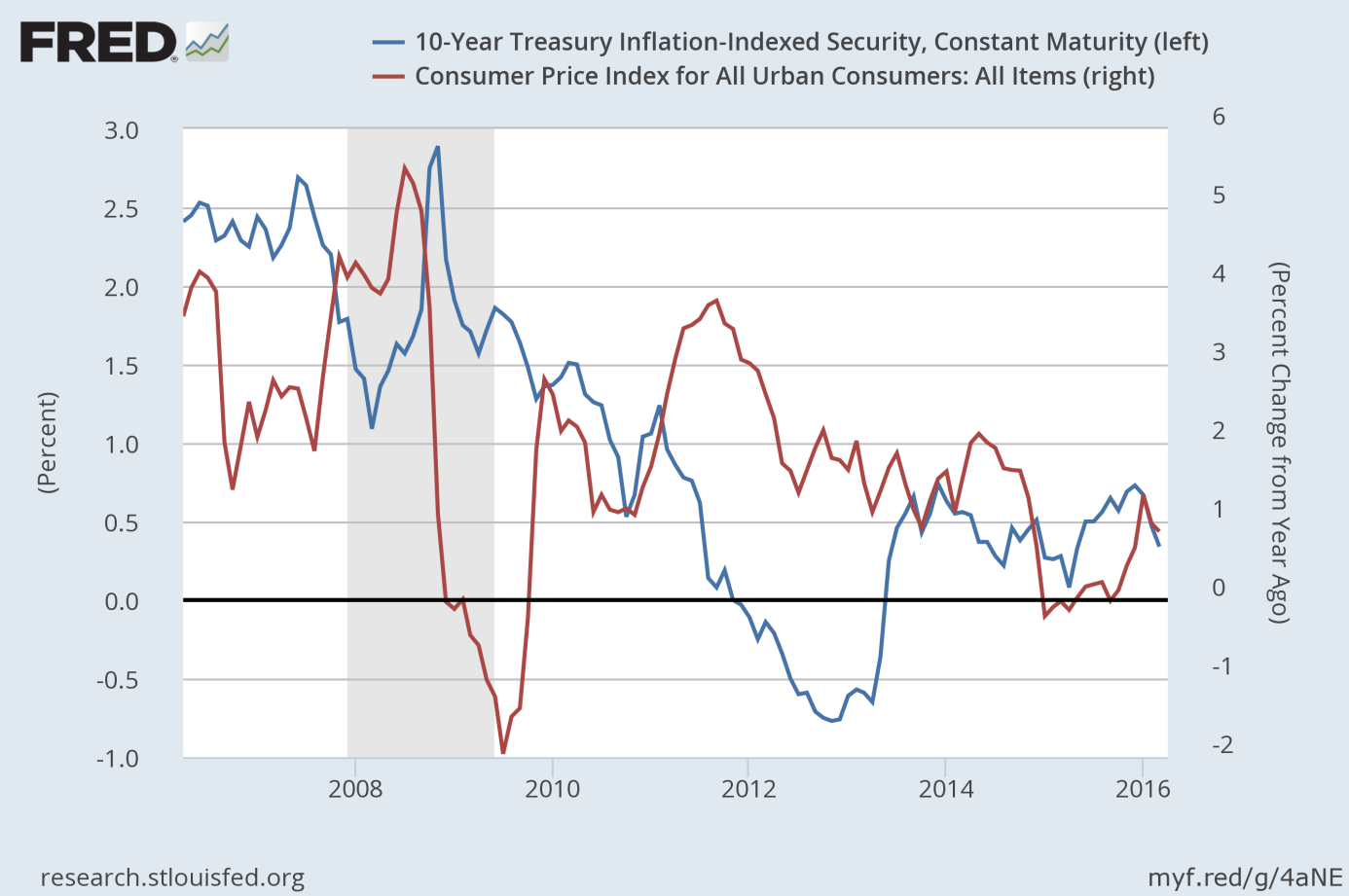

On the other hand, softer inflation could theoretically translate into higher real interest rates, which would be negative for the gold prices. However, as one can see in the chart below, there is no clear negative correlation between the CPI and real interest rates. Therefore, the first channel should be stronger and the eased inflationary pressure should be bullish for the gold market on balance.

Chart 2: The CPI (red line, right axis, as percent change from a year ago) and real interest rates (blue line, left axis, as the yield on 10-year inflation-indexed Treasuries) over the last ten years.

Summing up, the CPI rose 0.1 percent in March, but the inflationary pressure generally softened. Given that the gold trade is now about the Fed’s actions, the eased inflationary pressure should be positive for the price of gold, as it could convince the hawks among the FOMC members to wait longer before further hikes. However, investors should remember that the data on inflation is quite volatile and if energy prices steadily rise, the inflation pressure may strengthen.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium-term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor