India Bought 77+ Tons Of Gold Last year, Its Second Largest Purchase Since 2009

Strengths

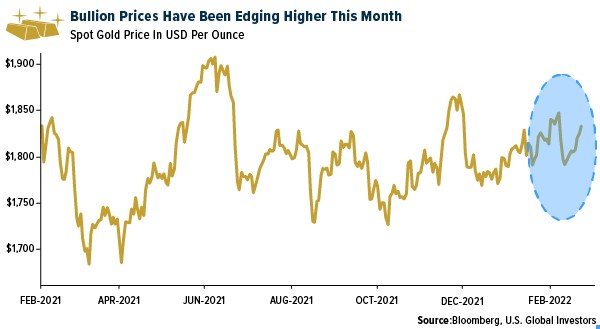

- The best performing precious metal for the week was silver, up 4.74%. The metal escalated faster than gold on the back of stronger inflation and geopolitical tensions. Gold firmed up as the week ended amid concerns over inflation after the U.S. consumer prices report for January exceeded expectation with a 7.5% year-over-year headline number. Meanwhile, tensions over Ukraine have boosted haven demand, even as Moscow has repeatedly denied that it plans to attack the country.

- Bloomberg reports that the Royal Bank of India purchased 77.5 metric tons of gold in 2021, its second largest purchase since 2009 when it bought 200 metric tons.

- Centerra Gold shares rose to their highest level since January 5 after reports that the Canadian gold miner has resolved a disagreement with Kyrgyzstan’s government over the Kumtor gold mine. Kyrgyz Prime Minister Akylbek Japarov said negotiations are “finishing up, and we’re parting ways with Centerra Gold amicably,” according to an Interfax report. Kyrgyzstan seized the gold mine from Centerra in 2021, prompting a series of claims by Centerra and a round of international arbitration.

Weaknesses

- The worst performing precious metal for the week was platinum, but still up 0.25% as precious metals moved higher across the board. Gold Fields indicated an earnings range of $0.88-0.94 per share, which is below consensus of $1.00 per share. There may be consensus earnings downgrades following detailed 2021 results on February 17.

- Money managers are becoming less bullish on gold. Money managers have decreased their bullish gold bets, with the net-long position the least bullish in 18 weeks.

- Local governments in the Philippines can impose reasonable regulation but cannot totally prohibit open-pit mines, following national government’s decision to lift the ban on mining methods, Mines and Geosciences Bureau Director Wilfredo Moncano says.

Opportunities

- Wheaton Precious Metals’ five-year annual average production guidance of 850,000 ounces from 2022-2026 and 10-year guidance of 900,000 ounces from 2022-2031 represented an improvement over its previous five-year guidance of 810,000 ounces from 2021-2025 and 10-year guidance of 830,000 ounces from 2021-2030.

- Triple Flag Precious Metals (TFPM) has announced that it has entered into agreement to acquire a 2.75% net smelter returns royalty on Monarch Mining Corporation’s Beaufor Mine gold project in Quebec, Canada for C$11.25 million. TFPM will acquire the Beaufor royalty through two transactions. First, TFPM has entered into a binding agreement with a third party to acquire an existing 2% royalty for C$6.75 million. Second, TFPM has entered into an agreement with Monarch to provide an additional C$4.5 million to increase the royalty to 2.75%.

- Newmont Mining announced that it has entered into an agreement to acquire Buenaventura’s 43.65% interest in Yanachocha for $300 million plus up to $100 million in contingent payments. NEM's Yanacocha sulfides project is expected to add average annual production of 525,000 gold equivalent ounces per year with a cash cost of $700-800 an ounce in the first five full years of production.

Threats

- Platinum miners in Zimbabwe asked the government to push back a tax on exports of semi-processed metals, requesting more time to invest in processing plants at home. The Treasury announced the tax in 2020, giving miners two years to prepare before its planned introduction early this year. The levy of as much as 5% is aimed at spurring the companies to develop their own processing facilities, allowing Zimbabwe to increase the value of its mineral resources.

- There may be upward cost pressure. Miners flagged the inflationary cost pressures and recognized increases in reagents, consumables, labor costs and, of course, fuel costs. Capital projects are seeing a more material increase on budgets due to inflation. Feasibility study updates have shown a real trend of increasing capital spending. The magnitude has varied given that inflation is only one part of the equation, with scope changes also attributing to capital spending increases lately.

Gold risks a big drop according to market pendants. This conundrum of real rates moving back toward zero, reducing gold’s allure, while the dollar recently hit its strongest since mid-2020. Yet, gold holding out, trading above $1,800 an ounce. Yes, the Federal Reserve is going to raise rates, but gold is going to keep on climbing, as the Fed is behind the curve, and with the long end of the yield curve so low the Fed may be limited in how fast they can raise rates.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of