Industry Slides Deeper Into Recession. Will Gold Shine Now?

Some analysts has argued that the manufacturing sector reached a through. But this not the case. The latest Fed’s report on the industrial production and capacity utilization clearly shows that the pundits were wrong again. As they so often are. The industrial production fell 0.8 percent in October, much more than expected. It was the third drop in the industrial production in the past four months, following a 0.3-percent decrease in September, and the largest decline since May 2018.

Of course, the United Auto Workers strike at General Motors negatively affected the October report, pushing down automotive production by 7.1 percent. However, the weakness was not limited to the car industry. Excluding motor vehicles and parts, the index for total industrial production moved down 0.5 percent. The decline was broad-based: the index for manufacturing edged down 0.1 percent, mining production decreased 0.7 percent, while utilities output fell 2.6 percent. And the capacity utilization for the industrial sector decreased by 0.8 percentage point in October to 76.7 percent, the lowest level in 25 months.

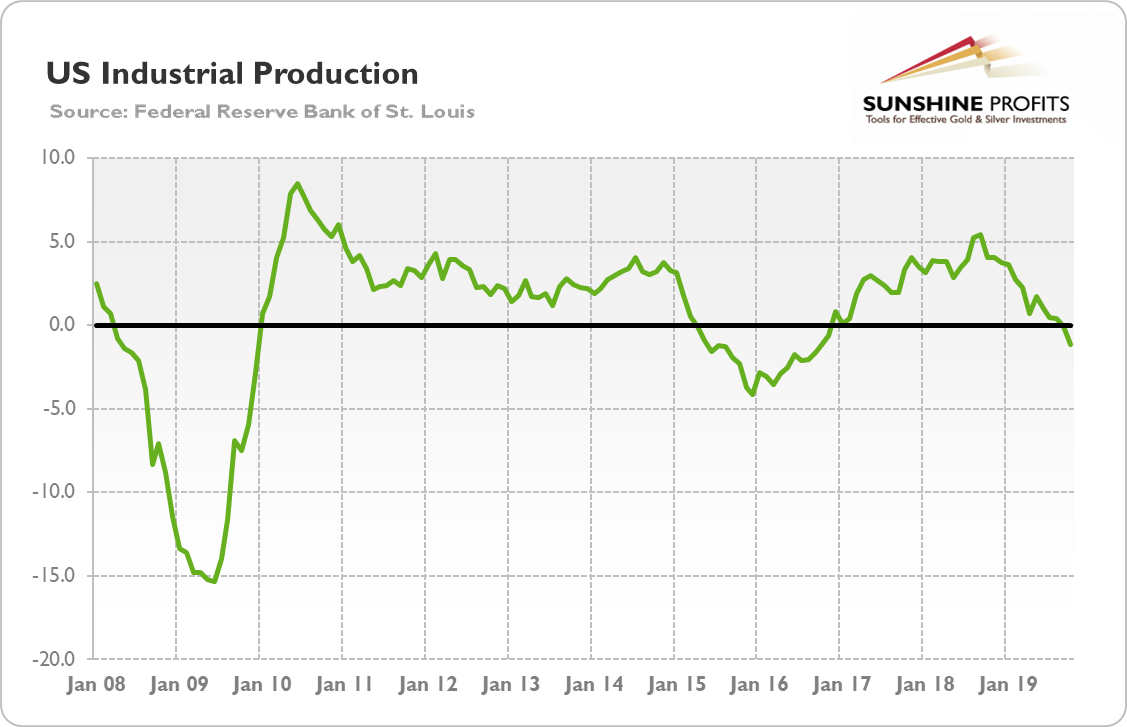

The situation in the industrial sector does not look good on an annual basis either. As the chart below shows, the industrial production fell 1.1 percent over the twelve months ending in October, moving decisively into the contraction area.

Chart 1: US Industrial production from January 2008 to October 2019

So, now it should be clear that the industrial sector was significantly hit by weak global demand and trade wars and entered recession. It should be worrying for the policymakers, but the Fed Chair downplayed the dangers. Powell said that the weakness in the manufacturing sector has not spilled over into the broader economy. He also pointed out the economy is driven by the consumers, not manufactures, so we should not worry: “the 70% of the economy that represents the consumer is healthy, with high confidence, low unemployment, wages moving up.”

Arrrgh, I hear this argument very often. Although it’s invalid! Would you like to know why Powell is wrong on the significance of the industrial sectors? If so, I encourage you to read the full version of today’s Fundamental Gold Report, which analyzes the myth of economy driven by consumer spending. I will demolish this die-hard belief and draw conclusions for the current outlook of the U.S. economy and the gold market. In order to receive the following (posted bi-weekly) analyses and stay informed on all things fundamentally golden, please subscribe now on our website.

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

*********