Inflationary Financing And GDP

This article demonstrates that only government borrowing in the US and UK drives GDP growth. This surprising conclusion is confirmed by long-run statistics. GDP does not represent economic progress, nor does it include the expansion of activity in the non-financial private sector, because that marries up with larger trade deficits, which are excluded from GDP. These findings have important implications for how the global downturn will be reflected in national statistics for the US and UK and the eventual prospects for the dollar and sterling.

Introduction

We tend to think of a nation’s accounts as being split between government and the private sector. It is for this reason that key tests of a nation’s economic sustainability and prospects for the currency are measures such as a government’s share of a nation’s economic output, and the level of government debt relative to gross domestic product.

While there is value in statistics of this sort, it is principally to give a quick overview in comparisons with other nations. For a more valuable analysis it is always worthwhile following different analytical approaches in assessing the prospective evolution of a currency’s future purchasing power.

Bald comparisons between government and non-government activity are a bad indicator of the true position. A more practical approach would admit that government finances are inextricably linked with the private sector. As Robert Louis Stevenson might have put it, a public servant is a Mr Hyde, who is a non-productive cost on productive society, while being a Doctor Jekyll spending his salary into the private sector as a consumer and contributing to a nation’s production in a demand role. The source of Mr Hyde’s income is the production of others, and increasingly his pay is made up by the debasement of everyone’s currency. Governments also spend money acquiring private sector goods and services, further distorting the overall picture. It all takes some untangling, a long way beyond a simplistic or conventional approach.

We must also think about what government statistics actually mean, and besides the dumbing-down of price inflation the most abused of them is gross domestic product (GDP). It is commonly used as a substitute for measuring economic progress, because progress cannot actually be measured. GDP only records monetary transactions, which are increasingly divorced from any assessment of economic value. It rates government spending, which is never economically constructive, pari passu with private sector spending, which for the most part is progressive.

As a statistic, GDP should only be useful for government accountants. If GDP should relate to anything, it is to current and expected tax revenues, but as a measure of a nation’s progress it should be banned. So long as we are in thrall to GDP, finance ministers can simply goose the figures by increasing government spending, which almost always voids any progress that would have occurred if this spending had remained in the command of the private sector. These basic truths should be enough to cause us to stop, think, and seek a new approach to understanding the state’s economic role and how it is financed. Rarely is there a better time presented for a new analysis than the rise of both President Trump, overturning the established order in America, and Boris Johnson to the premiership of the United Kingdom.

The financing of government deficits

One way or another, governments are wholly dependent on economic production for their finances. If taxes fail to cover a government’s expenses, they are paid for by expanding the quantities of money and credit, diluting the money stock.

When government spending is wholly covered by taxation and the budget is in balance, there will simply be a shift of GDP allocation from the private to the public sector. If a shortfall is covered by private savers investing in government bonds, there is simply a change of capital allocation from the productive private sector to the non-productive state. Monetarists have long argued this is so. But when savings are drawn away from the non-financial sector, there is a secondary effect which cannot easily be quantified: the extent to which the savings redirected into government bonds are in turn replaced directly or indirectly by an expansion of bank credit.

So far, our statements in this matter accord with classical economics, which have always assumed silos of financial activity based on sound money: consumers defer some of their consumption to provide capital funding for production as well as for funding temporary government spending overruns. Deposit money was the source of working capital and fed investment in corporate and government bonds. But in nations like the UK and US, savers of this sort hardly exist today. The classical model is no longer appropriate, replaced by one dependent on monetary expansion for the provision of monetary capital.

Today, the UK and US operate almost exclusively on this new basis, increasingly dependent on financing by monetary expansion; that is to say money created out of thin air by the banking system. Making this doubly attractive to the state is the effect on nominal GDP, which increases as the new money, which did not previously exist, is spent into circulation.

In the past the problem that restricted monetary inflation was the inevitable knock-on effect on prices, which would reflect the erosion of the currency’s purchasing power. But politicians and their bankers believe they need worry no more: so long as price increases are subdued, or subdued by national statistical method, infinite inflationary financing becomes possible.

Despite this temptation, one would hope that the UK’s new Prime Minister, along with his Chancellor of the Exchequer, is aware that government spending is economically destructive, while private sector activity is the only productive sector. There is encouraging evidence that this is the case. But following his appointment as Prime Minister, Boris Johnson has been quick to promise new unfunded spending on popular causes: the hopelessly inefficient National Health Service, needlessly costly state education, policing and, if he follows through on an earlier promise, income tax cuts for middle-class earners. All these are good causes politically with the possible exception of the proposed tax cuts. And importantly, spending on these areas lifts the national mood above the slough of despond under Mrs May and Chancellor Hammond.

In theory, a clean Brexit without paying a £39bn divorce settlement and the £9bn annual membership fee gives some financial leeway. But this presupposes that the £39bn is already built into the Treasury’s forward planning, and the £9bn is not earmarked to be offset against tariff reductions on post-Brexit UK imports. Given the Treasury’s previous determination under former Chancellor Hammond to Remain, there must be some uncertainly over the treatment of both these figures in the national accounts.

Assuming the worst case that no provision has actually been made, Boris Johnson’s extra spending commitments will still need financing. The unpopularity of higher taxes and his commitment to lower them for some are certain to result in higher government borrowing. Not much is new in this.

Wise heads should now take the opportunity of a new broom to pause and think about the nation’s finances in the broadest sense. Spending commitments are being made at the top of the global trade and credit cycle, which could have consequences for sterling in an increasingly unstable world. It is time to reflect whether a Johnson government, which seems to echo President Trump’s approach to national budgets, will turn out for the better. There is little doubt that his administration is supportive of free markets, and that in itself presents a tremendous national opportunity. But it’s the finances that will matter.

A different way of looking at national finances

A spendthrift government diverts capital from the productive private sector to the unproductive state. This cannot continue for long without negative economic consequences becoming apparent. In a sound-money economy, where money and credit cannot be magically created by the banking system, the economy would rapidly decline below its potential as a government’s share of the economy increases, and even the man in the street would understand why.

With a fully-expandable fiat currency, this restriction on government finances appears to be removed. Originally, the use of inflationary money and credit was proposed as a means to assist an economy to recover to its economic potential, offset by the taxes that would eventually flow as a result of the earlier reflation. Keynes was a leading proponent of this theory, and he presumably saw savers as a hinderance to its full application. In the UK and US, savers have now almost been driven out of the financial equation as a material source of investment and working capital.

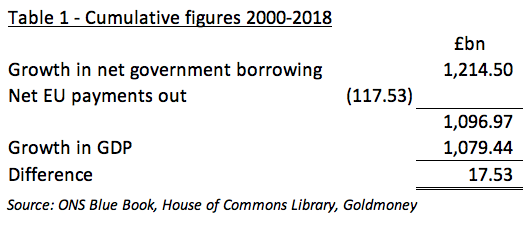

Now that the overall level of savings is unlikely to increase to fund government deficits, we can expect government borrowing in these states, which is now funded entirely through monetary expansion, to be more or less reflected in an increase in GDP as the money is spent into the economy. There are timing differences, and as it progresses, the credit cycle with its varying effects on investment risk will distort the picture. In the case of the UK there are also net payments by the government to the EU, which remain in Brussels. But removing these factors by observing three consecutive credit cycles from 2000 to 2018, we find total government borrowing less EU annual payments does balance GDP growth remarkably closely, as Table 1 illustrates.

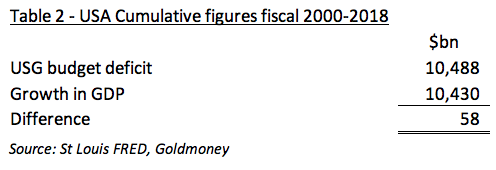

And when we look at the US, we get a similar story; this is shown in Table 2.

The difference between a government’s deficit and the growth in nominal GDP in both the UK and US is remarkably small, confirming there is a close link between the two. But it is not enough yet to draw a definite conclusion.

We have not accounted for net imports. GDP is the sum of consumer consumption, gross investment, government expenditures and exports less imports. When there is a trade deficit, the deficit amounts to consumption excluded from our GDP growth figures in Tables 1 and 2. Crucially, we have also neglected the role of the private sector in the national accounts, particularly the expansion of bank credit drawn down by it and the spending that is created therefrom. If the latter offsets the former, then we can assume the direct link between government deficits and GDP is real.

Private sector financing

For the UK’s private sector, the expansion of bank credit excluding mortgage debt since 2000 has been £357bn, and for the corporate sector a further £174bn, totalling £531bn between them. Note that the figure for the corporate sector does not include the increase in bond issues, which are not a direct consequence of bank credit expansion, though in practice banks will invest minor amounts in corporate bonds, amounting to the same thing.

Having matched all the increase in GDP to government borrowing, we must now see how the expansion of bank credit towards the private sector fits in with the trade deficit, which is excluded from GDP. Here we should note that the accumulated balance of payments deficits since 2000, representing goods and services imported and not produced in the UK net of exports, totalled £949bn. If we allocate all this to the private sector (because none of this consumption has been allocated to government in Table 1), that leaves the remaining balance of unallocated imports since 2000 at £418bn.

This is probably as close as we can get to identifying for whom the expansion of money and bank credit has been created. The balance, which is an average of £22bn per annum with some variance, is a little over one per cent of GDP and is consistent with the unrecorded transactions that should be included in GDP statistics, and those that fall outside of their scope.

Admittedly, these calculations are best described as being rudimentary. They ignore the fact that some government spending is on imported goods, and in the UK’s case, government tenders also have to be available for EU-wide tendering. However, our intention is less to be accurate but more to establish a principle.

This exercise has revealed that the expansion of broad money is mainly to finance government spending, which almost exactly matches the expansion of nominal GDP. It has the effect of driving the expansion of private sector demand into excess imports over exports, and out of the GDP growth statistics altogether. It is also consistent with the twin deficits observation, which despite President Trump’s tariff policies continues to feature in both American and British economies.

The tight link between budget deficits and growth in the GDP statistic strongly suggests nominal GDP can only increase if the government is prepared to increase its deficit. Clearly, using nominal GDP as our principal measure of economic health and progress is fundamentally wrong. To this error we can now add the further mistake of regarding GDP growth as emanating from the private sector, when in a credit-driven economy it is principally a reflection of government deficits.

This is an important finding. As an example, it confirms what Austrian economists have always known but often been unable to get across to monetary planners, that modern statistical analysis badly misrepresents an economy. It should cause mainstream economists to look at their whole science in a new light. They will find that monetary inflation and Keynes’s wished-for euthanasia of the rentier has taken economic analysis, and therefore today’s monetary and economic policies, down a delusional and ultimately destructive path.

Implications for the economic future

Politics is one thing, economics is another. While Boris Johnson has lifted the gloom that prevailed over his predecessor’s administration, economic considerations suggest he should do the time-honoured manoeuvre of declaring the national accounts to be in more of a mess than was publicly evident when he made his spending promises, and that extra spending will have to be postponed until after Brexit. And then excuses must be found to scale them back. Perhaps that should be after a general election.

This seems unlikely for now. Statistically, there is little sign of price inflation. Therefore, inflationary financing appears to be a course upon which politicians can embark without adverse consequences. Whether the new Treasury ministers are aware of it or not, government spending is required to bolster GDP, and at this sensitive time, before and after Brexit, politicians will want to see GDP grow.

This is also the course President Trump has chosen. We can now say that the growth in US GDP, besides cyclical variations, is not economic strength at all. It is purely a reflection of the hike in deficit spending by the federal government. The nation that provides everyone’s reserve currency is in exactly the same boat as the UK. In order for President Trump to be re-elected he must continue with deficit spending to ensure GDP grows and satisfies financial commentators unaware of the inflationary dynamics. He will have to hope, as we all will, that price inflation remains moderated, and that the statisticians continue to suppress evidence of it.

Of course, eventually it will all unravel, because we are overdue a recession and inevitably with it a credit crisis. Even assuming these unpleasant events can be contained, the budget deficit will increase at a far faster pace, which in turn means nominal GDP will continue to rise. One wonders how long it will take before the private sector’s financial establishment realises there is a divergence between statistics and economic reality.

It is likely to be slow to cotton on. We have been here before. When he was Chancellor, Gordon Brown continually surprised the City’s scribblers by delivering economic growth better than forecast. An examination of the evidence showed this was almost entirely due to the inclusion of government spending in the GDP statistic, which Brown was inflating by increasing it. You won’t easily find this in the literature covering the period.

The consequences for currencies

Today, when GDP appears to be rising, the markets’ gut reaction is to think it is evidence of economic strength in the non-government sector. It is then argued that interest rate suppression will be lessened, bond yields will rise, and this economic strength will lead to a firmer exchange rate. The fact that all supposed economic recovery in a credit-driven economy such as the US and UK is due to increasing budget deficits is the polar opposite of market assumptions.

This error in market perceptions is the backdrop to a developing slump in global economic activity, of which there is growing evidence. The combination of trade protectionism with the top of the credit cycle was last experienced in 1929-32 and led to the great depression of the 1930s. At that time, sound money set the tone for prices through the gold standard. Today, a similar economic outcome will undoubtedly result in an unprecedented expansion of government budget deficits, the more so when major banks have to be taken into public ownership to keep them functioning.

Instead of the slump being reflected in national statistics, our analysis shows that nominal GDP will continue to rise. At some stage, too obviously to ignore, the continuing resilience of this statistic will contrast with rising unemployment and, despite statistical suppression, prices will also be seen to be rising. Unemployment will be real, but rising prices will be solely due to the currency’s loss of purchasing power, the consequence of monetary policies.

However slow government economists are to realise the errors of regarding GDP as a valuable indicator, clearly there will come a time when foreign exchanges realise that far from being an indicator of economic health, it is just a reflection of a government’s inflationary financing. Savings-driven currencies, which we can define as those whose balance of payments are in surplus despite budget deficits, will expose their economic condition more clearly, because bank credit expansion or contraction taken up by the private sector will be included in their GDP totals.

Eventually, economies driven by monetary and credit expansion to the exclusion of savings will get their come-uppance. Notwithstanding the US dollar’s reserve currency status, it is bound to crack. And the new Johnson government in the UK, unless it can find a way to reign in government spending and weather the resulting underperformance of the GDP statistic, risks a sterling crisis to end them all.

Alasdair Macleod

HEAD OF RESEARCH• GOLDMONEY

Twitter: @MacleodFinance

MOBILE: +44 7790 419403

Goldmoney

The Most Trusted Name in Precious Metals tm

NEW YORK | ST. HELIER | TORONTO

Publicly Traded Symbols: CA: XAU | US: XAUMF

© 2017 GOLDMONEY INC. ALL RIGHTS RESERVED. THIS MESSAGE MAY CONTAIN CONFIDENTIAL OR PRIVILEGED INFORMATION. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE ADVISE US IMMEDIATELY. THIS MESSAGE IS FOR GENERAL INFORMATION ONLY AND SHOULD NOT BE CONSTRUED AS AN OFFER OR SOLICITATION OF AN OFFER TO BUY SECURITIES OR ANY OTHER FINANCIAL INSTRUMENTS. WE DO NOT PROVIDE TAX, ACCOUNTING, OR LEGAL ADVICE, AND RECOMMEND THAT YOU SEEK INDEPENDENT PROFESSIONAL ADVICE IF NECESSARY. WE CONSIDER INFORMATION IN THIS MESSAGE RELIABLE BUT WE DO NOT REPRESENT THAT IT IS ACCURATE, COMPLETE, AND/OR UP TO DATE AND IT SHOULD NOT BE RELIED ON AS SUCH. OPINIONS EXPRESSED ARE OUR CURRENT OPINIONS AS OF THE DATE APPEARING ON THIS MESSAGE ONLY AND ONLY REPRESENT THE VIEWS OF THE AUTHOR AND NOT THOSE OF GOLDMONEY INC OR ITS SUBSIDIARIES UNLESS OTHERWISE EXPRESSLY NOTED.

********