Italian Political Uncertainty Could Lead Investors To Gold

Strengths

· The best performing metal this week was palladium, up 2.39 percent. In terms of gold, traders and analysts were bullish on the yellow metal this week after being split in the previous week, according to the Bloomberg weekly survey. The bullishness is driven by uncertainty over the future leadership of Italy and Spain, which could lead investors to gold. Hussein Sayed, chief market strategist at ForexTime Ltd. said to Bloomberg in regard to the Italian political uncertainty that “a re-election will lead to a stronger populist group forming, and thus, a possible referendum on the European Union.”

· According to Reuters, sales of American Eagle gold coins in May rose by 433 percent from April to be the highest sales since 2015. U.S. Mint sales of American Eagle gold coins totaled 24,000 ounces in May, up dramatically from 4,500 in April, also the highest level since 2015.

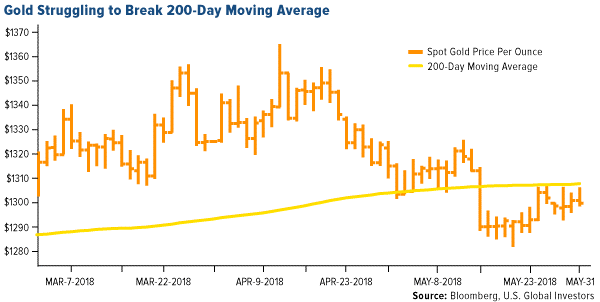

· Gold advanced earlier in the week on a weaker U.S. dollar and mounting global trade war fears. Ole Hansen, head of commodity strategy at Saxo Bank said “the dollar strength has paused and there’s now talk of renewed U.S. trade tariffs against both friends and foes, which is adding to support for gold prices.” Although gold is trading just below its 200-day moving average, as seen in the chart below, the consensus is for higher prices. Such a technical breakout above the 200-day moving average will likely lead to money flow into the sector.

Weaknesses

· The worst performing metal this week was silver, down 0.62 percent. U.S. hiring rose more than forecast in May, payrolls increased to 223,000 and unemployment fell to 3.8 percent. Shobhana Chandra of Bloomberg writes that while wage gains are positive, they have yet to show a sustained acceleration. Although unemployment is now at its lowest since 2000, companies are launching more incentives to attract and retain employees. Walmart, one of the largest employers in the U.S., will begin offering subsidized college tuition for its 1.4 million workers, after raising its base wage to $11/hr earlier this year in an effort to woo employees. While the employment numbers were strong, the fact that wages and benefits are going higher should reinforce inflation expectations.

· Although gold tends to perform well during times of political uncertainty, the gold price this week barely moved. Italy’s political situation and renewed trade war fears should have seen gold rise, however it did not due to the lingering effects of a U.S. dollar rally earlier in the month.

· According to the Financial Times, the Indian rupee is the worst performing currency in Asia so far this year and has declined 5.3 percent against the dollar. A lower rupee affects the ability of India, the world’s second largest consumer of gold, to purchase gold and gold jewelry.

Opportunities

· Newmont Mining announced this week that is has entered into an agreement to sell its royalty portfolio to Maverix Metals Inc., an emerging mid-tier precious metals royalty and streaming company. Maverix Metals is relatively unknown but has been making significant progress in building a royalty streaming company. Initially, the company started with a package of royalties from Pan American Silver, thereafter added a package of royalties from Gold Fields, and then Li Ka-shing of CEF Holdings purchased a stake in the company. Newmont is the latest to roll its royalty package into Maverix, resulting in the stock climbing 18 percent this week.

· Mike McGlone, Bloomberg Intelligence commodity strategist, writes that gold didn’t fall as much as it usually does when the dollar rallies. Gold typically declines at 1.2 percent the rate of the dollar, but in April and May gold retreated at about half that rate. Even though a dollar rally might be masking gold right now, bullion should rise in the near future due to a spike in Italian sovereign bond yields and renewed questions over the future of the eurozone. Twice in the past decade the dollar and gold relationship flipped and instead climbed together. Both times the cause was the European sovereign-debt crisis. The last time the dollar and gold rallied in unison, the metal soared to records in euro and dollar terms, writes Eddie van der Walt of Bloomberg First World.

· Increased risks of a global trade war, again, could be positive for bullion prices as investors tend to flock to safe haven assets such as gold in times of uncertainty. President Trump announced steel and aluminum tariffs on Canada, Mexico and the European Union, which risks a “tit-for -tat” response of tariffs on American goods.

Threats

· Europe has seen quite the week of political shake-ups. European commission President Jean-Claude Juncker told an audience in Brussels this week that he thinks it is time to reconnect with Russia given its size and importance. Juncker said “I am not very happy with the state of our relations.” The Spanish Prime Minister, Mariano Rajoy, was ousted by a vote in Parliament of no-confidence after being plagued by corruption revelations. Socialist leader Pedro Sanchez is set to be sworn in as the new Prime Minister in the next coming days, reports Bloomberg. Italy’s populist parties, Five Star Movement and League, are set to take power after three months of political deadlock, however there is still much risk associated with the nation’s stability.

· At least 23 companies that announced initial public offerings (IPOs) valued at $10 million or more this year have now withdrawn or postponed, compared with five IPOs that were announced and then scratched during the same period last year, according to Bloomberg. This is in stark contrast with the news that Moscow has emerged as the number two city for fast-growing private companies, according to the Inc. 5000 Europe list. “If it weren’t for political risks, Russia could become a global startup powerhouse,” says William Courtney, a retired diplomat and executive director of the nonprofit policy firm Rand Business Leaders Form in Arlington, Virgina.

· Bloomberg reports that Jay Wintrob, chief executive officer of Oaktree Capital Group, expects to see a flood of troubled credits topping $1 trillion, as rising interest rates overwhelm low-quality loans and bonds. Wintrob said that the supply of low-quality debt is significantly higher than prior periods and that a lack of protections makes investing in shaky creditors riskier than ever when interest rates rise.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of