M And A In The Goldfields

Strengths

-

The best performing metal this week was palladium, up 5.41 percent. Palladium surged this week on bets that the Chinese auto industry will boost global demand due to tight supplies of the metal, which is used in vehicle pollution-control devices. Gold traders and analysts were bullish for the second week in a row in the Bloomberg weekly sentiment survey. Many expect the yellow metal to benefit from continued Brexit-related chaos, which leads some investors to turn to perceived safe haven assets.

-

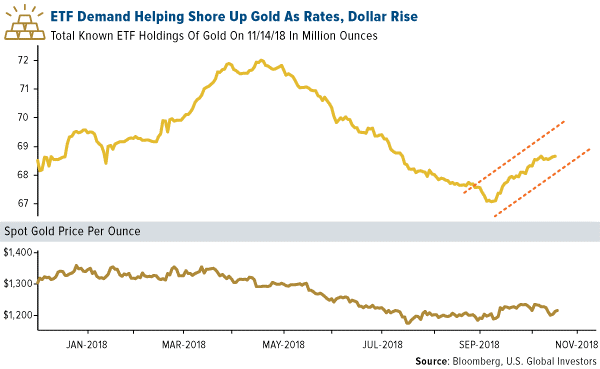

Although gold appears to have fallen from its October rally, ETF investors and hedge funds are not showing signs of abandoning the yellow metal, writes Bloomberg. Holdings in ETFs backed by gold rose for five consecutive weeks – the longest stretch is more than a year. The iShares Physical Gold ETF attracted $156 million in inflows last week, the most since July.

-

Deals are ramping up in the precious metals space. Pan American Silver has agreed to buy Tahoe Resources for $1.1 billion in a deal that is expected to close in the first quarter of 2019. Shareholders of Tahoe Resources may elect to receive $3.40 in cash or 0.2403 Pan American shares for each Tahoe Share, reports Bloomberg. Australian gold mining companies Silver Lake Resources and Doray Minerals are set to merge, with shareholders of Doray to receive 0.6772 Silver Lake shares for each of their Doray shares. The merged group as a first quarter of 2019 production guidance of around 240,000 ounces of gold.

Weaknesses

· The worst performing metal this week was platinum, down just 0.91 percent, on the news that demand for diesel-powered vehicles might continue to fall as the metal is in surplus for the year. Turkey continues to sell its gold reserves in an effort to support the falling lira. The country’s reserves fell $47 million this week from the previous week, and as a whole are down 16 percent year-over-year.

· Iran executed a gold dealer, Vahid Mazloumin, known as the “Sultan of Coins,” in a warning to merchants not to exploit the country’s financial troubles, writes Ladane Nasseri of Bloomberg. Mazloumin was sentenced to death last month after being accused of contributing to price hikes by hoarding gold and forming the largest illegal network in this area, despite not holding a permit to trade gold and foreign currency.

· Iamgold Corp. faced trouble this week after a group of analysts’ site visit to the Rosebel gold mine in Suriname was cancelled after a strike began just before their arrival on Tuesday. On Thursday the company reported that operations have resumed and that the site visit has been rescheduled.

Opportunities

· Even as gold fell two quarters in a row this year, billionaire hedge fund manager Ray Dalio has kept his positions in the yellow metal. Dalio maintained his holdings in the SPDR Gold Shares ETF of 3.9 million shares and his stake in the iShares Gold Trust of 11.3 million shares, as of the third quarter of this year according to a regulatory filing this week.

· Although the U.S. dollar has been strengthening and interest rates are rising, gold has drawn support from inflows into ETFs backed by bullion. Holdings in ETFs have risen by around 1.6 million ounces from a one-year low hit in October, reports Bloomberg. Suki Cooper, from Standard Chartered Bank, said in a note that these inflows “suggest a more stable cushion is emerging for gold prices on the downside.”

· Former Federal Reserve Chairman Alan Greenspan said in a Bloomberg TV interview this week that he’s beginning to see the first signs of inflation due to a tight labor market. Greenspan also warned that the rising U.S. debt level could undermine the current economic expansion. “The tax cut actually did get a buoyancy, and we’re still feeling some of it, but it’s nowhere near enough to offset the actual deficit,” Greenspan said. “You can’t have a tax cut without finding the revenues elsewhere, or you run into problems.”

Threats

· Miami-based Republic Metals Corp., a bankrupt gold and silver refiner, is reportedly missing inventory worth around $100 million. The company filed for Chapter 11 protection last week, saying it discovered “a significant discrepancy in its inventory accounting,” reports Bloomberg. Republic Metals listed around $265 million in liabilities and its senior lenders are a handful of international banks. Counterparties such as jeweler Tiffany might be out a significant amount of gold and silver that was with the company for refining.

· Billionaire hedge fund manager Paul Tudor Jones said in an interview this week that a hike in interest rates triggered by faster growth from the tax cuts might cause the credit bubble to pop. “We’re going to stress test our whole corporate credit market for the first time,” Jones said. He added that today’s levels of leverage could be systematically threatening even if policymakers respond appropriately and that stocks, bonds, currencies and real estate are all overvalued, reports Bloomberg.

· Although many strategists predict the U.S. dollar to resume its downtrend in 2019, they are advising investors not to abandon it just yet. Valentin Marinov, head of group-of-10 currency strategy at Credit Agricole, said in an interview last week that the “king dollar” trend many have more room to run and that we “may see a gradual grind higher, even though it will fall well short of the lofty highs of late 2016, early 2017.” Kit Juckes, global fixed-income strategist at Societe Generale wrote that the dollar is overvalued and the market is positioned long, which suggests a correction is likely in 2019, but that he is “wary of jumping the gun,” reports Bloomberg.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of