Milking The Savers

Do you want to lend your hard-earned money to the US government? In exchange for the high, high interest rate of 2.8%? It’s a most generous deal, even though the Federal Reserve is committed to dollar devaluation at the rate of 2% per annum. So you are getting 0.8% per year, assuming that the Fed hits its goal. In exchange for lending to a profligate and counterfeit borrower—the government has neither the means nor intent to repay.

No, you don’t? This sounds like a bad deal? Well, tough.

It sucks, but if you need to hold a cash balance, your other choices suck more. Instead of lending to the government, you could deposit the cash in a bank. There’s only one problem. The bank will lend to the government. After taking out the costs of compliance, this rate is 2% according to the St Louis Fed.

This is actually up from 0.13% over the last three years, in our current bout of risinginterestrate-itis. Enjoy this high rate while you can.

In any case, the bank adds risk. On top of all of the risks you incur by lending to the government, you take the risk of bank insolvency too. The government does provide deposit insurance—but this is the same government whose risk you are trying to avoid by not buying its bonds.

Finally, you could hold paper cash, $20 bills. Ignoring the risk of theft, there is still a problem with this. You are lending to the Fed. The Fed issues dollars, which are its liability, to fund its purchase of Treasury bonds. The dollar is backed by government bonds.

To have a dollar is not to own a thing. It is a credit relationship. Someone else owes you. If you own the dollar bill, the Fed owes you.

Savers Have No Say

No matter which way you go, if you hold dollar cash, you are lending to the government. You can do this at low interest, lower interest, or zero interest. No matter which way you go, you are disenfranchised. You have no say over the interest rate.

In the gold standard, if you have a gold coin, you have something. It is not a credit relationship. It is a positive value, a piece of metal that is no one else’s debt. And to own this coin is a choice. You can lend, if you like the interest rate and the risk. Or withdraw from lending, if you don’t.

In the dollar standard, you are stuck. Sure, you can trade your dollars for cotton or copper. We suppose there are a few people for whom holding bulky inventory with special storage requirements could be almost as good as holding cash. However, for most people there is no comparison between commodities and cash.

Sure, you could trade your dollars for stocks or real estate. But in each case, you are subject to risk of capital loss, and you incur costs to trade (especially in real estate, classic cars, old wines, and artwork).

And even if you do make this trade, the seller of the stock, property, car, wine, or painting now has the dollars. And he now has inherited from you the same bitter choices.

This disenfranchisement is, as they say in software development, a feature not a bug. This is the real purpose of President Roosevelt’s and President Nixon’s orders that removed gold from the monetary system. They took away the exits. Savers and anyone else who need to hold a cash balance (e.g. debtors), are trapped in the pen like animals.

You may not want to lend to the government, but you have no choice. A lender you shall be. The choice is whether direct to the Treasury, in exchange for a pittance of interest; indirect through a bank for even less interest; or indirect through the Federal Reserve Note for zero interest.

This is what irredeemable currency does. It turns savers into milch cows. The savers think they are accumulating something positive. But they are really lending more to the government.

We have been developing an ongoing theme of capital destruction and capital consumption. This is another mechanism of it. The saver works hard to produce more than he consumes. He sets aside the difference as savings. And, unfortunately, that savings is fed into the maw of a ravenous government. The savings is consumed.

Most savers seem reasonably happy with this arrangement, or at least they tolerate it, because the purchasing power of this government debt paper which they call money does not fall too fast to alarm them. Or it can even rise, as the debtors are desperately increasing production to get their hands on more dollars which they need to service their debts.

Well, it’s not money. Its purchasing power rises, if enough debtors produce enough goods to dump on the market, to raise cash. In other words, in the Fed’s perverse game, producers bid up the dollar and they can do so to extreme levels.

Opting Out

The reason to own gold—with that portion of your savings that you don’t need for liquidity—is not price speculation. If the same ounce fetches more of the Fed’s failing paper, then that is not a profit. That is not gold going up. That is said Fed paper going down.

The reason to own gold is to opt out of being a creditor. One may have a moral concern to lend to a fraudster who calls it “borrowing” but has not the means or intent to repay, and of course, the fiscal concern is that one may not get back one’s capital.

Of course, one won’t get it back, in the sense of the government returning what it borrowed with interest. We mean that there is a risk that a third party won’t bid on this paper.

This is another consequence of irredeemable currency. There is no getting back the capital that you lent. There is literally no mechanism for the return of capital. There is only the hope that a third party will give you his capital. That is, he will buy the note from you.

This distinction is as important as it is underappreciated.

If you lend capital to an honest borrower, you expect he will give you your capital back. If you lend irredeemable currency, the government will not give you back anything. However, there is a liquid market in which other people will give you their capital. Redemption is not the same as selling. The way operating a farm to grow food is not the same as selling off pieces of the farm to buy groceries.

The flaws of our irredeemable monetary system are much deeper than merely falling purchasing power.

Keith will give a talk in Las Vegas in early May. Please contact us if you would like to attend.

Supply and Demand Fundamentals

The so-called petroyuan was to revolutionize the world of irredeemable fiat paper currencies. Well, since its launch on March 26—it has gone down. It was to be an enabler for oil companies who were desperate to sell oil for gold, but could not do so until the yuan oil contract. It has been possible to do in New York, so they obviously were not desperate to do this trade. The price of gold has fallen a bit since March 26 as well.

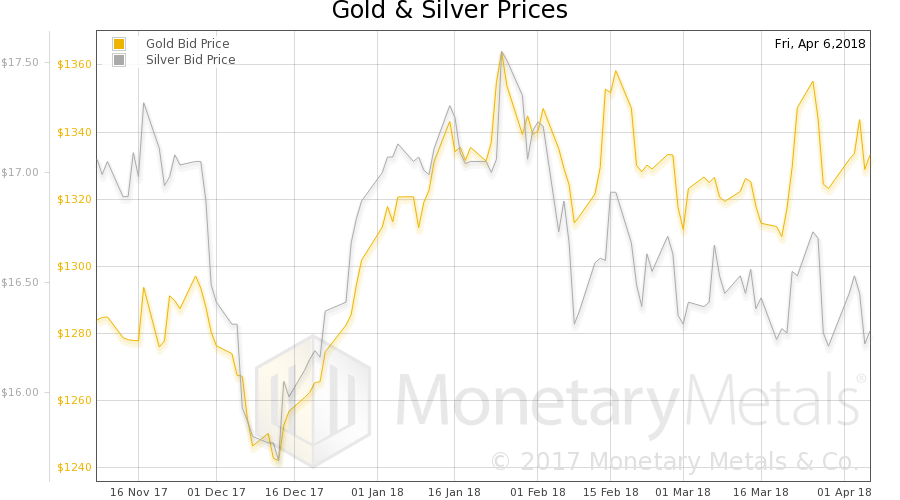

This holiday-shortened week, the price of gold rose $8 and the price of silver went up 4 cents. However, something has been happening to the fundamentals of one of them. We will take a look at that.

But first, here is the chart of the prices of gold and silver.

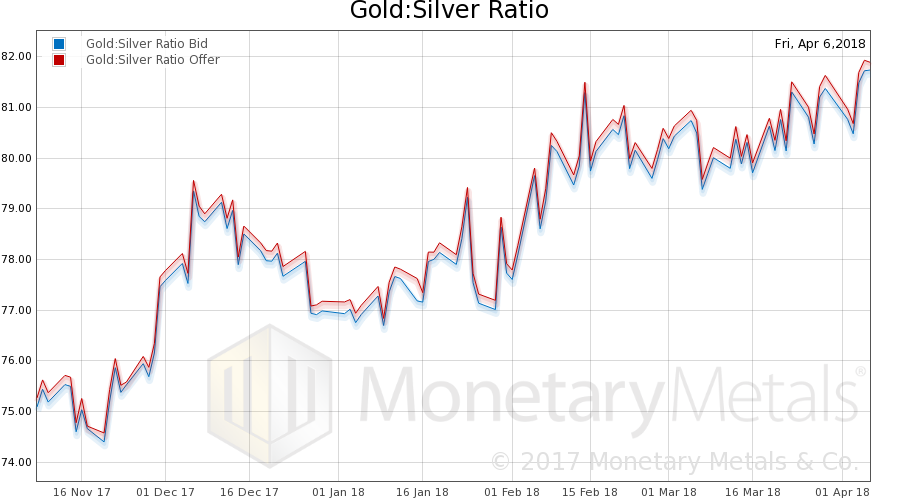

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose slightly.

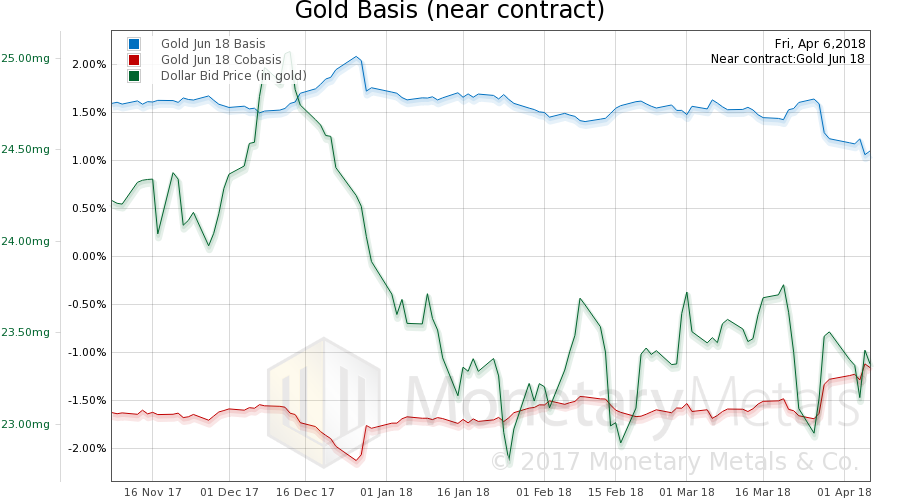

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

We have another instance where the dollar is falling (inverse of the rising price of gold, measured in dollars) while gold becomes scarcer at the higher price (i.e. the cobasis, the red line).

Unsurprisingly, the Monetary Metals Gold Fundamental Price rose $44 this week, to $1,493. This is above the end-of-year target we published in our Outlook 2018.

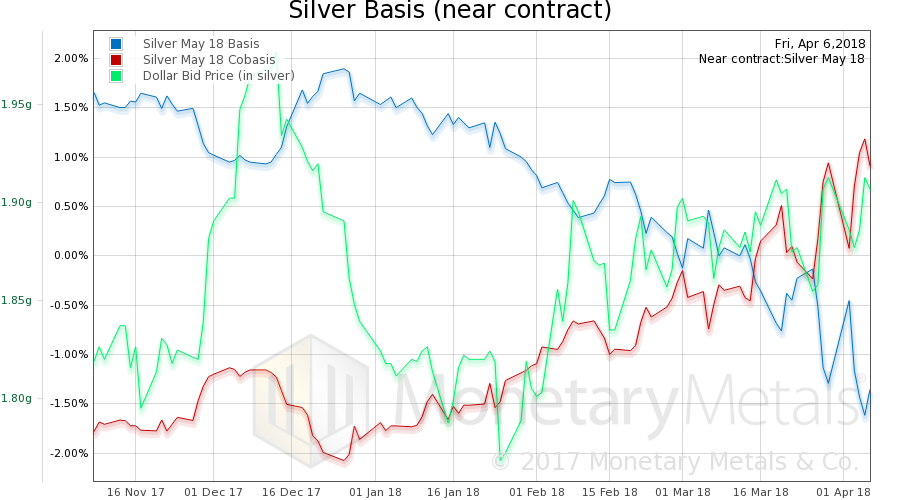

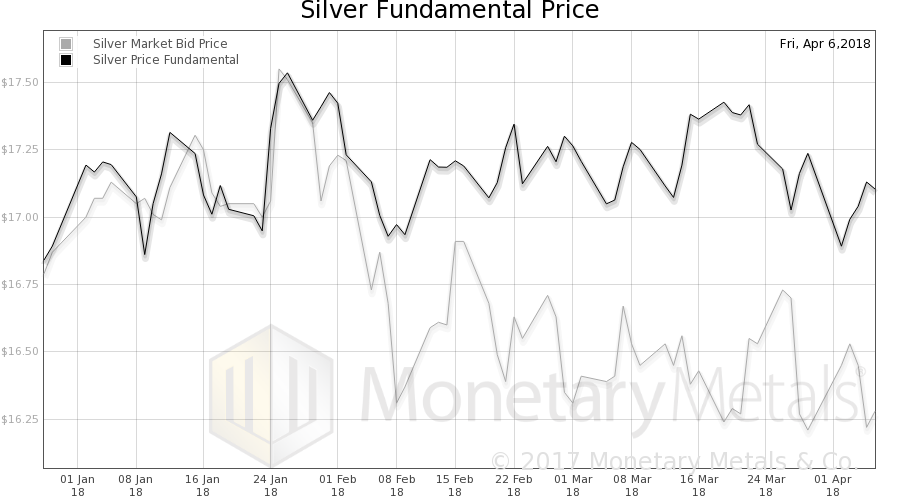

Now let’s look at silver.

The May contract is nearing expiry, and as is typical in silver there is a falling basis and rising cobasis due to the contract roll aside from any changes in abundance or scarcity.

That said, the silver cobasis fell slightly from March 29.

The Monetary Metals Silver Fundamental Price fell 14 cents to $17.10.

Here are graphs of the gold and silver fundamental prices. There is a noticeable uptrend in gold, and not in silver.

© 2018 Monetary Metals

*********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the