Mr Bear Likes Gold And Silver - A Lot!

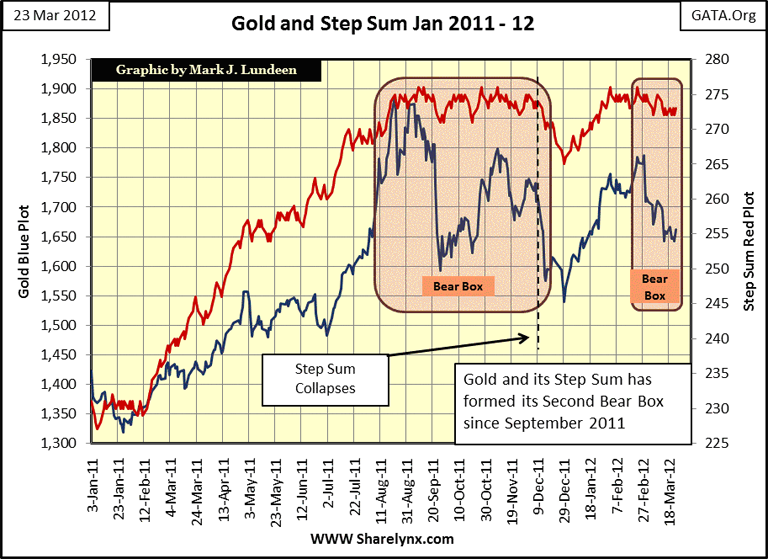

Gold is forming its second bear box since last September. So what does that mean? Well, by taking the daily closings in the price of gold and noting if each day was up or down from the day before, I then add all the +1 & -1 and plot the resulting step sum (red plot below). In effect, the step sum below is a single item advance - decline line for the price of gold.

The step sum is a sentiment indicator of the only people who really matter: the people who are actually buying and selling; in this case gold. Typically, market prices and their step sums trend up and down together, but in those instances where their trends diverge, the step sum tells tell us that market sentiment is on the wrong side of the market. Look at the price of gold above; it is going down as market sentiment is stuck in neutral.

So who is right; the price of gold or its step sum? If you value your money, you'll know that the price trend is * always *right! The step sum is just telling us that the gold bulls are a bit confused right now; hoping that tomorrow will return what yesterday took from them.

Bear and bull boxes are usually dependable technical patterns. Right now the bear box is telling us that the gold bulls have it wrong, and they haven't yet lost all the money their stubbornness is going to cost them. What I'm expecting to happen is that gold will continue trending down until the pain of being long in the futures gold market forces the gold bulls to exit their positions. The bulls' recognition of failure will be registered in the step sum above, as it collapses downward, and once again the red and blue plot trends find themselves in agreement; by going down. But this current decline is just a correction in a larger-bull market for gold, silver too. The step sum will once again provide us with a safe entry point back into the gold market, when the trends for both the gold and its step sum reverse abruptly and together to the upside.

The bear box from August to December 2011 is a perfect example of what I'm expecting in the months to come. But before the price and step sum plots gives us our all-clear signal, don't be surprised if the price of gold and silver decline below your comfort zone.

The swamp the global financial markets now find themselves in is draining; things have changed in the last six months, and there is no going back. After MF Global, where all reasonable persons can see that Jon Corzine's thief of a billion dollars of his client's money is being protected from legal consequences by the Federal Government itself. Then there is the case of the ECB pushing its way to the head of the line for payment in the Greek tragedy, leaving the peasants with the crumbs. These are just the first two episodes of what will soon become a long parade of corruption in the American and European financial systems.

Washington, Wall Street and the Masters-of-Europe are up to their asses in alligators with intractable problems, all of their own making. We can count on the "policy makers" doing everything but the right thing to extract themselves from their quagmire. And what is the right thing for our leaders to do?

- Stop manipulating market valuations for political purposes, trashing their national currencies in the process

- Mark-to-market all financial assets, and clean up everyone's balance sheet

- Let their favorite insolvent financial institutions fail

At the end of this process, the world will discover that the "policy makers" drove everyone who trusted them into bankruptcy, all for the benefit of themselves and their friends. This truth is a very bitter pill for politicians and their academics to swallow. So, doing the right thing after decades of doing the wrong thing is something they won't do willingly!

For this reason, expecting gold and silver to have a rough time for the next few months is logical, as rising prices in the monetary metals is equivalent to a failing grade for their "economic policies." I could be wrong. But with banking and sovereign bond problems in Europe and elsewhere rising to the boiling point, there are lots of very powerful people in the world who want to see much lower prices for precious metals, and they don't play fair!

"The primacy of politics over markets must be enforced." -- Angela Merkel, Germany's chancellor during the Greece Debt Debacle, 2011.

So, I expect I'll be correct about the short term down trend for gold and silver. But longer term, history tells us that in the epic battles between politicians and their economic-alligators, the reptiles ultimately win.

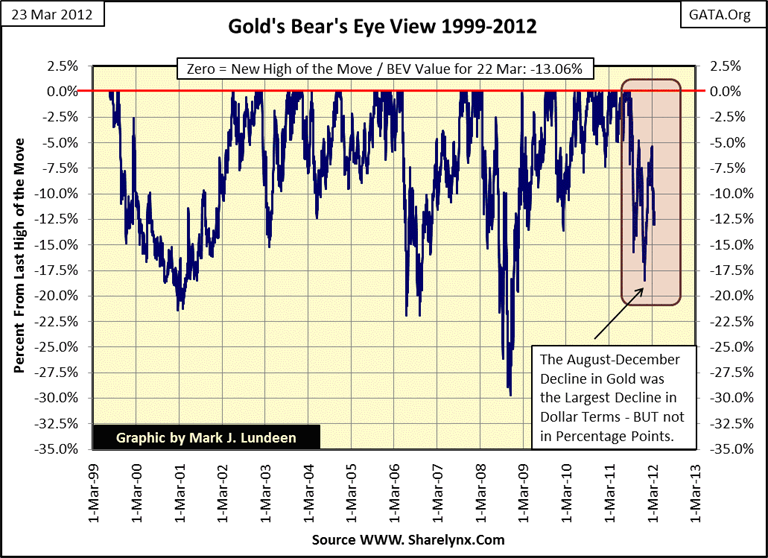

Last December I was on a vacation from my weekly articles, but was forced to write some comments during the panic in the gold market. It seemed that the August - December 2011 dollar decline in the price of gold was the largest in the history of the gold market, a fact much noted in the financial media that caused many sheeple to mindlessly stampede out of gold and silver. Me, I stopped thinking of markets in dollar terms a long time ago, because the dollar is an inflationary unit of account that confounds all honest notions of valuations in the markets.

Here is how to follow bull and bear markets, by tracking their market trends with the Bear's Eye View Plot, or BEV plot. This is really simple; every new all-time high is equal to Zero, and never more. Heck, Mr Bear doesn't care if the price of something just made a new all-time high; each is just a big fat ZERO to the big furry fella! What Mr Bear wants to know is how much of a percentage from the last all-time high he can claw back from the bulls, and that is exactly what we see with a BEV Plot: new all-time highs and Mr Bear's percentage claw-backs from them.

The formula for a BEV series is simple:

Look at last December's decline in the box above; yes it was the largest dollar decline in the history of the gold market. But the BEV plot shows that in percentage terms, the market corrections of autumn 2001, 2006 and 2008 actually cut deeper into gold investors' net worth. So forget dollar declines, think BEV points!

Let's look at the gold BEV chart for the 1969-81 bull market (next chart). Unlike our pussy cat of a gold bull market, BEV 20% declines were common; look at that huge 45% crater in 1976! Yes, even in 1976 the US Treasury was selling its gold reserve in the open market to suppress the price of gold in the free market.

"London - At the regular monthly auction held by the International Monetary fund last Wednesday, gold fetched the highest price recorded * since such sales began in 1976 *. Despite the sharp reaction which promptly set in when the U.S. Treasury took aggressive steps to defend the dollar, bullion dealers view that as a signal that the precious metal has resumed it upswing and could even match, or exceed the all time high it set three years ago: $197.5 an ounce." -- Robert M Bleiberg: Barron's Managing Editor, 01 January 1979

A similar 45% decline today, from our current all-time high of $1888.70 would take gold down to $1,038. I'm notpredicting this, but if we do see such a decline I wouldn't be surprised. As long as the "policy makers" control the paper gold and silver markets, and America's financial regulatory and judicial system remains dysfunctional, political necessity, not market reality controls the price of gold and silver.

So forget dollar declines, stick to percentage declines from previous all-time highs for a superior perspective of market action in a corrupt world with its rapidly devaluing currency.

Look at gold's BEV plot for our current bull market (two charts up); it's a battle between the BEV -5% and its -19% line (let's call it the -20% line). Should gold rise above its BEV -5% line sometime in the next month or two, my step sum's bear box will be invalidated. But should gold break below its BEV -20% line, the formation of the bear box provided a timely warning of things to come.

So what should one do? I'm not a financial or investment advisor, but for what it's worth, selling actual metal in expectation of lower future prices is * not * a good idea. Sometime in the next few years (maybe this year) the gold market is going to get chaotic. Little people, like you and me, may not be able to get back in (at published paper gold prices). But if you have some money on the side, waiting for lower prices before you buy seems reasonable idea at this time.

How's silver doing? It could be doing better, but any pessimism from my keyboard is only for the short term. We are still far from the BEV lows of 2008, but if they are going after gold in the next few months, silver will get its share of grief too. Will silver break below its 2008 lows in the BEV chart below? If it breaks below its BEV -45% line, there is a good chance that the current correction will be deeper than 2008's. Looking at square E below, it's obvious that someone has it out for silver!

But what kind of market sees bull-market declines below 55%? Well, I guess the silver market does. Look at square D above, from its November 2008 bottom, silver went from $8.80 to $48.58 just last April. That's a three year gain of 452%. Should silver again decline 58% by this summer, the price of silver would be $20.40, but that is still 130% above its lows of $8.80 in November 2008. Heck, three years after its credit crisis lows, the Dow Jones is up only 102% from its lows of March 2009. What can I say, silver is a wild animal!

But what if the precious metal prices fall, and continue to decline into a purgatory of a bear market? Well that is always a possibility. But for myself, I'm not in the least worried that gold, silver and the mining shares have yet seen their final bull market highs. I say that because I know that Mr Bear likes gold and silver - a lot!

You have to understand that bear markets have a place in this world. Bear markets clean up the disgusting mess (mortgages, derivatives and sovereign debt) left behind by the bulls, and right now there is a ton of crap on every balance sheet that needs to be scraped off and tossed in the trash. We have trillions and trillions of dollars and euros of worthless financial garbage that must go before the American and European economies can once again become viable in the world's markets. But current "monetary policy" now finds such garbage an indispensable reserve to be monetized. Currently, we live in a world gone mad. I blame this mental illness of the masses on our college systems' professors of economics.

No matter, when Mr Bear begins his clean-up duties in earnest, the world will be taught a lesson it will not soon forget. Eventually, even academic "policy makers" will once again see that that honesty and free market valuations are the best policy. Though these idiots don't believe that today, but before this bear market is over - they will! And believe me when I say that there will be no end to our current economic malaise until Mr Bear takes the garbage out!

Need some help seeing where all the garbage is that Mr Bear is going to take to the dumpster? Well you won't find any in the Physical gold and silver markets, but it is piled high in the NY and London paper markets. I know that because a few years ago I hired private detectives to uncover the truth about what was going on in the big trading houses on Wall Street. These free money making machines were (supposedly) regulated by the US Government and universally praised by central bankers in all 24 time zones. But things were not as advertised on CNBC!

To protect my sources, I can't disclose names or locations, but below is an actual photograph taken at one of many meetings of CEOs and CFOs for the largest banks in the world during the 2008 credit-crisis, with officials from the Federal Reserve and the US Treasury observing the proceedings, obviously with great interest, in the background.

My sources informed me that this orgy in high finance has been going on since Alan Greenspan first bailed out the big banks in October of 1987. Hell, since Greenspan took the Fed over in August 1987, every time one of these little rascals began upchucking, the two regulators in the back dutifully look the other way as the goat brought more fire-water to the party!

Trust me. Mr Bear is very aware of what has been going on in the world of high finance, and he isn't going away until this mess gets cleaned up, and disinfected! If you promise to keep it to yourself, I'll tell you something else. Mr Bear personally told me that there is no better way for him to sober up these naked-party animals than to create upside chaos in the paper and physical gold and silver markets - so that is exactly what he is going to do. He's only waiting for the right time when he can inflict the maximum amount of pain on the "policy makers" financial system. He couldn't stop giggling when he told me this. I was shocked and asked him what that was going to do to my pension fund and life insurance policy? He only flared his nostrils and growled. I left it at that.

So you see, Mr Bear is the biggest gold-bug in the world. Sure, the kids above may cause the metals to crash down over 50% in the near future, if they are willing to float even more paper gold and silver contracts; contracts that they and government regulators know they can't cover if asked for delivery in a panic. And in a panic, delivery of gold and silver will become a major issue in the paper markets. So this thirty year bacchanal is almost over, and then things are going to change. For the better I hope. Until then, the real bull market in gold and silver will only start when Mr Bear says so, and there is nothing the above party goers can do about it.

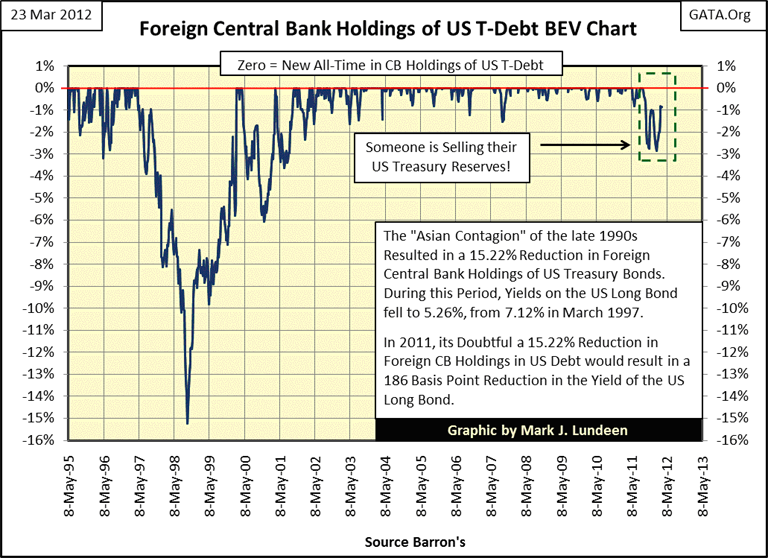

Now, you may suspect that my photo and conversation with Mr Bear are only figments of my fertile imagination; maybe. But what is for sure is that the world's central banks are losing their appetites for US Treasury debt, as the BEV chart below proves. Since August 2011's last all-time high for the global holdings of US Treasury reserves, some central banks have been reducing their positions in US Treasury bonds.

BEV charts are good at recognizing early changes in long term trends that charts using raw data frequently miss. And what this BEV chart is telling us is that the ten year trend of central banks buying, and holding US Treasury bonds is over.

Sure, there was the 15% reduction in 1998, but that was due to the "Asian Contagion", the first crisis that blamed an inflationary collapse on an unspecified "contagion." What is a financial "contagion? In 1998 it was the result of hot inflationary flows from the Federal Reserve, injected into the SE Asian "Tiger Economies" via hedge funds. The inflationary flow reversed as the hedge funds took their profits, and everyone else took their losses as SE Asian markets had a painful mini-crash.

South-east Asian central bankers, just as they were taught at Harvard and Princeton, bailed out their banks by liquidating their monetary reserves. But "confidence" in the faith of the US dollar was so strong in 1998, that no US dollar crisis resulted from this massive 15% decline in central bank holdings of US Treasury debt. Well after all, Alan Greenspan, the towering genius of central banking was at the Fed's helm, and the NASDAQ was going up something like 300%-400% a week in 1998 with no complaints from anyone as gold and silver got crushed. So guess what? No one in the financial media noticed that foreign central banks liquidated a whopping 15% of their total holdings of US Treasury Bonds. I, with my BEV chart, and a little help from Barron's statistics department, may have been the only person in the world outside the world of central banking who followed this inflationary debacle.

Compare 1998 to now. Grim faces on CNBC now report rumors of reductions in the holdings of foreign central banks' US Treasury portfolios. Look at the BEV chart, before 2001, reductions of 5% were not only routine, but always ignored by the press. Suddenly, today's little 2% & 3% reductions in foreign CB US Treasury bond holdings are currently news-making events? Don't tell me the world of central banking and high finance doesn't feel Mr Bear's hot breath on the backs of its neck!

So what does Washington and Wall Street do? Go back and review my photo of these guys in action. The bankers and their regulators will do what they always do when they are in big trouble:

- Run around naked

- Get sloppy drunk on "liquidity"

- Short gold and silver into submission at the COMEX!

In the event of another European "contagion crisis", if that goat brings enough liquid courage from the Federal Reserve to the party, and Doctor Bernanke will make sure he does, those little stinkers from Wall Street will likely do something really stupid; like shorting gold and silver down to new all-time dollar declines as Europe's bank reserves burn. But the American financial media will lead with the straw-man story that gold and silver are crashing, as they down play or totally ignore the convulsions in the EU's financial system. I'm not saying this because I'm so brilliant; it's just that after more than a decade following this nonsense, I'd have to be in a coma not to see this coming!

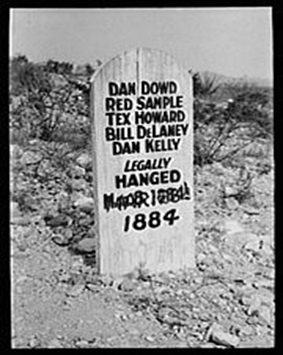

Just remember; there is a new sheriff coming to town. His badge may be made of tin, but he walks on all fours and doesn't care that he smells like he lives in the woods. That seems important for some strange reason. No matter, he also knows exactly who needs a fair trial before they're "legally hanged" and a given a decent burial in boot hill. Andguess what, gold and silver, just like the goat, is not on the list below.

[email protected]