Notes From The Denver Gold Forum

Strengths

-

The best performing precious metal for the week was silver, with a gold-inspired lift of 4.80 percent. It is typical for silver to have a higher beta to gold.

-

Gold is headed for its biggest weekly advance since July, reports Bloomberg, following the Federal Reserve’s decision this week to leave interest rates unchanged. The 25-percent rally that gold bullion saw in the first half of the year has sputtered this quarter, partly on concern that the Fed could have raised rates as soon as this week. In a similar fashion, gold futures gained after the Bank of Japan changed its focus on Wednesday (as traders awaited the Fed decision), from expanding the money supply to controlling interest rates.

-

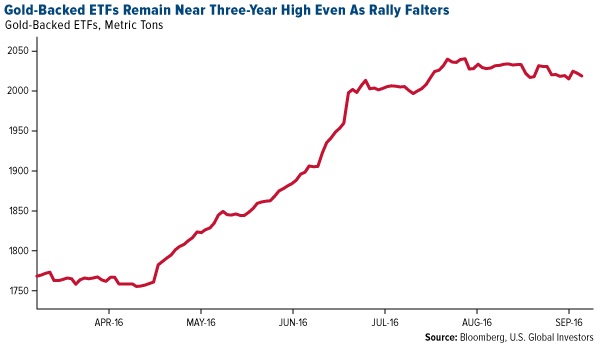

According to the average estimate in a survey of 16 participants at the Denver Gold Forum this week, gold prices will reach $1,385.63 an ounce by year end, reports Bloomberg. This forecast is 4.1 percent higher than Wednesday’s closing futures prices. As seen in the chart below, investors poured $249 million into gold-backed ETFs over the last week, the article continues. This has helped keep holdings near a three-year high.

Weaknesses

-

Although gold was the worst performing precious metal for the week, it was a welcome gain none-the-less in light of worries surrounding a possible rate hike this month. Saxo Bank’s head of commodity strategy Ole Hansen believes that gold is due for a correction. Hansen recognizes that gold gains have been elusive lately, but says that the “market has become stale” and prices have “struggled to move higher.” He sees the metal falling back to the $1,250 per ounce level, but says once the stale longs have been cleared out of the market, gold could rise to $1,375 per ounce.

-

According to Bloomberg, a potential interest-rate hike in the U.S. this year is spurring lower gold price expectations in India. This has the potential to deter buying, as the dollar strengthens versus the rupee. Interesting enough, estimates from Bloomberg Intelligence show that India’s gold hoarding since 2000 exceeds 12,500 tons (the U.S. reserve holdings come in at 8,133.5 tons during this period and China’s at 10,500 tons).

-

An employee with the Royal Canadian Mint was caught this week for allegedly smuggling around $180,000 worth of gold from the facility, hiding the metal in his bum. An alert bank teller discovered the alleged theft, reports Postmedia News, after the man took small circular chunks of gold on multiple occasions to Ottawa Gold Buyers – typically receiving checks in the $6,800 range for pucks that weighed around 210 grams.

Opportunities

-

Several members of the U.S. Global team attended the Denver Gold Forum this week, where investor attendance was up 15 percent from last year, with a mood that was a bit more optimistic. According to a recap from BMO, there were several key themes at this year’s event: 1) Disciplined capital allocation and reductions in costs, 2) Muted M&A, with an emphasis on existing portfolios and development pipelines, and 3) Renewed focus on exploration, and targeting organic over incremental. In the prior week, the Precious Metals Summit, where many of the exploration and development companies presented their investment merits, had just come to a close. There were numerous mine tours scheduled around the events. We attended the Klondex Mines tour of their True North Mine which was acquired late last year on very reasonable terms.

-

Diego Parilla from Old Mutual Global Investors sees gold entering a long-term bull market, reports Bloomberg, likely soaring to a record within five years as asset bubbles pop in everything from bonds to credit to equities. “As some of the excesses in other asset classes get unwound, gold will perform very strongly,” Parilla said. Similarly, Robert McEwen (one of the industry’s most unabashed bulls, says Bloomberg) believes gold prices could rise as much as 44 percent by year end, trading in a range of $1,700 to $1,900 an ounce. McEwen says gold is a store of value that has gone for millennia. “The big argument against gold used to be it costs you money to store it,” he said. “Right now, it’s costing you money to store you cash.”

-

According to a recent UBS Evidence Lab consumer survey in India, results show that the country has a relatively stable appetite for gold. When asked about the potential for gold purchases in the coming months, results were more or less the same, to slightly higher, versus 2015, reports UBS. The research continues by stating that there is a good potential for physical offtake in India to improve over the next couple of months.

Threats

-

Gold mines in South Africa have seen output drop for decades, reports Bloomberg. The country’s largest gold producer is turning to an overlooked (and potentially cheaper) source of supply: the dump. “It’s easy gold, but the processing volumes are enormous,” said Grant Stuart, VP of projects at Westonaria, South African-based Sibanye. According to Bloomberg, once Sibanye’s mines are depleted, the company faces huge cleanup costs at so-called tailing dams that contain toxic materials like uranium and sulfides, along with traces of the yellow metal. If the tailings can be reprocessed economically that might ease the burden.

-

Goldman Sachs is calling for an end in capex cuts, according to a note released this week. “Our thesis on capex cuts is that the sector has approached a point where there are limited opportunities to continue cutting capex – essentially the sector has ‘hit bone’”, the report reads. “Although the capex trend is still likely to be down year-over-year from 2016 levels, as projects roll off, we do not expect to see further cuts in our existing capex profile.” Should the gold price continue to rise, miners will be hard pressed to contain their spending.

-

Gran Colombia announced this week that it is monitoring the civil situation in Segovia and Remedios in the Department of Antioquia, Colombia, where the company’s Segovia Operations are located. A local mining collective (made up mainly of illegal miners) has convened a civil strike to exert pressure on negotiations it’s having with various levels of government and Gran Colombia. The discussions are related to the Colombian government’s national program to formalize illegal mining in the country, at issue is Decree 1421 from the Ministry of Mining and Energy (which became effective on September 1). Earlier in the quarter, the government put an end to illegal mining on Continental Gold’s property.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of