This Past Week In Gold

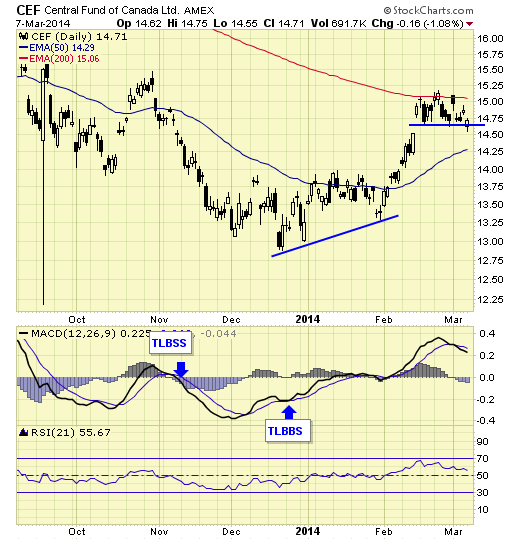

Gold sector cycle – up as of 12/27.

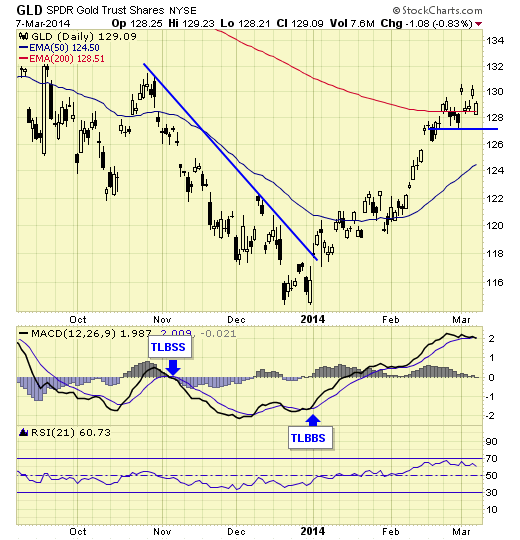

GLD – on buy signal.

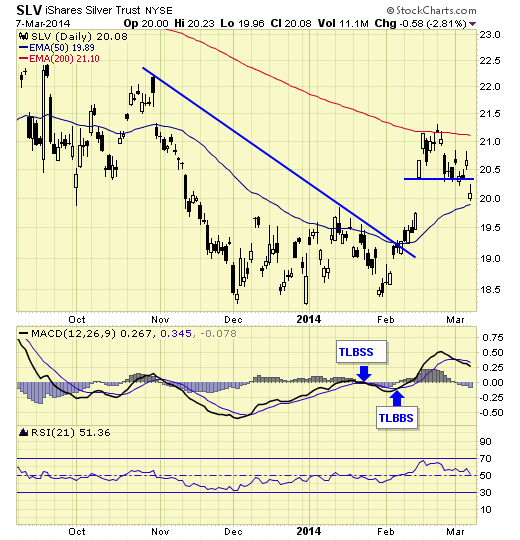

SLV – on buy signal.

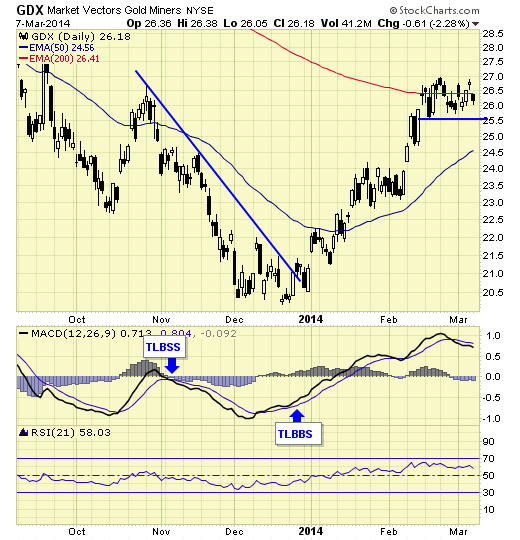

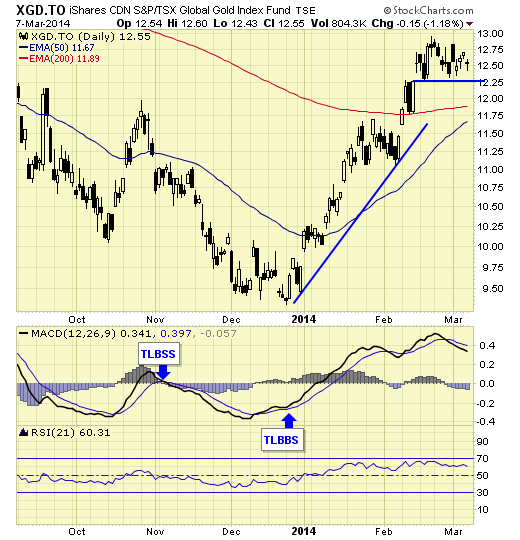

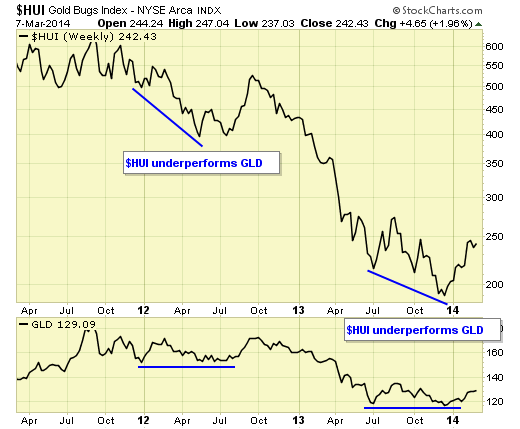

Prices rejected at 200ema resistance.

GDX – on buy signal.

XGD.TO – on buy signal.

CEF – on buy signal.

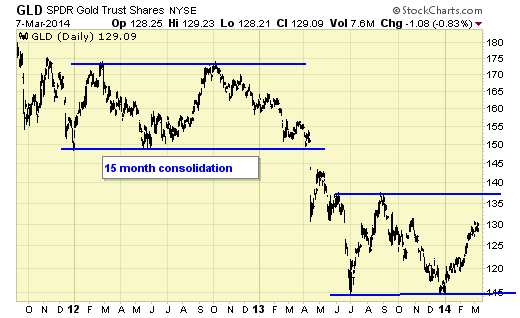

In 2012 when gold made a double bottom in June and with prices rallying in the summer months, some analysts were sure that the bottom was in and gold was destined to reach new highs. Obviously that did not happen as it was merely a consolidation which broke down in 2013.

Gold again made a double bottom this past December and with prices well off that Dec low, we are now hearing similar calls.

May be, maybe not.

Until prices can break above resistance near 138 on GLD, this is just another consolidation within a bear market.

The chart above tells the story.

Summary

Long-term – on major sell signal since Mar 2012.

Short-term – on buy signals.

Gold sector cycle – up as of 12/27.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.