The Precious Metals Sector And The Fed

While the Fed is almost powerless these days, as it has succeeded in "painting itself into a corner," the markets still seem to think that its utterances are important and react, sometimes violently, to its apparent stance, or implied stance. For this reason we have to treat Fed statements as important, even though they really aren't. Today we have the Fed making pronouncements and the markets can be expected to gyrate around and react as usual.

Chart courtesy of www.sentimentrader.com

In general they are not expected to "rock the boat." Powerful vested interests—what may be described as the status quo—want Hillary Clinton as the next President, as she will serve as their marionette and do their bidding. Trump can talk a lot, but even if he gets in, it won’t make much difference for two reasons. One is that he is the candidate for the Republican Party, and the same plutocrats control the Republican Party that control the Democrats—they are two sides of the same coin. So if elected Trump will have to buckle down and do as he is told. If he tries to seriously take on the military-industrial complex that runs the U.S. he will end up like JFK. In any event, he has already indicated that he will yield and comply, by talking about "beefing up our great military" and by paying homage to "our great friend in the region (Mid-East) Israel."

So whoever gets in, the outlook for the ordinary American citizen remains hopeless, despite all the mindless pre-election hype and razzmatazz. Between the two candidates, the powerful vested interests prefer Hillary. Therefore, we can expect the Fed to do as little as possible to upset the markets ahead of the elections (i.e. nothing of any consequence). This being so, today's Fed remarks might be greeted with a sigh of relief - and spark another up-leg in the broad market, which is now supported by a gigantic slush fund.

Although at first sight it looks like we are being presented with a buying opportunity in the precious metals sector, which has reacted back over the past couple of weeks. Nonetheless, we have to careful here. There has been no major correction in this sector all this year, which has all inflated after months of rallying. Moreover, we will look at some evidence here that the correction may have considerably further to go in points terms…if not in time terms.

We will start by looking at the eight-month gold chart. As we can see, although stocks have been slammed over the past couple of weeks, gold has barely dropped yet, although it has broken down from a Triangle as predicted at the start of the week in Gold and Silver Probable Short-term Scenario. If the dollar rallies, gold could get whacked back to the vicinity of its 200-day moving average, now at about $1,220. Such a drop would lead to further heavy losses in PM stocks over a short-term time frame, and would be expected to be followed by a reversal to the upside…and thus present a MAJOR buying opportunity.

The latest gold Hedgers chart (a form of COT chart, shown at the top of the article) shows an extremely lopsided situation that normally calls for a significant drop, which has contributed to our cautious stance of recent weeks…

On the latest 8-month chart for GDX, the sector looks like it is at another buy spot. It may be, depending on how markets react to the Fed later. However, other factors such as the gold chart above…and sentiment readings that we will look at in a moment, urge caution and suggest that instead the sector could break down into a short-term plunge that sees GDX correct back to the vicinity of its 200-day moving average. If the sector reacts positively after the Fed, it will be in order to buy it, but prudent to set quite close stops.

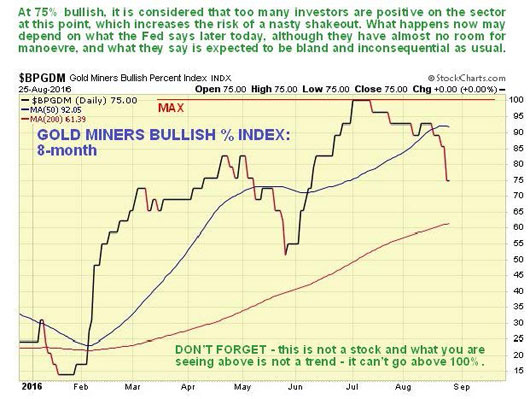

After the latest retreat the Gold Miners Bullish Percent Index is still at an uncomfortably high reading of

75% bullish, which increases the risk that this correction is not done yet…and could end with a nasty flush-out that will also throw up a great buying opportunity.

One thing worth pointing out here is that it looks like a breakout by US Treasuries is imminent -- and it may well be triggered by the Fed's remarks today. On the 8-month chart for Treasury proxy TLT we see that the neat Symmetrical Triangle that has been forming in recent weeks is now closing up. Various factors suggest an upside breakout, although the gap between the moving averages is now large, so the opposite outcome is possible, depending on the market's interpretation of the Fed.

So let's see how the markets react after the Fed meeting.

********

Courtesy of Courtesy of http://www.clivemaund.com