The Silver Lining To Gold's Storm Cloud

Summary

- Gold's woes have begun to attract major media attention.

- Increased awareness to gold's decline is increasing short interest.

- That, plus improved gold/silver ratio, could pave the way for rally.

The fact that gold remains controlled by the bears has been strongly underscored in recent days. A collapse to below the pivotal $1,200 level is one such reminder; the continued strengthening of the U.S. dollar index is another. Yet for all the bearish signs everywhere, the market did provide a sign that a relief rally, if only a temporary one, is in sight. We’ll discuss the prospects for a short-term gold rally in today’s comments.

After a tumultuous week for the metals, Thursday’s session provided a slight glimmer of hope for the bulls. Spot gold rose from 19-month lows on Thursday as the dollar pulled back on news that the U.S. and China will resume talks later this month. December gold futures settled 0.18% lower in the latest session and wasn’t able to benefit from the dollar’s slide. Silver outperformed, however, with a 1.50% rally after earlier hitting its lowest level in 18 months.

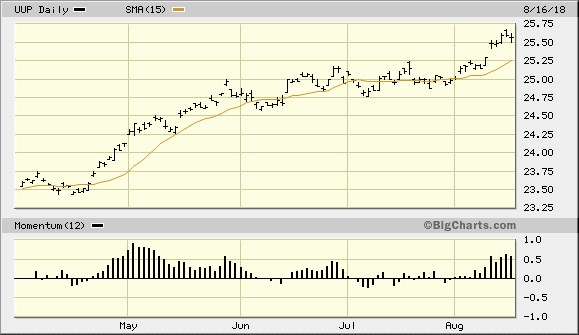

In an environment characterized by ultra-bearish investor sentiment and nothing but bad news for gold, an increase in short sales on top of existing short interest levels could potentially create a powder keg for an explosive gold rally. The only problem standing in the way of such a rally for gold is the powerful forward momentum of the U.S. dollar. This will serve as a limitation of gold’s next relief rally due to the metal’s weakened currency component. Shown here is a graph of the Invesco DB US Dollar Index Bullish Fund (UUP), which I sometimes use as a proxy for the U.S. dollar index. One important prerequisite for a gold rally is that UUP should close below its 15-day moving average. As long as UUP remains above the upward-trending 15-day MA, gold’s immediate trend is still technically down and the bears will still enjoy an immediate-term (1-4 week) advantage.

Another important requirement before gold can commence a meaningful short-covering rally concerns the dollar/gold ratio. This important measure of the dollar’s relative strength versus gold continues to trend higher at an accelerating rate. The upward trend in the dollar/gold ratio should sharply reverse below the 0.078 level (see chart below) to let us know that the currency backdrop is ideal for a worthwhile gold rally.

Source: StockCharts

If you’ll pardon the pun, there is a silver lining to gold’s latest woes, however. For one thing, gold’s harrowing performance of recent weeks is beginning to catch the attention of some mainstream media outlets. Yahoo Finance ran a feature headline on Wednesday about gold hitting its lowest level of the year. From a contrarian’s perspective, this could be interpreted as a sign that there is maximum awareness of gold’s decline. Articles like this should serve to attract a horde of late-arriving bears to the gold scene, in turn setting up a short-covering rally for gold at some point in the next few days.

Of even greater significance is the latest development of the gold/silver ratio. In my Aug. 9 commentary I noted that the gold/silver ratio was potentially on the verge of a big upside move. Historically, whenever the ratio spikes above the 0.80 level it has boded well for the silver price in the near term. Moreover, when silver outperforms gold it typically sets the stage for a gold rally - especially when gold is extremely “oversold” (as it has been lately). Thus the latest move in the gold/silver ratio to 0.82 this week can be viewed as a potentially positive indication for the near term outlook of both gold and silver.

Another important requirement before gold can commence a meaningful short-covering rally concerns the dollar/gold ratio. This important measure of the dollar’s relative strength versus gold continues to trend higher at an accelerating rate. The upward trend in the dollar/gold ratio should sharply reverse below the 0.078 level (see chart below) to let us know that the currency backdrop is ideal for a worthwhile gold rally.

Source: StockCharts

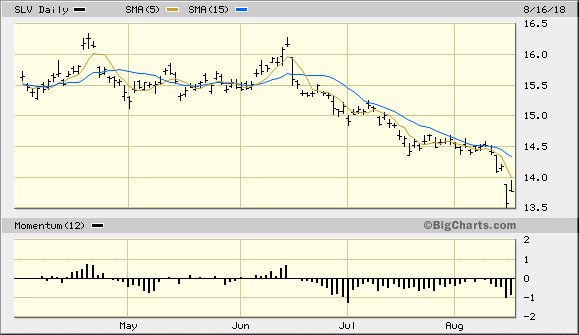

One such indication of silver’s near-term intentions can be seen in the following graph of the iShares Silver Trust (SLV), my favorite silver ETF. SLV managed to rally almost 1.5% on Thursday and in doing so has already begun outperforming gold on a micro-term basis. If the silver ETF follows through with this rally in the next few days by closing two days above its 5-day moving average (see below), then by closing above its 15-day MA, we’ll have a confirmed immediate-term (1-4 week) bottom for SLV. This in turn would bode extremely well for gold’s immediate-term prospects.

Source: BigCharts

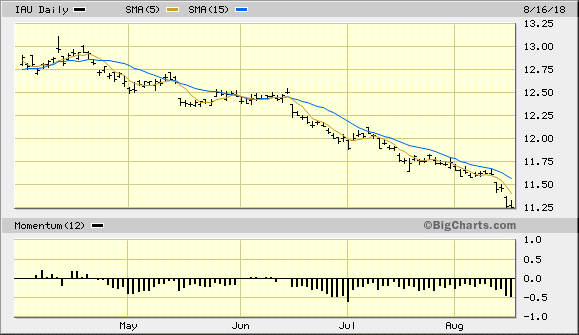

Meanwhile the iShares Gold Trust (IAU), which is my preferred gold trading vehicle used in this commentary, remains under both its 5-day and 15-day moving averages as can be seen in the following graph. I’ll reiterate what I wrote in a recent commentary by saying that a simple 2-day close decisively above the 5-day MA would serve notice on the bears that a preliminary bottoming attempt has begun. Even the simple act of closing the gold ETF price two days above its 5-day moving average would be viewed as a sign of latent strength since IAU has been unable to manage this feat since early July. This would also likely discourage the shorts and force them to temporarily back off enough to allow the bulls to take over.

Until the above mentioned developments take place (namely a 2-day close above the 5-day moving average in the gold and silver ETFs), investors should stand pat and make no new purchases of the iShares Gold Trust (IAU). A confirmed immediate-term bottom could come as soon as early next week, so once the technical requirements for a preliminary bottom are met as discussed in this report we'll be able to evaluate the prospects for another entry point with greater clarity. For now, I recommend investors remain in cash.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.