Simple Trades in the Gold Sector

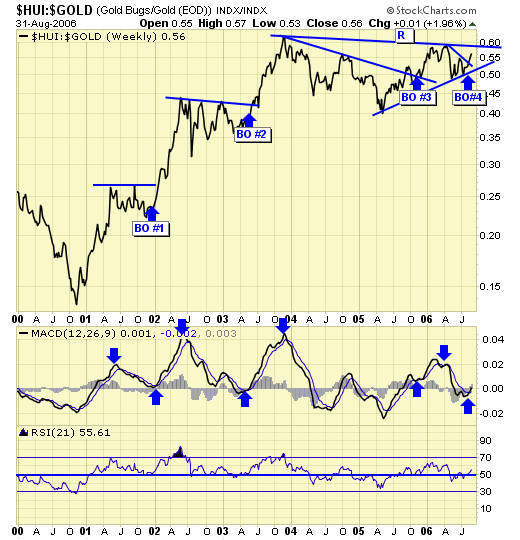

Our breakout model finally confirmed the much anticipated BO#4 a few days ago, and alerted us to be aggressive buyers of the gold sector.

BO#4 is now confirmed, and there is one more final hurdle, by exceeding resistance at the .60 level . Nevertheless, the breakout alerted us to watch for set ups in the gold sector.

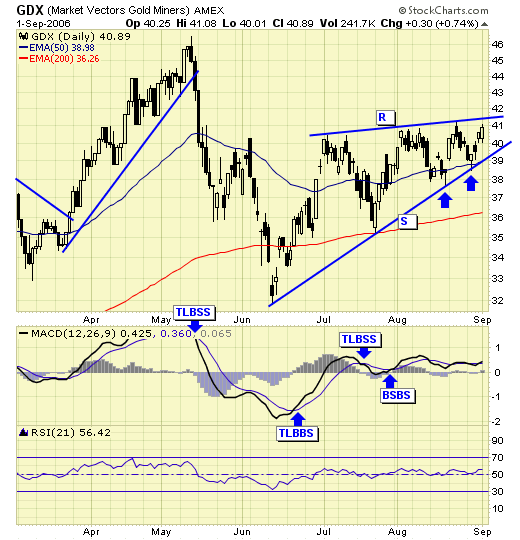

US traders bought GDX at $39.35, with stop at $38.44, risking just over 2%.

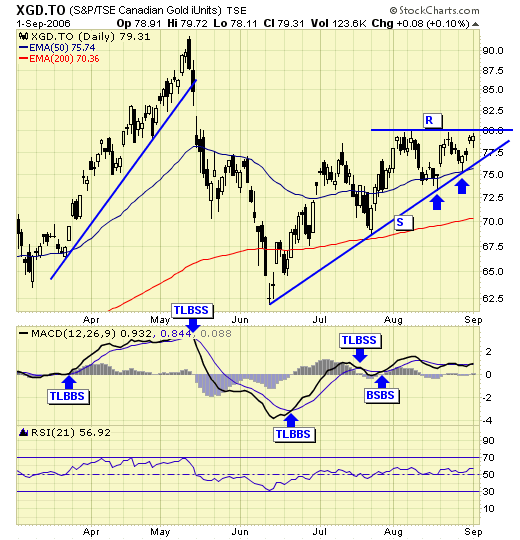

Canadian traders bought XGD at $77, with stop at $75.45, risking 2%.

Summary

Prices in both ETFs are now approaching resistance. If the breakout model is correct, the resistance should not be a problem as prices should exceed it and challenge the May high in the next few weeks. Risk/reward on these two trades are very attractive, as we are risking 2% for a potential 20% return if the May highs are reached, and more if they are exceeded.

********