Slaughter Of The PIIGS Looms On The Horizon

Indubitably, the Euro Union (EU) has been and remains a modern day Greek Tragedy, which will eventually and inevitably implode as the Euro currency becomes relentlessly worthLESS. The only exiting doubts are WHEN…and the source spark causing implosion of the Euro Union. Two schools of thoughts postulate that Greece will throw in the towel (and abandon the EU)…and the second more probable is that Germany will say it has had enough of the financial support of the indolent PIIGS (Portugal, Italy, Ireland, Greece & Spain). Ergo, the EU will be KAPUTT (i.e. destroyed). Effectively, the German sow nation mothering the PIIGS is (financially) running dry and tired.

Indubitably, the Euro Union (EU) has been and remains a modern day Greek Tragedy, which will eventually and inevitably implode as the Euro currency becomes relentlessly worthLESS. The only exiting doubts are WHEN…and the source spark causing implosion of the Euro Union. Two schools of thoughts postulate that Greece will throw in the towel (and abandon the EU)…and the second more probable is that Germany will say it has had enough of the financial support of the indolent PIIGS (Portugal, Italy, Ireland, Greece & Spain). Ergo, the EU will be KAPUTT (i.e. destroyed). Effectively, the German sow nation mothering the PIIGS is (financially) running dry and tired.

There are three overtly prominent indications of the forth-coming demise of the EU:

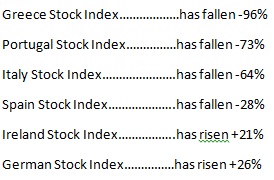

- The many years long grinding Bear Stock Markets in the PIIGS nations;

- The horrific decline in the bank stocks amongst the PIIGS and other European countries;

- And the relentless decline of the Euro Currency.

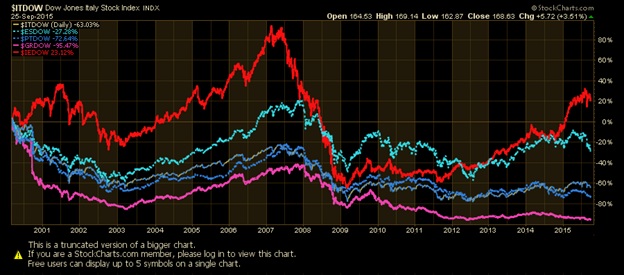

Bear Stock Markets Abound Amongst The PIIGS

The Stock Indices of the PIIGS have suffered a protracted 15-Year Bear Market. Here is the accumulated negative performance since March 2000. Please note the German Stock Index (DAX) is super-imposed in the same chart in order to provide perspective to the pathetic performance of the PIIGS…which dropped on average -47% during the past 15-year period!

The horrific decline in the bank stocks amongst the PIIGS Countries

Not only have hapless investors lost a horrific amount of money during the past 15-years under the black cloud of the EU, the banks of the PIIGS nations were also decimated financially.

Cracks in the Banking Wall of the Euro Union

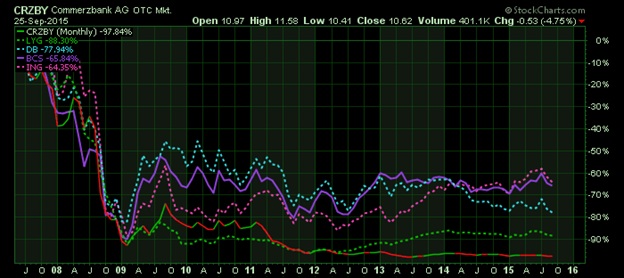

In decades past, the financial backbone of Europe has been its banking sector. To be sure, a few old name (once) prestigious banks have suffered irresistible dumping of their stock by institutional shareholders. Most devastated are Portuguese Banco Espirito Santo, German Commerzbank, Deutsche Bank and the National Bank of Greece.

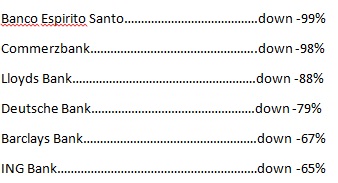

Portuguese Banco Espirito Santo stock has plummeted -99.8 % from its 2007 high of $6.18…and sells today for a mere One Penny a share ($01/share). However, several other EU banks have suffered the same dreadful fate of relentlessly tumbling stock prices. The chart below shows the heart wrenching losses of share value since mid-2007, which include Commerzbank (Germany), Deutsche Bank (Germany), Barclays Bank (UK), ING (Netherlands) and Lloyds (UK).

Negative stock performance of leading European Banks since mid-2007:

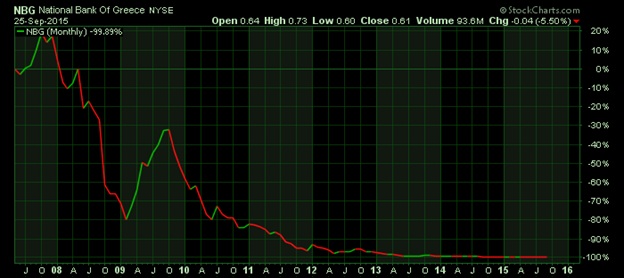

And then there is the National Bank of Greece, whose stock has plummeted -99.9% during the past eight years (See chart):

It is sadly obvious that investors and banks in Europe are literally going bankrupt! And last but not least horrifically pernicious negative, there’s the fiat currency called the Euro.

Relentless Decline Of The Euro Currency

Relentless Decline Of The Euro Currency

Since its high in early 2008, the value of the Euro currency has steadily declined by 30%. Moreover, the Euro chart presently demonstrates a multi-year bearish Complex Head&Shoulders top…that indeed has triggered…projecting a fall to at least the 2001 low of 85. However, it gets even worse. The Euro chart shows a recently formed bearish Inverted Flag…which if triggered would imply another drop in value to 75ish, which would translate to a devaluation of about 34% from today’s level (113).

Since its high in early 2008, the value of the Euro currency has steadily declined by 30%. Moreover, the Euro chart presently demonstrates a multi-year bearish Complex Head&Shoulders top…that indeed has triggered…projecting a fall to at least the 2001 low of 85. However, it gets even worse. The Euro chart shows a recently formed bearish Inverted Flag…which if triggered would imply another drop in value to 75ish, which would translate to a devaluation of about 34% from today’s level (113).

-----------------------------

In the event conditions in the Euro Union continue to worsen (highly probable), then possibly the

bearish Inverted Flag pattern might trigger and cause the Euro to go into free-fall. Consequently, the US greenback could rise to 120 resistance (See chart below).

Guru Greenspan says shattering of European Union will begin with imminent Greek implosion

“The former chief of the US Federal Reserve says it is just a matter of time before the European Union implodes, along with its currency, following what he believes will be a "Grexit" -- a Greek exit -- from the EU.

In an interview earlier this year with the BBC, former Fed Chairman Alan Greenspan said he did not see a scenario in which the EU or its lending institutions, including its own central bank, would risk loaning the economically struggling nation more money, especially after its new far-left leadership came to power vowing to scrap current austerity measures called for in a previous loan package.

Greek finance officials are seeking to renegotiate the country's prior bailout loan, which amounts to more than $250 billion, but Greenspan said, "I don't think it will be resolved without Greece leaving the eurozone." (Source: http://www.naturalnews.com/048792_European_Union_Greece_Alan_Greenspan.html

CONCLUSIONS

Picture yourself living (that is surviving) in the Euro Union, which bears three unsustainable crosses:

- Where the average stock investor in the PIIGS nations has lost 47% during the past 15 hears

- Where major European banks are literally going bankrupt

- Where your currency has been relentlessly falling in Purchasing Power since 2007, and looks to decline another 34% in the next few years.

What possible hope could you have for yourself and your children, where the political and economic structure threaten to collapse at any given moment…where indeed dissolution of the Euro Union is practically a feat accompli?! Where hope is an illusion…indeed an impossible dream of Don Quixote?!

Related Articles

Related Articles

The Ultimate Demise Of The Euro Union

https://www.gold-eagle.com/article/tragedy-euro

Euro Forecast Via Cartoons…Can The PIIGS Fly?

If Deutsche Bank Goes Under It Will be Lehman Times Five!

********