The Stock Market’s Long-Term Trend

Whether the stock market is in a long-term bullish trend or a long-term bearish trend can't be determined by looking at nominal prices. The reason is that the nominal price of an investment is determined by the value of the investment AND the value of the money in which the price is denominated, meaning, for example, that it would be possible for a large rise in the stock market to be primarily the result of a large decline in the value of money. To put it another way, if the stock market's major trend were determined solely by the change in the nominal price level, then the central bank could create a bull market simply by depreciating the currency. How, then, should we determine the stock market's long-term trend? Let us count the ways.

The first way is to look at the long-term trend in valuation terms (for example, the average P/E ratio) rather than in nominal price terms. During a long-term bull market the average valuation should make progressively higher highs and higher lows, whereas during a long-term bear market the market's valuation should make lower highs and lower lows. Furthermore, we know from the historical record that once a long-term bull market gets underway it doesn't end until the average valuation becomes very high, and that once a long-term bear market gets underway it doesn't end until the average valuation becomes very low.

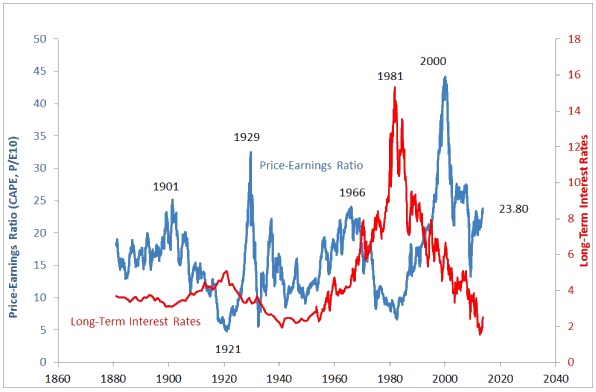

With regard to the US stock market, we present the following chart of the S&P500's Cyclically-Adjusted P/E ratio (also known as the "Shiller P/E") and point out that:

a) The average valuation was a lot lower at the 2007 peak than at the 2000 peak and the average valuation was lower at the 2008-2009 bottom than at the 2002-2003 bottom. This tells us that a long-term bear market commenced in 2000.

b) Although the average valuation at the 2008-2009 bottom was reasonable, it wasn't unusually low by historical standards. This suggests that the long-term bear market did not end at that time.

c) The market now appears to be rolling over to the downside from a significantly lower average valuation than existed at the 2007 peak. If this turns out to be the case it will confirm that the long-term bear market is still in progress.

Chart Source: http://www.irrationalexuberance.com/index.htm

As an aside, while the current valuation is very low compared to the valuation at the 2000 peak, it is roughly the same as the valuation at the secular 1966 peak.

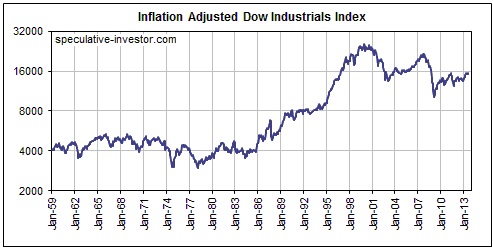

The second way of determining the stock market's long-term trend is to look at performance in terms of inflation-adjusted (IA) currency. Provided that a realistic measure of inflation adjustment is used, this will indicate whether the market is falling or rising in purchasing-power terms. Irrespective of its nominal price performance, an investment is not really in a bull market unless its purchasing power is trending upward.

With regard to the US stock market, the following chart shows that the inflation-adjusted (IA)* Dow Industrials Index has been making lower highs and lower lows since 2000. This chart is therefore consistent with our assessment of the long-term valuation trend -- it shows that a long-term bear market commenced in 2000 and does not contain any evidence that the bear market is over.

The third and final way of determining the stock market's long-term trend is to look at performance in terms of gold. This works because gold tends to at least maintain its purchasing power over the very long haul and because secular gold bull markets invariably coincide with secular equity bear markets.

With regard to the US stock market, the following chart shows that the Dow/Gold ratio commenced a long-term downward trend in 2000.

Fortunately, the three reasonable methods of determining the long-term trend of the US stock market are in synch. Each method indicates that a long-term bear market definitely began in 2000 and that the long-term bear market is probably still in progress.

*We use a method of adjusting for the effects of US monetary inflation that is far more accurate over the long term than either the official CPI or the Shadowstats.com CPI.

********

Regular financial market forecasts and

analyses are provided at our web site:

http://www.speculative-investor.com/new/index.html

We aren’t offering a free trial subscription at this time,

but free samples of our work (excerpts from our

regular commentaries) can be viewed at:

Steve Saville graduated from the

Steve Saville graduated from the