A Stock Market Crash Is Coming!

Conventional “Wisdom:” Markets move up and down, but the stock market always comes back. The DOW is frothy and needs a correction, but the stock markets are healthy and big gains lie ahead.

Pessimistic version: Jim Rogers said, “the next crash will ‘the biggest in my lifetime.’” [Coming soon …]

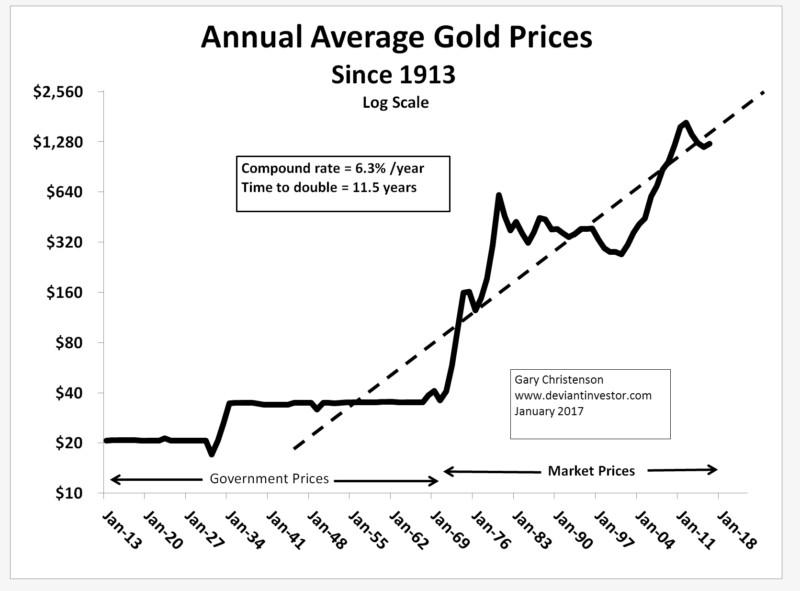

Question: Given the craziness in politics, the Middle-East, Central Banking, and global debt levels … do you own enough gold bullion?

Conventional thinking:

“Trump will save the markets, reduce taxes, and boost stock prices even higher.” [Don’t plan on it.]

“Gold pays no interest and has gone down for six years.” [True but irrelevant.]

“The Yellen Fed can’t let market bubbles pop so they will create more QE, more bond monetization, “printing,” and Fed support. In short, the ‘Yellen Put’ is alive and will protect investors.” [Maybe not…]

“The market got hurt in 1987, 2000, and 2008. It rallied back each time and went higher. This time will be no different. Stocks may correct but they are a good long term investment.” Read “The Bull Case: S&P is heading to 3,000.” [How big a loss before the rally?]

In the long-term the S&P probably will hit 3,000 but the short-term risk is substantial. The attractive lie is appealing but not necessarily true. Sometimes reality is harsh.

The Fed and other central banks have added many $ trillions to their balance sheets since 2008. Official U.S. national debt is roughly $10 trillion larger in ten years. Consumer prices are higher, stocks and bonds have been levitated, the DOW and S&P are trading at all-time highs, and the markets haven’t crashed … YET. Something will puncture the bubble in stocks and bonds. Bubbles in currencies and confidence in central banks also await pins.

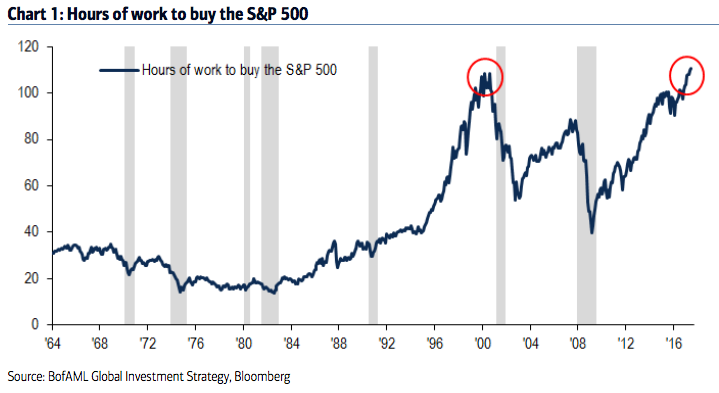

Examine the following chart of the S&P prices in average wages. Cause for concern?

Price to earnings can be “adjusted” by well compensated accountants, but is still high. Price to sales is more real and tells us the S&P is quite high.

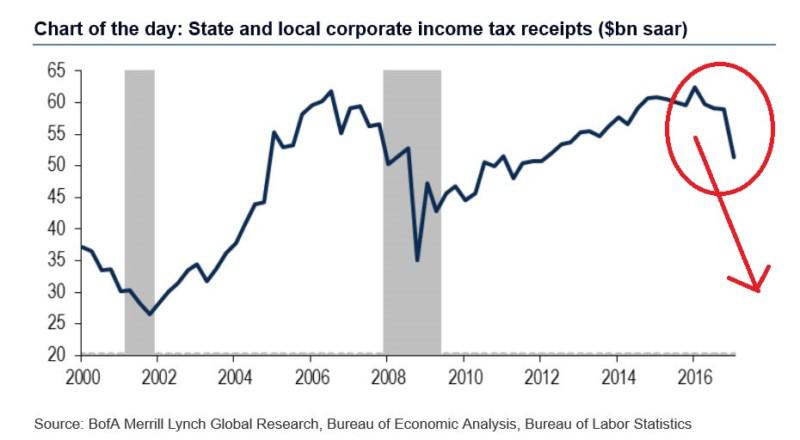

But the economy is supposedly healthy. Why are tax receipts falling in the US?

Henry Kissinger answers the question about the increasing deviation between the realities most people experience versus official narratives and statistics.

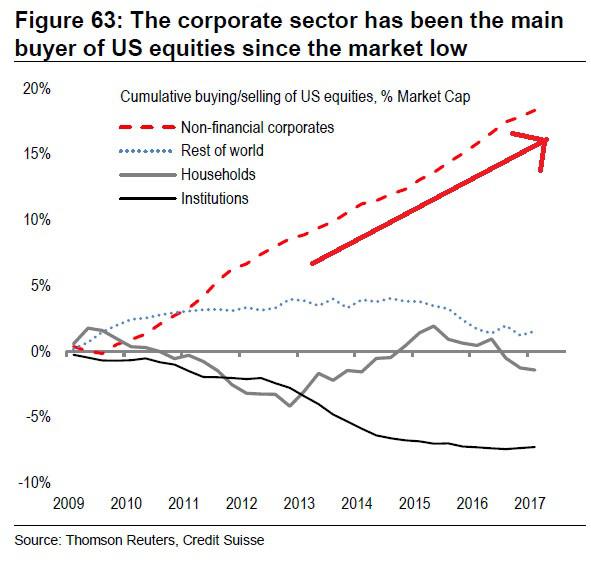

Question: If a corporation could borrow $ billions at near zero interest – thanks to Fed “stimulus” – and those $ billions would buy back millions of shares of corporate stock and boost share prices, and higher stock prices benefited corporate management, do you think the corporation would borrow to boost stock prices? [Of course!]

From Zero Hedge: “There Has Been Just One Buyer of Stocks Since the Financial Crisis”

“Stock buybacks enrich the bosses even when business sags.”

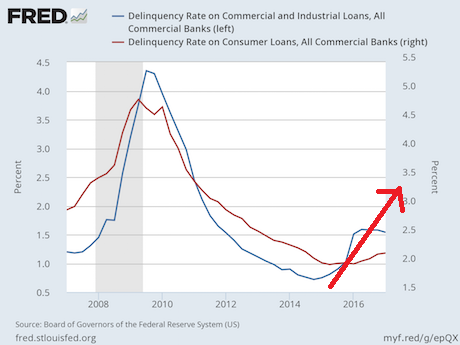

The consequences of inexpensive credit, “stimulus,” and relaxed lending standards (“Can you fog a mirror?”) are:

-

More credit is available for less cost, so more credit is used. Auto loans, credit card debt, and student loans have steadily increased.

-

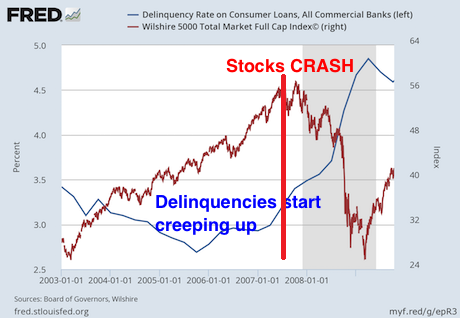

Relaxed lending standards increase default rates.

-

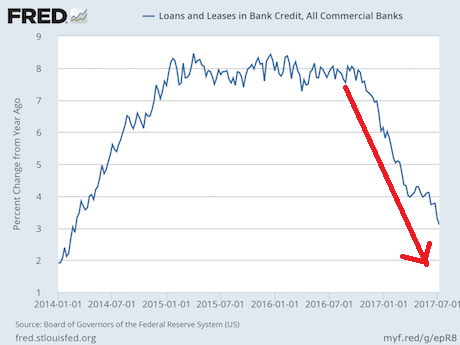

Banks and creditors reach the end of the credit cycle, reduce loans, and anticipate higher delinquencies.

-

Delinquencies lead to reduced earnings, weakened confidence, and stock market crashes.

From Graham Summers: “Banks are Pulling the Plug on Another Debt Bubble”

Before the crash the S&P Index accelerates higher.

The “wedge” is narrowing, the RSI (timing indicator) is high, and prices have moved “too far, too fast.” Ask yourself:

-

Can the S&P increase for several more years?

-

Do you feel lucky?

-

When will Buffet’s “pin” deflate the bubbles?

-

Can the Fed save the markets?

-

How much debt can the U.S. economy accommodate before “something breaks?”

-

Gold or silver bullion?

PREPARE FOR TURBULENCE:

From John Mauldin, a self-described optimist:

“Looking with fresh eyes at the economic numbers and central bankers’ statements convinced me that we will soon be in deep trouble.”

“I believe a major crisis is coming.”

Yellen’s comment on a financial crisis: “… and I hope that it will not be in our lifetimes and I don’t believe it will be.”

Mauldin’s response: “I disagree with almost every word in those two sentences, but my belief is less important than Chair Yellen’s. If she really believes this, then she is oblivious to major instabilities that still riddle the financial system. That’s not good.”

His conclusion: A Major Crisis is Coming!

From Goldcore: “Bank of England Warns ‘Bigger Systemic Risk’ Now Than 2008”

“The central bank [England] is primarily concerned that those dealers making markets in bonds will not be able to cope with panic-selling levels by investors.”

“… the level of debt in the financial system in the UK and most western countries is unsustainable.”

From Graham Summers: “ Did The Fed Just Ring A Bell At The Top? ”

“A crash is coming…”

And the Solutions Will Be:

Western countries: More debt, more spending, increase the debt ceiling, extend and pretend, and boost stock prices until they crash and burn.

Since western countries have no ability or intent to repay their massive debts, we should expect one of two outcomes:

-

Politicians and central bankers resign in mass, admit culpability, and revalue their debt to a much smaller value. [Seems unlikely!]

or

-

Devalue their currencies (Inflate or die!) so the effective value of their debt is much smaller, perhaps near zero. [Much more likely! In that case, buy gold!]

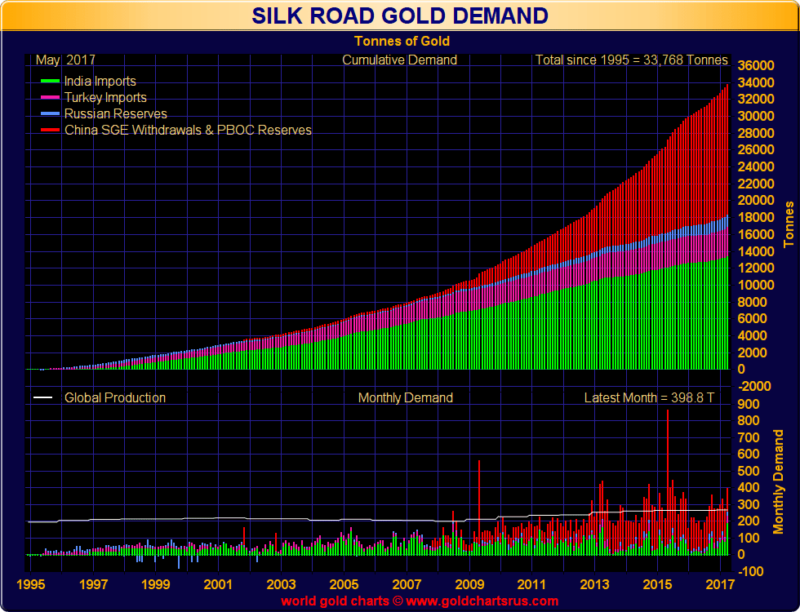

Asian countries: Import gold, distance their economies from the U.S. dollar and convert “funny money” into real gold. China possesses a massive hoard of gold and wants more.

Russia and China aggressively mine gold, refuse to export it, and import all they can…

Timing:

Read “Wrecking Ball” by John P. Hussman, Ph.D.

“I’ve periodically framed market action from the perspective of Didier Sornette’s Model of log-periodic power-law bubbles…”

“… I’ve refined the date of the ‘finite-time singularity’ in this model.”

“That ‘critical point’ is not necessarily the date of a peak or the beginning of a crash, but what Sornette describes as ‘an inflection point from self-reinforcing speculation to fragile instability.’”

“… first week of August…”

CONCLUSIONS:

-

Stock markets are trading at all-time highs in dangerous risk territory, as measured by price-to-sales and many other measures. Prepare for turbulence in the months ahead.

-

Bubbles pop. Plan on it.

-

Tax receipts are falling, new credit is slowing, and delinquencies are increasing.

-

Inexpensive loans created by the Fed have fueled corporate stock buybacks and levitated the stock markets.

-

Western countries will respond with currency devaluations, “printing” and other failed policies that benefit the financial elite.

-

Asian countries, also in trouble, import gold and refuse to export gold. They understand its protective value.

-

My estimate: Prepare for turbulence and rig for stormy weather in August, September and October 2017. Do you own due diligence!

Bonds, Yen, Euros, Dollars, and stocks have counter-party risk.

Depending upon “lucky” and central banks is unrealistic. Gold is safer and has no counter-party risk!

********

Gary Christenson

The Deviant Investor