Stocks Are Hell Bent To Suffer A Sharp Correction In 2014

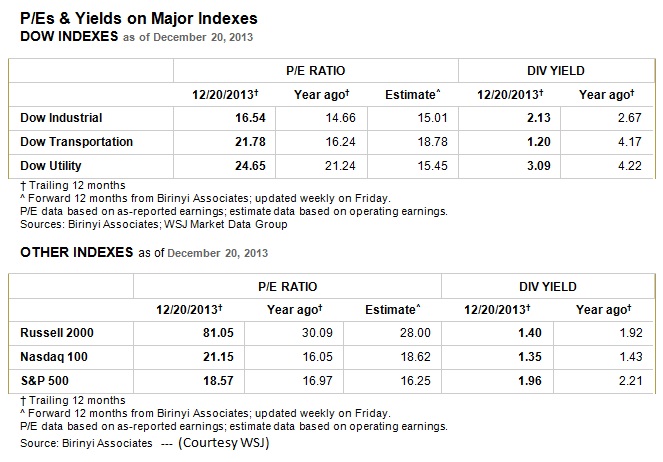

The hubris among today’s exuberant stock bulls is unbelievable and groundless, given the extreme levels of the underlying stock evaluation fundamentals. How can these delusional bulls in good conscience continue recommending (ie pumping) the purchase of Dow stocks at all-time record highs – knowing that interest rates are being forcibly held down in the U.S. at untenable levels? How can they look their readers in the eye, and tell them that stocks are NOT exorbitantly expensive with the Dow Utilities at 25x trailing earnings, the Transportation Index average at 22x, the DJIA at 17x, the S&P500 at 19x and the NASDAQ-100 at over 21x, and the Russell 2000 at an insane 81x?! What makes these hubris stricken stock bulls so delusionally confident this is not just another 1987, 2000 or 2007?!

The hubris among today’s exuberant stock bulls is unbelievable and groundless, given the extreme levels of the underlying stock evaluation fundamentals. How can these delusional bulls in good conscience continue recommending (ie pumping) the purchase of Dow stocks at all-time record highs – knowing that interest rates are being forcibly held down in the U.S. at untenable levels? How can they look their readers in the eye, and tell them that stocks are NOT exorbitantly expensive with the Dow Utilities at 25x trailing earnings, the Transportation Index average at 22x, the DJIA at 17x, the S&P500 at 19x and the NASDAQ-100 at over 21x, and the Russell 2000 at an insane 81x?! What makes these hubris stricken stock bulls so delusionally confident this is not just another 1987, 2000 or 2007?!

Three of the most accepted and respected mainstay barometers to accurately forecast where stocks are heading are: Price/Earnings Ratios (PER), Dividend Yields and NYSE Margin Debt.

Market History is testament that skyscraping levels of Price/Earnings Ratios (PER), very low Dividend Yields and peaking NYSE margin debt belie the Irrational Exuberance of the hubris media…and the greedy stock brokers who think only of mounting commissions rather than the safety of their investors’ portfolios.

Presently, PER are approaching record highs, which has historically been the precursor to a sharp stock market sell-off. Furthermore, stock Dividend Yields are at abysmally low levels, which likewise have been the precursor to sharp stock market sell-offs.

PER and Dividend Yields on many Indices

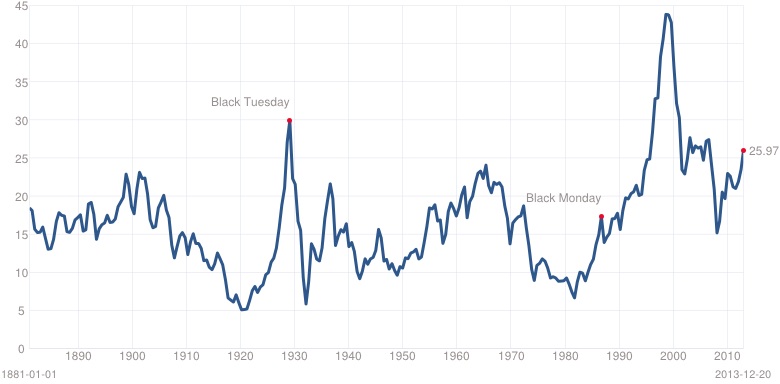

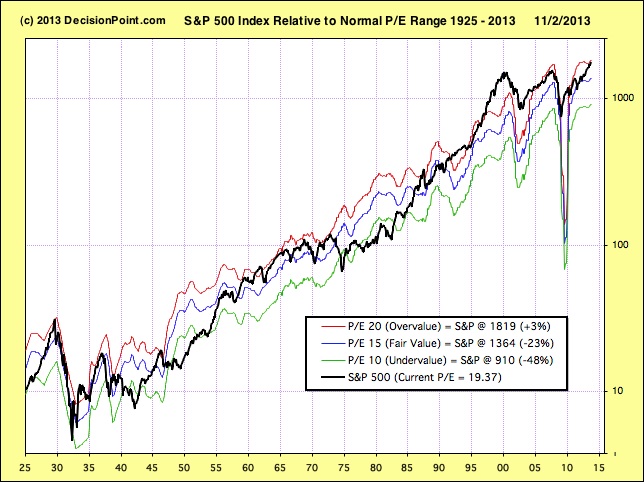

As stock market seer, Carl Swenlin recently opined: “Conclusion: Based upon valuations alone, stock prices are vulnerable to correction or bear market, and the probability for QE tapering provides the trigger for beginning that decline.” It is imperative to observe the juxtaposition in the following chart of the P/E ratios in 1929, 1987, 2000, 2008…and of course today’s! Each peaked just prior to a sharp correction in stocks.

(Above (P/E chart courtesy of DecisionPoint.com)

Stock Market seer, Yale Professor Robert Shiller, has created a graph of the S&P500 PER from 1880-2013. This mind-blowing chart clearly shows the present PER is at a very dangerous level (nearly 26x). Indubitably, Wall Street stocks are dangerously over-bought…ie over-valued.

The Schiller P/E is a more reasonable market valuation indicator than the P/E ratio because it eliminates fluctuation of the ratio caused by the variation of profit margins during business cycles. Shiller’s P/E is 53.9% higher today than the historical mean of 16.5 (Chart courtesy of http://www.multpl.com/ )

A related stocks analysis is “2014…Déjà vu 1987”

https://www.gold-eagle.com/article/2014%E2%80%A6d%C3%A9j%C3%A0-vu-1987

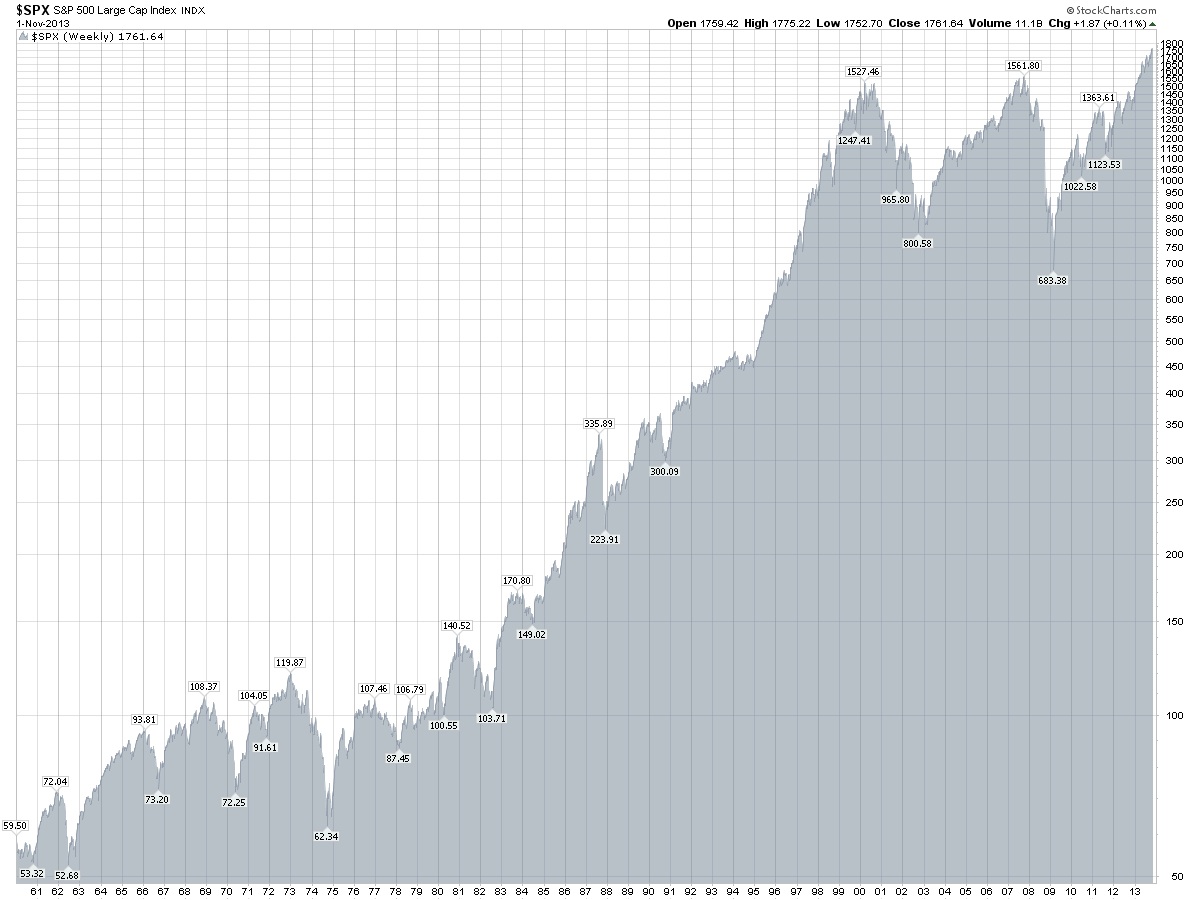

S&P500 Index from 1960 – 2013 clearly demonstrating today’s astronomical height.

(Courtesy of StockChrts.com)

Another Stock Market Metric for Evaluation is a low level of DIVIDEND YIELDS

A simple test of the dividend yield as a forecaster of future stock prices is presented in the table below (courtesy of "Stock Market Logic"). Shown are the one year returns which have ensued from various DJIA dividend yield intervals since 1941.

During the 35 year period (1941-1975) the Dividend Yield was under 3% only 17 weeks (in mid-1959 and early 1966) - and in each case the average ensuing one year market return was sharply negative....ie the stocks indices crashed, which eventually raised the Average Dividend Yield to acceptable levels.

Again in March 2007 the DOW average Dividend Yield was a mere 2.50%. As we all well know history does NOT always repeat. NONETHELESS, the then pitifully low Dividend Yield suggested Wall Street stocks might drop 10% in value during the next 12 months. However, the correction was far deeper than history might have predicted. The ensuing bear market plummeted stocks by 54% during the next 17 months.

It is imperative to take careful note that TODAY’S S&P500 Dividend Yield is dangerously low at 1.96…and falling. This is a GLARING RED ALARM that a big bad bear lurks on the horizon.

It is imperative to take careful note that TODAY’S S&P500 Dividend Yield is dangerously low at 1.96…and falling. This is a GLARING RED ALARM that a big bad bear lurks on the horizon.

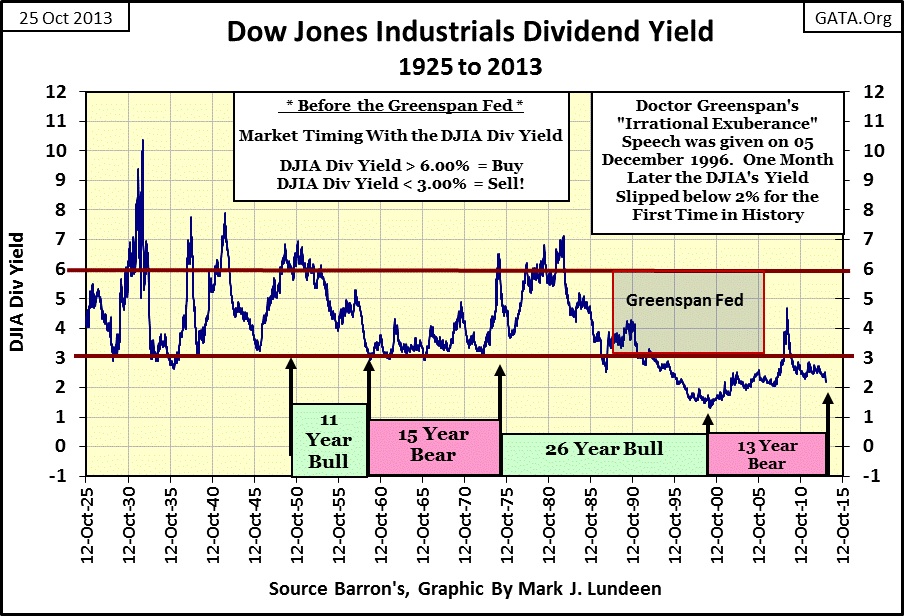

DOW Index Dividend Yields 1925-2013

(Source: https://www.gold-eagle.com/article/evil-market-omens-seen-dow-jones%E2%80%99-earnings-and-dividends )

Clearly, today’s pitifully low Dividend Yield of the DOW Index is heralding the birth of another BEAR MARKET IN STOCKS, as it is even below the level in October 1929, which gave birth to the 1929 Great Stock Market Crash, where the Dow Index lost 88% of its value during the subsequent three years.

Two related stocks analysis are “Great Crash Of 1929 Similarities Suggest Gold Prices Will Soar In 2014”

https://www.gold-eagle.com/article/great-crash-1929-similarities-suggest-gold-prices-will-soar-2014

and “Blue Skies and Market Blues (1929 & 2000)”

https://www.gold-eagle.com/article/blue-skies-and-market-blues-1929-2000

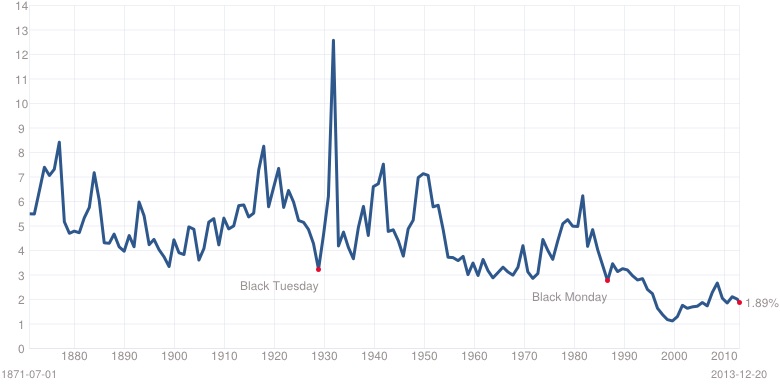

Dividend Yield Chart (1870-2013)

(Source http://www.multpl.com)

During the past 143 years in Wall Street, the present S&P500 Dividend Yield (1.89%) has only been lower once…and that was in year 2000, which birthed a bear market where the S&P500 plummeted -51% during the next 30 months. See the 2000-2003 correction deluge.

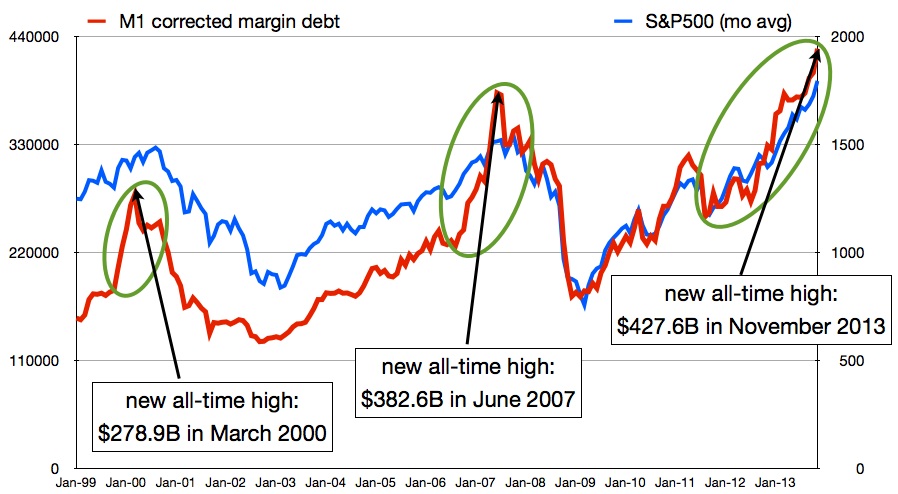

And lastly, NYSE Margin Debt has pin-pointed important market reversals.

Amazingly, NYSE Margin Debt (borrowing money “on margin” to make leveraged bets) has reached a new all-time high in November, which is another irrefutable sign the stock market is wildly over-priced.

Here’s the chart. (Note: the data is corrected for the M1 money supply)

(Chart courtesy Greedometer.com)

Here is the Stocks Forecast based upon the metrics of today’s:

- Historically High PER

- Pitifully Low Dividend Yields

- All-time Record High NYSE Margin Debt

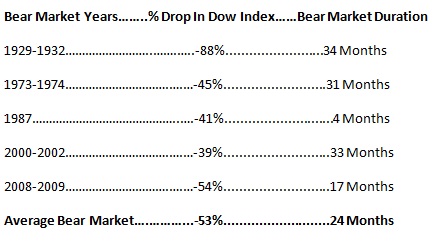

The five major bear market declines since 1929 were: 1929-1932, 1973-1974, 1987, 2000-2002 and 2008-2009 periods. And here is what happened in each bear market.

Our basic assumption is that the DOW Index might peak out at about 17000 due to a historically high PER, miserly low Dividend Yield and dangerously high NYSE Margin Debt. In this event stocks would probably enter a bear market correction, which may well replicate the average decline of the last five Big Bear Markets. Consequently, we might envision the DOW Stock Index falling -53% to about 8000 by early 2016.

The Aging Stock Market Bull

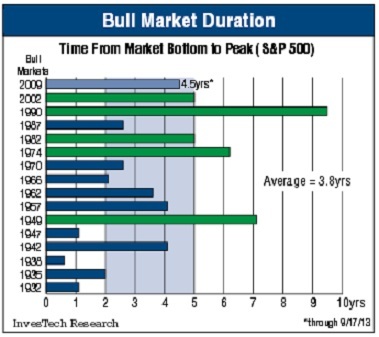

At 4.8 years, the current bull market (2009 to the present) is already one of the longest since the 1930s Great Depression. Looking at the S&P500 back to 1932, the average bull market duration (see graph) is 3.8 years and, in comparison, the present bull market is getting materially too long in the tooth. Still, it does have a few peers…of the 16 bull markets over the past eight decades, only three prior to this one lasted more than 4.8 years (green bars).

(Courtesy FORBES)

(Courtesy FORBES)

Based upon all the above historical evidence, the level of irrational hubris among today’s euphoric stock bulls is ludicrous. To be sure the wildly bullish hoopla of the media is unbelievable and devoid of common sense…and rings of Irrational Exuberance without precedent…ie the stuff that Stock Market Blow-Offs are made of.

Prudent advice for all stock investors is CAVEAT EMPTOR...as a big bad bear lurks on the horizon.