Weak Payrolls, September FOMC And Gold

August nonfarm payrolls came in short of expectations. Earlier months were also marked by downward revisions. Does it send a signal to act for the Fed, and what is gold likely to do in return?

August Payrolls below Expectations

The U.S. created only 130,000 jobs in August, following an increase of 159,000 in July (after a downward revision). The nonfarm payrolls were short of the analysts’ forecast of 170,000. While the gains were widespread, it was the professional and business services (+37,000), government (+34,000), and education and health services (+32,000) that took the lead. Retail trade, mining, utilities, and transportations cut jobs.

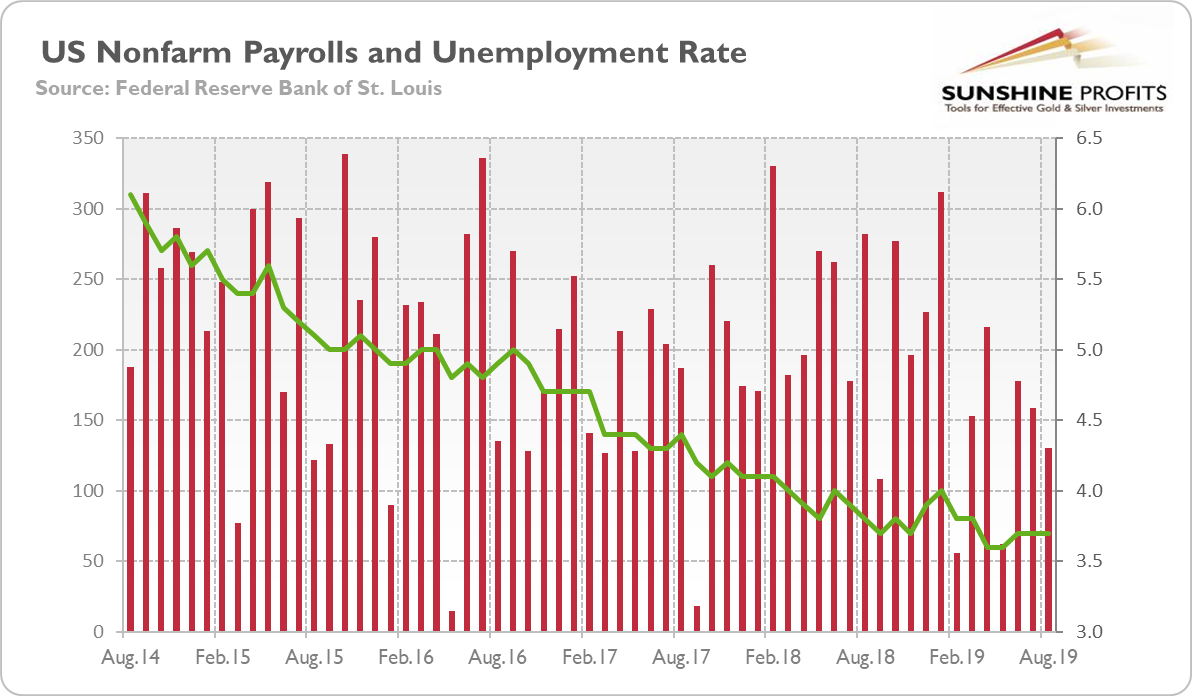

Moreover, the headline number was accompanied by downward revisions in July and June. Counting these, employment gains in these two months combined were 20,000 lower than previously reported. Consequently, job gains have averaged 156,000 per month over the last three months, and 158,000 so far this year, significantly below the average monthly gain of 223,000 in 2018.

Although the pace of hiring has slowed (see the chart below), the U.S. economy is still creating jobs at a reasonable pace. The job creation kept the unemployment rate again at 3.7 percent, near a 50-year low. It means that the US labor market is likely to further contribute to the longest expansion on record, at least for the time being.

Chart 1: U.S. nonfarm payrolls (red bars, left axis, change in thousands of persons) and the unemployment rate (green line, right axis, %) from August 2014 to August 2019.

Simultaneously, more people entered the labor force in search of work. The labor force participation rate edged up from 63.0 to 63.2 percent in August, and the employment-population ratio also increased slightly from 60.7 to 60.9 percent. The average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents to $28.11, which implies a wage inflation at 3.2 percent, a slight drop from 3.3 percent in July.

Hence, the US labor market is strong and fuels record-long expansion. From the macroeconomic point of view, the domestic economy is thus still doing relatively well. This is bad news for the gold bulls.

Implications for Gold

Some analysts consider the recent Employment Situation Report as weak. The nonfarm payrolls marked the smallest increase in three months, indicating a slowdown in hiring amid thee trade wars with China and the resulting disruptions in the global economy. The soft employment figures are said to keep the Fed on track to cut interest rates, which should be good news for the gold bulls. According to the CME FedWatch Tool, there is almost 90-percent chance that the FOMC will trim the Fed Funds Rate by a quarter-percentage point following its meeting later this month.

However, the initial estimate of the nonfarm payrolls in August is not very reliable as many people are on vacation and the number of respondents to the government’s questionnaire is often the lowest one of the year. Moreover, Powell said on Friday that the most recent monthly gauge of the U.S. labor market fits into an overall picture of a healthy jobs market and economy. He said: “incoming data for the U.S. suggests that the most likely outlook for the U.S. is still moderate growth, a strong labor market, and inflation continuing to move back up.”

Therefore, one should not read too much into the recent nonfarm payrolls. The slowdown is normal at this stage of the business cycle and it does not forecast recession yet. Given the high market odds, the Fed might deliver another interest rate cut in September, but the action will be caused more by the Trump’s pressure and the recessionary fears stemming from the inverted yield curve that from the state of the U.S. labor market.

It means that the recent employment data does not have to move significantly gold prices. However, as we are arguably in the later innings of the business cycle, its turning would work to make the yellow metal shine.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Arkadiusz Sieron

Sunshine Profits‘ Gold News and Gold Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********