What Powell Said And Why It Matters

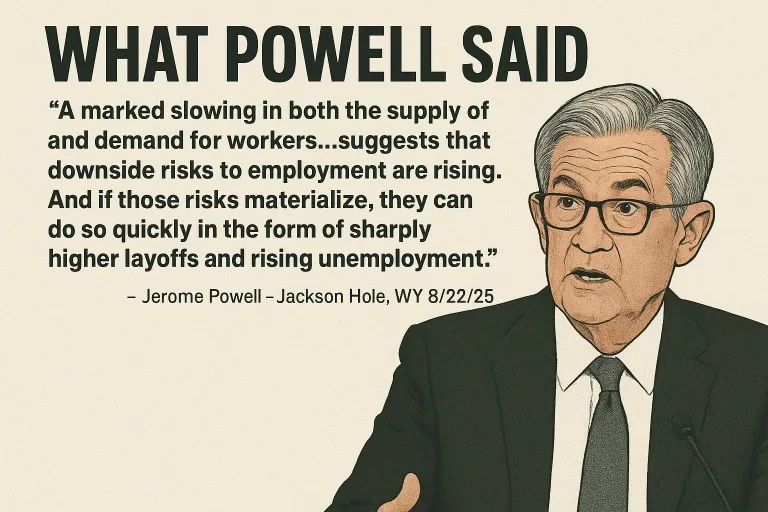

WHAT POWELL SAID

“a marked slowing in both the supply of and demand for workers…suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.” and “…the shifting balance of risks may warrant adjusting our policy stance,” Jerome Powell – Jackson Hole, WY 8/22/25

An AI summary of Powell’s remarks sans the emotion and frothiness of investors and others said that “Powell’s Jackson Hole remarks were carefully calibrated—not a firm commitment to cutting rates, but a clear signal of readiness to pivot if economic conditions warrant it. He recognized rising risks in the labor market and suggested that, given such risks and the Fed’s already restrictive stance, a policy adjustment might be justified. However, any change would be data-driven and cautious.”

WHY IT MATTERS

Investors and the media interpreted those remarks as the signal that “the race is on”. Someone said that Powell’s remarks “opened the door to a possible interest rate cut”.

Investors rushed through the door with complete abandon and drove stock prices up to new highs, seemingly oblivious to Powell’s expressed statements that conditions “may warrant adjusting our policy stance” and “any change would be data-driven and conscious.”

The door was kicked open almost one year ago when the Federal Reserve announced its intention to lower the Fed funds target rate in September 2024. After two successive cuts, the target rate has remained unchanged.

Jerome Powell acknowledges the growing risks in the labor market and the presumed risk of higher inflation from tariffs. The labor market threat is real and appears to be significant. Hence, Powell’s comments that labor market risks can accelerate “quickly in the form of sharply higher layoffs and rising unemployment” are noteworthy.

Tariffs are not inflationary.

“Tariffs are taxes imposed by a government on imported goods. Tariffs are assessed at the port of entry and must be paid before the goods can be unloaded. Whoever (businesses, consumers, etc.) imports the goods pays the tariff(s) to U.S. Customs and Border Protection, a government agency. Subsequently, remittance is made to the U.S. Treasury. (see Tariffs Are NOT Inflationary)

The effects of tariffs compound the risks associated with the labor market. Any acceleration in layoffs and unemployment will be exacerbated by the effects of tariffs. The results could lead directly to deflation and economic depression.

CONCLUSION

The Fed dilemma pertaining to interest rate policy remains the same. Lower interest rates and aggressive monetary growth will slam the dollar. Higher rates and restrictive monetary policy will depress economic activity.

Holding rates stable seems the more prudent choice. If nothing else, a disastrous day of reckoning might be postponed.

Far from being a boon to growth (domestic or otherwise), the effects of tariffs will magnify and accelerate problems in the labor market and the economy. Those effects can overwhelm Fed efforts to stave off financial and economic collapse.

The worst that could happen is likely to come quickly. (also see Complete Financial Collapse Is Unavoidable)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED

********