Why Gold Prices Will Soon Soar…For Years to Come

There are several cardinal reasons why gold will be continually buoyed upward in the future.

There are several cardinal reasons why gold will be continually buoyed upward in the future.

Reasons:

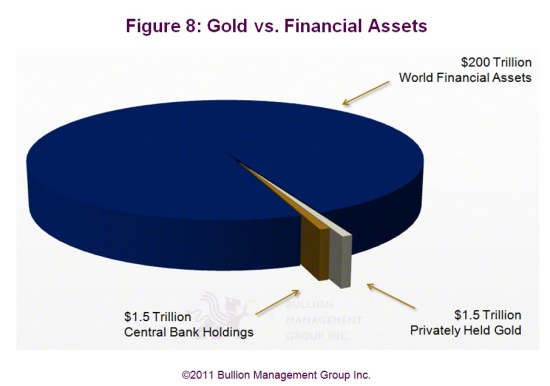

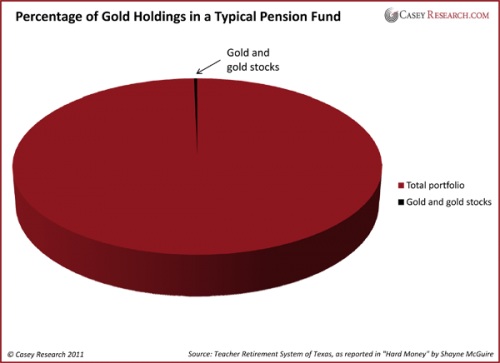

1-Total world’s financial assets and Pension Funds surpass US$200 Trillion

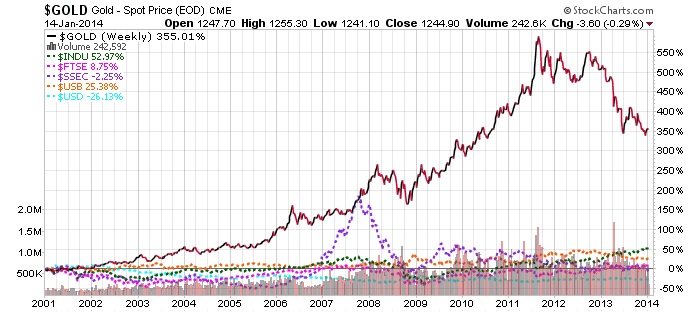

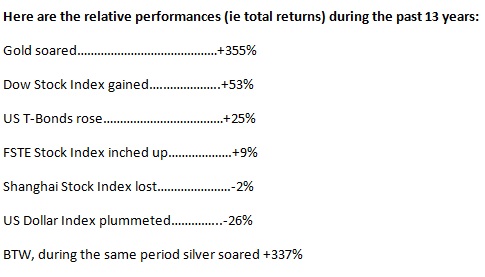

2-Relative Performance of Gold, US T-Bonds, Dow Index, Shanghai Stocks, FTSE & US$

3-China’s Exploding And Insatiable Gold Demand

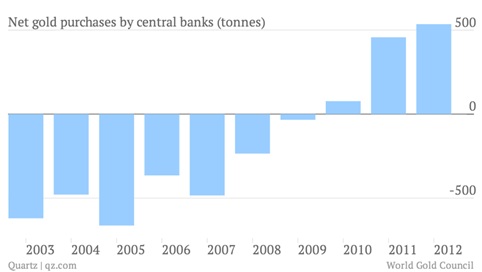

4-Net Gold Purchases by Central Banks is increasing at a rapid pace

5-Many American States accepting gold and silver as legal tender (ie currency)

6-Instantaneous Internet Communication Worldwide

(The report below will provide details regarding the above six cardinal reasons)

Total Investment Assets worldwide is over US$200 TRILLION in 2013

HOWEVER, less than 2% of the world’s US$200 TRILLION in Total Investment Assets are in gold.

Moreover, the percentage gold holdings in a typical U.S. Pension Fund is even less than 2%.

This is absurdly ridiculous because the best performing asset class (by far) since 2001 has been the shiny yellow.

The following chart clearly demonstrates that gold’s performance left all other asset classes dead in the water…literally!

China’s Exploding Gold Demand

There is irrefutable evidence that China is today the world’s largest consumer of gold. Moreover, there are several justifications for the Sino country’s growing insatiable gold appetite.

- China must reduce FOREX risk.

- China’s objective to replace the US$ with the Renminbi as the global Foreign Reserve Currency

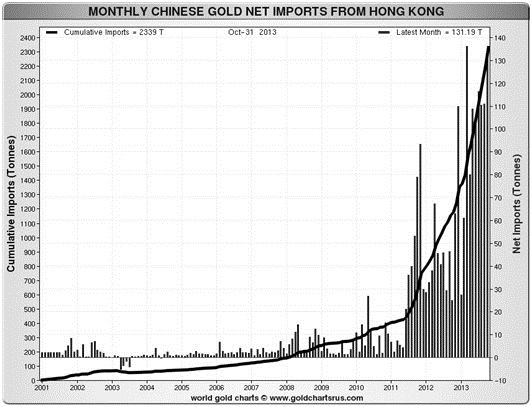

- Monthly Chinese Gold Imports has gone viral since 2011

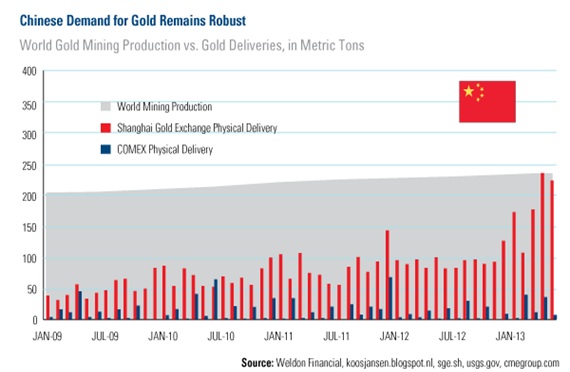

- China’s demand for gold is enormous and growing vis-à-vis flat global gold mine production

China's foreign exchange reserves, already the world's largest, reached $3.82 trillion at the end of 2013, The Peoples Bank of China said recently. This is a new record. Furthermore, more than one third of this humongous amount is in US Dollars (mostly in US Treasuries). This is in sharp contrast with USA’s FOREX risk, because 75% of its Total Foreign Reserves is in gold…whereas less that 2% of China’s Total Foreign Reserves is in gold. (http://en.wikipedia.org/wiki/Gold_reserve )

For many months there have been information leaks emanating from China that it has the covert plan to replace the US$ with the Renminbi as the global Foreign Reserve Currency. Here is a detailed report on this subject, “A Gold Backed Renminbi (Yuan) Looms On The Horizon” (https://www.gold-eagle.com/article/gold-backed-renminbi-yuan-looms-horizon )

This next chart shows the massive amount of gold that is moving into China via Hong Kong. As long as this trend continues, the fundamentals for gold are positive, and the bull market lives on.

(courtesy Goldchartsrus.com)

China’s demand for gold is enormous and growing vis-à-vis flat global gold mine production

Net Gold Purchases by Central Banks is increasing at a rapid pace

As prices have dropped and investors lost faith, central banks worldwide have been on the opposite side of the trade, gobbling up bullion at a rate of 27-metric tons a month, according to UBS gold expert Edel Tully. To be sure Russia and South Korea are among the biggest buyers, while several smaller, first-time acquirers have emerged, suggesting global central banks aren’t snubbing the yellow metal in the same way the general market seems to have done, which, in the face of it, is definitely bullish for gold. It is estimated that Central Banks purchased approximately 500 tonnes also in 2013 (not shown in the table)

Many American States are considering acceptance of gold and silver as legal tender (ie currency)

Last year the State of Arizona and Utah passed legislature recognize gold and silver as legal tender. Moreover, other States are considering similar bills include Colorado, Kansas, Idaho, Indiana, Missouri, Montana, New Hampshire, South Carolina and Virginia. To be sure if this materializes, the Federal government will be obliged to make it universal throughout all 50 States. The upshot would be cause demand for gold and silver to soar along with their dollar value.

Instantaneous Internet Communication Worldwide

Undeniably, the greatest invention since the wheel and the light bulb is the INTERNET. Where communication in the past took days, weeks and even months to reach all corners of the globe, TODAY an valuable idea can be transmitted globally…limited to how fast one can type…and it’s communicating 24X7. And once the current consolidation in gold and silver reverses upward to continue its Secular Bull Market that commenced in 2001, there will be an unbelievably awesome GLOBAL GOLD RUSH which will fuel its price into orbit.

********

More by vronsky: https://www.gold-eagle.com/authors/vronsky & https://www.silver-phoenix500.com/authors/vronsky