Will Inflation Look Different In 2022?

One swallow doesn't make a summer, but when it comes to slower inflation pressure, there have been several. Will the narrative change soon?

While Fed Chairman Jerome Powell had been preaching his “transitory” doctrine for months, the thesis was obliterated once again after the headline Consumer Price Index (CPI) surged by 6.8% year-over-year (YoY) on Dec. 10. Additionally, while the Commodity Producer Price Index (PPI) – which will be released on Dec. 14 – is likely provide a roadmap for inflation’s next move, signs of deceleration are already upon us.

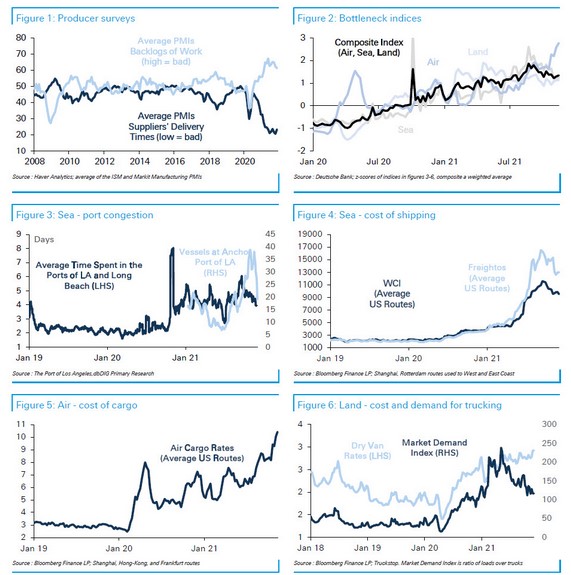

For example, supply bottlenecks, port congestion, and rapidly rising commodity prices helped underwrite inflation’s ascent. However, with those factors now stagnant or reversing, inflationary pressures should decelerate in 2022.

To explain, Deutsche Bank presented several charts that highlight 2021’s inflationary problems. However, whether it’s suppliers’ delivery times, backlogs of work, port congestion, bottleneck indices, or the cost of shipping and trucking, several inflationary indicators (excluding air cargo rates) have already peaked and rolled over.

Please see below:

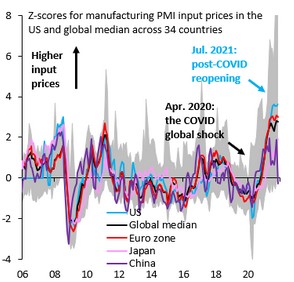

To that point, global manufacturing PMIs also signal a deceleration in input price pressures. With input prices leading output prices (like the headline CPI), the latter will likely showcase a similar slowdown if the former’s downtrend holds.

Please see below:

Source: IIF/Robin Brooks

To explain, the colored lines above track the z-scores for prices paid within global manufacturing PMI reports. In a nutshell: regions were experiencing input inflation that was ~2 and ~4 standard deviations above their historical averages. However, if you analyze the right side of the chart, you can see that all of them have consolidated or come down (the U.S. is in light blue). As a result, it’s another sign that peak input inflation could elicit peak output inflation.

As mentioned, though, the commodity PPI is the most important indicator and if the data comes in hot on Dec. 14, all bets are off. However, the monthly weakness should be present since the S&P Goldman Sachs Commodity Index (S&P GSCI) declined by 11.2% in November.

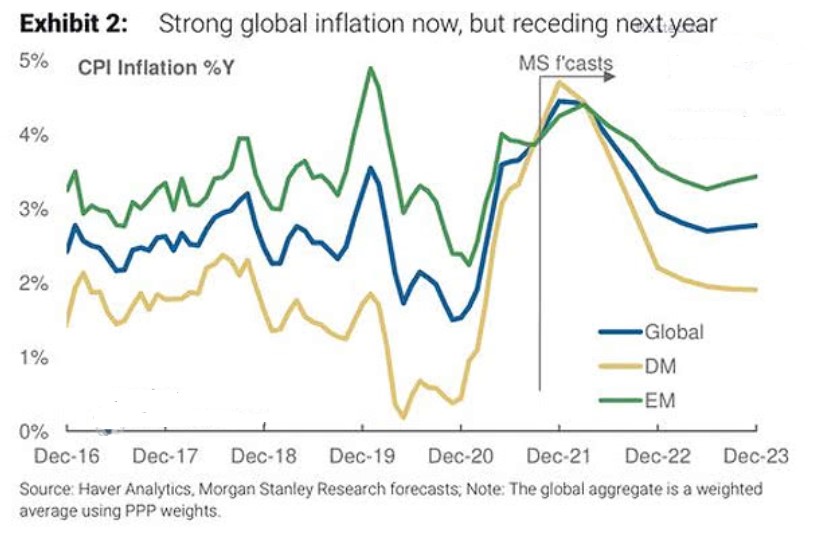

Also noteworthy, Morgan Stanley’s Chief U.S. Economist, Ellen Zentner, also sees signs of a deceleration. She wrote:

“We are seeing nascent signs that pipeline inflation pressures are easing – based on evidence from company earnings transcripts, ISM comments, Korea trade data, China's inflation data, the Fed's Beige Book, a department huddle with our equity analysts, and our own survey.”

To explain, the green, gold, and blue lines above track Morgan Stanley’s core inflation estimates for emerging markets, developed markets, and global markets. If the predictions prove prescient, the 2022 inflation narrative could look a lot different than in 2021.

However, please remember that inflation doesn’t abate without direct action from the Fed, and with a hawkish Fed known to upend the PMs (at least in the short- or medium run), the fundamental environment has turned against them. For example, when the Fed turns hawkish, commodities retreat, and with U.S. President Joe Biden showcasing heightened anxiety over inflation, more of the same should materialize over the medium term.

To explain, Morgan Stanley initially projected no rate hikes in 2022. Now, Zentner expects “2 hikes in 2022, followed by 3 hikes plus a halt in reinvestments in 2023.”

She wrote:

“Before investors close out the year, we need to get past the FOMC's final meeting next week, and it comes with every opportunity for surprise. On Wednesday, we expect the Fed to move to a hawkish stance by announcing that it is doubling the pace of taper, highlighting continued inflation risks and no longer labeling high inflation as transitory, and showing a hawkish shift in the dot plot. We think this shift will shake out in a 2-hike median in 2022, followed by 3.5 hikes in 2023 and 3 hikes in 2024.”

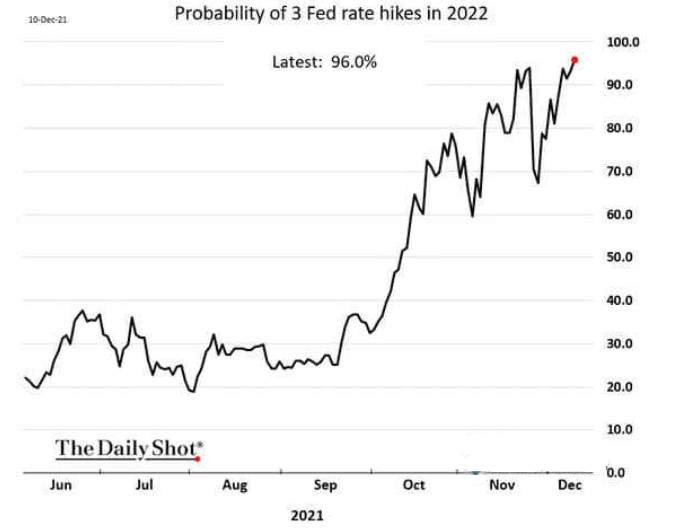

Furthermore, upping the hawkish ante, Goldman Sachs initially projected no rate hikes in 2022. Then, the team moved to three rate hikes in 2022 (June, September, and December 2022). Now, Goldman Sachs expects the FOMC to hike rates in May, July, and November 2022 – with another four hikes per year in 2023 and 2024.

The Fed’s Time to Shine

“The FOMC is very likely to double the pace of tapering to $30bn per month at its December meeting next week, putting it on track to announce the last two tapers at the January FOMC meeting and to implement the last taper in March,” wrote Chief Economist Jan Hatzius.

“We expect the Summary of Economic Projections to show somewhat higher inflation and lower unemployment. Our best guess is that the dots will show 2 hikes in 2022, 3 in 2023, and 4 in 2024, for a total of 9 (vs. 0.5 / 3 / 3 and a total of 6.5 in September). We think the leadership will prefer to show only 2 hikes in 2022 for now to avoid making a more dramatic change in one step, especially at a meeting when the FOMC is already doubling the taper pace. But if Powell is comfortable showing 3 hikes next year, then we would expect others to join him in a decisive shift in the dots in that direction.”

Speaking of three hikes, the market-implied probability of three FOMC rate hikes in 2022 has risen to 96%.

Please see below:

For context, I’ve been warning for months that surging inflation would force the Fed’s hand. I wrote on Oct. 26:

Originally, the Fed forecasted that it wouldn’t have to taper its asset purchases until well into 2022. However, surging inflation pulled that forecast forward. Now, the Fed forecasts that it won’t have to raise interest rates until well into 2023. However, surging inflation will likely pull that forecast forward as well.

More importantly, though, while the PMs have remained upbeat in recent weeks, the forthcoming liquidity drain will likely shift the narrative over the medium term.

The bottom line? While inflation shows signs of peaking, there is a vast difference between peak inflation and the Fed’s 2% annual target. As a result, even if a 6.8% YoY headline CPI was the precipice, it’s nothing to celebrate. Thus, the Fed needs to tighten monetary policy to control inflation, and anything less will likely re-accelerate the cost-push inflationary spiral.

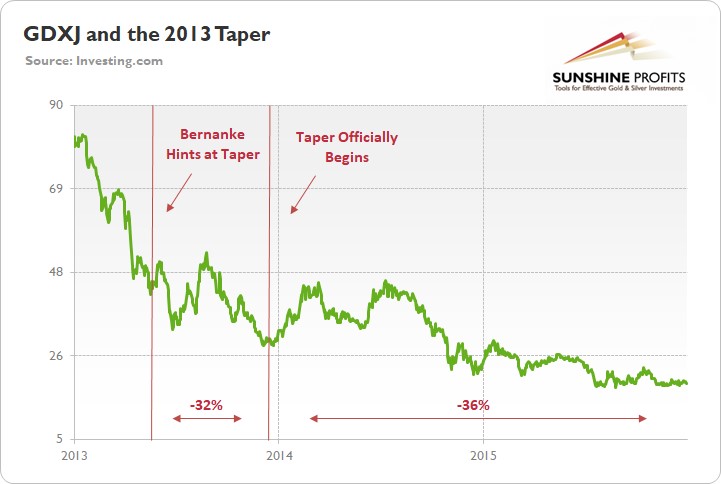

To that point, with the precious metals extremely allergic to a hawkish Fed, I’ve highlighted on numerous occasions how the GDXJ ETF suffered following the 2013 taper. With 2022 Fed policy looking even more hawkish than in mid-2014, the latter’s downtrend should have plenty of room to run.

In conclusion, the PMs were mixed on Nov. 10, and the scorching inflation print was largely ignored by investors. However, with the Fed poised to provide another dose of reality on Dec. 15, the recent volatility should persist. To that point, it’s important to remember that the S&P 500’s volatility increased materially after the Fed tapered in 2013. With stock market drawdowns bullish for the USD Index and bearish for the PMs, there are plenty of technical, fundamental, and sentiment factors brewing that favor the theme of ‘USD Index up, PMs down’ over the medium term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,