Will It Be China Or Europe That Collapses in 2016?

Will China experience a further contraction of its economy in 2016?

Will China experience a further contraction of its economy in 2016?

For more than three decades, China has enjoyed an average annual growth rate close to 11%, which has presently been on a decline in the past five years. The industrial boom which has been part of China’s most recent history, re their prosperity and unprecedented growth, year after year, is currently imploding! Heavy-debt, and excessive investments, of the Chinese middle-class: i.e. stocks and real-estate, a fixed-exchange rate, population decline and severe pollution problems, all indicate that an economic collapse is underway.

Take a look at China’s GDP growth rate the past 10 years in the chart below. Also, keep in mind they continue to devalue their currency the Yuan. This is not a sign of strength and I figure these are the core reasons for China’s massive stockpile of physical gold bullion.

Reality Check:

According to NationalDebtClocks.Org as of December 1, 2015, China has more than $5.3 trillion in debt with more than $5,500 in interest accumulating with every passing second. Currently, every Chinese citizen has approximately $4,000 in debt. In August 2015, China’s Manufacturing Index fell to a two-year low, sending shockwaves across the world as capital markets collapsed in the US, Europe, and Asia-Pacific.

Furthermore, in November 2015, a CNBC survey of Chinese company executives, in the manufacturing and service sector, listed on the Shanghai and Shenzen stock exchanges, showed a marked decline in business sentiment.

However, the Chinese real-estate market accounts for 10% of its GDP. With the collapse in equity markets and the devaluation of the Yuan, risks of a property market crash in China have begun to emerge.

In 2016, China working age population will decline, unlike Japan and Europe. China will have an increasing population of older people who will not be contributing productively to the economy and will have to be supported by their declining working population. Consequently, after 35 years, China has ended its “one-child” policy (which was responsible for preventing 400 million births) in order to correct and reverse the population decline.

In light of our discussion above and despite the slight positive effects, China will experience a slowdown in 2016. Whether it will trigger a global economic downturn or not is a very realistic possibility. The present slowdown in manufacturing activity in China is due to the direct result of any consumption decline from the countries, of whom it exports to ie: the US and Europe. As conditions in the US and Europe continue to deteriorate, manufacturing activity in China will collapse.

However, the biggest challenge for policy makers will be to shift from a debt-based model in years to come, so as to avoid a similar situation as occurred in the US. Cheap money and quantitative easing which have the flooded markets with liquidity has failed. Once that cycle ends, China will be left with more debt and economic chaos!

Will the Eurozone Collapse in 2016?

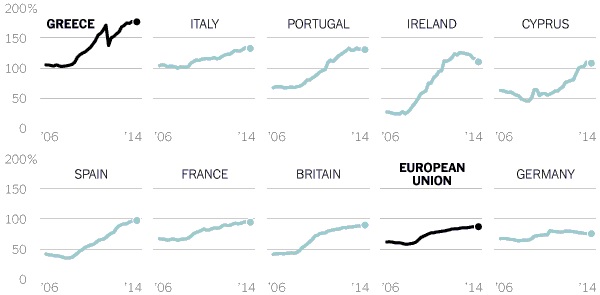

Since 2009, the Eurozone which has adopted the Euro, as its official currency, has been suffering from an ongoing crisis, in the form of rising sovereign debt, shortage of liquidity in the banking system, lower economic growth and a loss of competitive advantage. To date, the countries at the forefront of this crisis includes: Portugal, Ireland, Italy, Greece and Spain, all of which have been repeatedly bailed-out, by the rest of the European Union and the International Monetary Fund (IMF); with Greece being the most “fragile and risky” borrower.

Gross Government Debt of GDP at the end of 2014 Source: Eurostat

In the case that any country may default in the Eurozone, it will most likely exit the monetary union in order to rescue its economy. This would most likely have a “contagions effect” on other vulnerable countries that may soon follow their example. It is also likely that countries with a stronger economic base, such as Germany, may exit the Euro in order to cut their losses on their Euro-based exchange reserves. Hence, Europe could plummet into a complete economic collapse and carry the rest of the world with it.

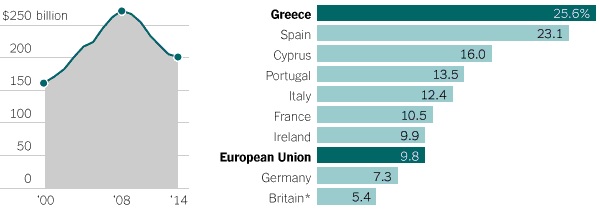

In June 2015, after having received $265 billion in bailouts, Greece made history by becoming the first nation, in the developed world, to default to the IMF on its first repayment of €1.5 billion. Huge austerity plans introduced into the country, have not only reduced aggregate demand but at the same time have also dampened its chance to make repayments on its debt. Consequently, Greece is left with no other alternative. but to borrow more money so as to make good on its earlier debt. This means that as long as the rest of the Eurozone and the IMF, are willing to continue to bailout Greece allowing it sufficient time to miraculously revive its economy, the Euro will remain intact for today!

Reality Check?

To date, With the exception of Greece, Ireland, Portugal and Spain are well on course in repaying their debts, with respect to their bailout packages by issuing more debt in the global markets. Lower interest rates in the US, the UK, the EU, and Japan have all assisted other affected countries, to issue bonds at lower interest rates. Unfortunately, for Greece, it has not been able to regain access to international debt markets in order to borrow and refinance its debt with affordable rates.

The major reasons for this occurring, are due to extremely low confidence among investors in the Greek government’s ability to repay on its obligations and it having one of the highest Debt-to-GDP ratios. The country has also been subject to mass demonstrations opposing austerity measures, rising political uncertainty and regular bank closures, resulting in a severe liquidity crisis within the country. The same has also affected its main industries, which are shipping and tourism. Unlike other counterparts of the debt crisis, Greece does not have a sound manufacturing or industrial base to rely on, for its economic growth.

In addition, Greece, has the highest unemployment rate, in all of Europe. All of these factors have significantly reduced its chances of an economic revival.

Conclusion

On August 14th, 2015, the Eurozone Finance Ministers approved a third bailout of Greece, in which it would receive up to $95 billion, over the next three years, in rescue funding. Furthermore, in the aftermath of the crisis, the European Central Bank (ECB) has lowered interest rates below zero percent, across the Eurozone, and continued with its policy of quantitative easing and outright market operations since 2012, purchasing bonds of member countries in the secondary markets, and establishing monetary stability funds.

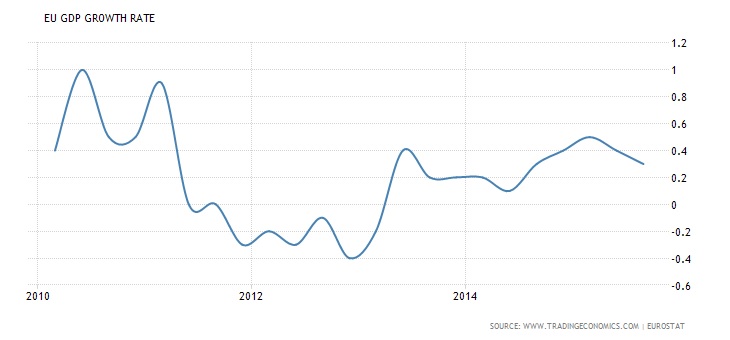

This month the ECB announced further cuts in its key deposit rates sending it to -0.30% and announced a further extension of its quantitative easing program into 2017. Although the news disappointed investors, it cannot be denied that the cautious monetary policy of the ECB has helped the Euro navigate through murky waters of an imminent failure.

In short, I feel the past 4 years of economic stability around the world has been nothing more than a few quick patches and injections of cash to help keep countries and the financial markets functioning. Many of us can see and feel the financial tensions rising and when the music stops those of us holding physical metals will feel at ease knowing they have a physical asset that will always be worth something and its price will likely skyrocket as currencies, countries, and lending institutions fall to their knees.

I recently purchase some physical bullion and knowing that I have this asset which I consider nothing more than an insurance policy for my financial safety, I feel much more at ease.

********

Keep learning and profit with my ETF Trading Alerts at www.TheGoldAndOilGuy.com

Chris Vermeulen