Gold Price And Silver Price Updates

Gold sector cycle is up.

Gold Sector

$HUI is on a new long-term buy signal, ending the sell signal from early 2012.

Long-term signals can last for months and years and are more suitable for the long-term investors.

$HUI is on a short-term buy signal.

Short-term signals can last for days and weeks and are more suitable for traders.

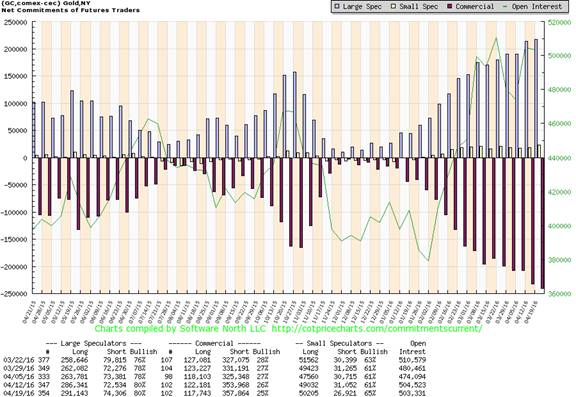

Speculation has reached levels of previous tops again.

COT data remains in bear market values, and also below the 2015 high at 1300.

Both factors are needed to confirm a new bull market.

A topping pattern is in progress.

Summary

Gold sector is on a new major buy signal.

Cycle is up but at levels of previous tops.

COT data remains in bear market values and is now at levels of previous tops.

Up side should be limited and a correction is due in coming weeks.

Once a bull market is confirmed, we will be buying/accumulating at cycle bottoms, as we did beginning in 2001.

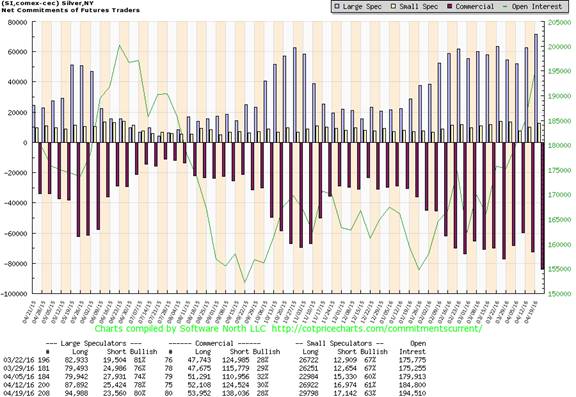

Silver Sector

Silver is on a long-term sell signal since Dec 2011.

Long-term signals can last for months and years and are more suitable for long-term investors.

SLV – short-term is on buy signal.

Short term signals can last for days and weeks and are more suitable for traders.

Speculation once again is at levels of previous tops.

Summary

Silver is on a long term sell signal and investors should be in cash or short.

Short term is on buy signal, but caution is advised to those who are chasing this market as a multi week correction can start anytime.

Courtesy of www.simplyprofits.org