Gold SWOT: Palladium Prices Rose as ETFs Posted Their Sixth Straight Day of Inflows

Strengths

- The best performing precious metal for the past week was palladium, up 1.11%. Palladium prices rose as ETFs posted their sixth straight day of inflows, adding 3,542 ounces and pushing year-to-date gains in holdings to 19%. The consistent buying helped lift sentiment and added price support, with palladium hitting a 52-week high of $1,248.12 per ounce.

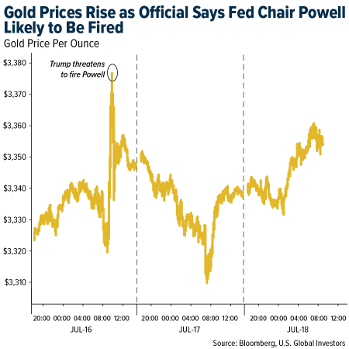

- Gold served its purpose as an inflation hedge as investors piled into the metal after reports surfaced that Trump may fire Fed Chair Jerome Powell to force interest rate cuts. Markets interpreted the move as inflationary—viewing aggressive rate cuts as destabilizing—fueling a flight to gold and lifting gold mining stocks.

- Newmont said it sold shares in Greatland Resources and Discovery Silver for aggregate cash consideration of about $470 million. They remain on track to deliver on its 2025 guidance, the company said in a press release.

Weaknesses

- The worst performing precious metal for the past week was silver, down 1.41%. Silver backed off as some profit-taking set in after its uptick last week. Silver remains well-positioned to benefit as a base metal, poised to cool down as some expect a historic bull run in the precious metal.

- Gold Road Resources had a second weak quarter, which RBC expects put CY25 guidance at risk. 1H25 is annualizing at 288,000 ounces versus guidance of 325,000-355,000 ounces. They also forecast all-in sustaining cost (AISC) guidance (A$2400-2600/ounce) will be missed at A$2668/ounce.

- Gold fell as the dollar gained after President Donald Trump downplayed the prospect of replacing Jerome Powell as Federal Reserve chair. Bullion and the greenback were whipsawed on Wednesday amid a bout of panic over Powell’s future, as a White House official said they expected Trump to soon move against the Fed chief. The president later said he is “not planning on doing anything” to remove Powell, calming markets.

Opportunities

- B2Gold Corp. announced positive results from the Feasibility Study for its 100%-owned Gramalote gold project in Colombia. The study outlines 6 million tons per year, open-pit mine with an initial 13-year life, producing 2.26 million ounces of gold at an AISC of $985/ounce. The project shows an after-tax NPV of $941 million and an IRR of 22.4% at $2,500/oz gold, with initial construction capital estimated at $740 million, according to Canaccord.

- According to RBC, the platinum market is forecasted by every major consultant to remain in deficit for the foreseeable future. The gold price remains 2.4x the platinum price, inviting both investment demand and jewelry demand (particularly in China). The threat of U.S. tariffs is not expected to subside, and stocks may begin to recover. Mine supply should recover from Q1, but it is still on course to deteriorate in the years ahead.

- AngloGold Ashanti has entered into a definitive agreement with Augusta Gold to acquire its entire issued and outstanding capital at C$1.70/share (C$152M) in cash. This is a small transaction for AngloGold but allows the company to consolidate the Beatty district further and provides greater infrastructure flexibility for the future development of AngloGold's large-scale Arthur project in Nevada, according to BMO.

Threats

- The Indonesian Government is considering collecting export levy on gold and coal to boost state revenue, reports local news outlets Bisnis and Kontan, citing Energy and Mineral Resources Minister Bahlil Lahadalia. The rule will be “flexible,” whereby the government collects levies when commodity prices are high, and not when they are low, says the report, citing Lahadalia.

- According to Morgan Stanley, South African PGMs sector AIC margins remain at close to 30-year highs and valuations continue to appear relatively fully priced, in their view: (1) they currently do not see further upgrade risk to earnings at spot; (2) the equities trade on 12-month forward free cash flow (FCF) yields of 12-14%, which is fair to rich for this point in the cycle.

- Newmont announced that its CFO, Karyn Ovelmen, resigned on July 11, 2025. BMO is somewhat surprised as she had only been in the role for 2 years. The company states her departure was not due to any disagreement on any matter.

*******

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of