Dollar Debates & Gold’s Winning End-Game

Whatever one thinks of the United States (economically, morally, militarily or politically), we can all agree that its dollar exerts tremendous influence (and controversy) over a rapidly changing world.

The Dollar’s Fate = Our Fate

The “greenback” is much more than the subject of what often feels like overly theoretical debates on its (near and longer-term) direction in both absolute terms (i.e., inherent purchasing power) or in terms of its relative strength to other currencies (i.e., as measured by the DXY).

As the world’s reserve currency, in which:

1) 58% of global FX reserves are held, 2) 80% of global trade finance is conducted, 3) $13T in global debt is denominated, 4) over $90T in FX swaps are traded and 5) the vast majority of US income-earners measure their wealth – the strength, direction and fate of this currency is of massive relevance to all of us – both within and outside of the United States.

A rising or falling dollar, for example, has a direct and immediate impact on stock market direction, bond market volatility, global trade shifts, local currency behaviors, tariff efficiency, central bank policies, alternative currency momentum, war motives and, of course, precious metal price action in the backdrop of gold’s rising reserve asset status.

Or stated even more simply: The fate of the USD matters because all of our fates – and not just the gold price – are tied to it.

More Than a “Debate”

Thus, when asking whether this USD will strengthen or weaken, there is far more at stake than just “winning a debate.”

What is of greater significance is understanding the moving parts of this admittedly complex issue before declaring a conclusion.

To help gain this understanding, we are compelled to respect both arguments – i.e. those who see a dollar’s “last dance” to record highs, and those who think the dollar’s dance (and hegemony) has already come to a historical turning point downwards, though, never, of course, in a perfectly straight line.

Lots of Smart

Toward this end, I have enjoyed unpacking this topic (debate?) with very smart leaders of the “strong dollar camp,” including a November 2023 conversation with the Milkshake Theory’s very own (and very smart) Brent Johnson.

I argued then for a secularly declining dollar; Brent saw a stronger dollar ahead.

At that time, the DXY was near 107. Two years later, the DXY sits today at 97.

Does that mean “I won” the dollar debate?

Hardly.

Start at the End

The dollar, like history, can be full of short-term surprises/movements despite a mathematically confirmed end-game, one in which all paper money, as Voltaire quipped, inevitably reverts to the zero-value of the paper it’s printed on…

But imagining a dying dollar (which has already lost 99% of its purchasing power against a milligram of gold since 1971) is almost impossible to do, especially a dollar as critical to global trade and finance as the world’s reserve currency.

And so, this critical debate, like time and he dollar itself, marches forward.

My Latest Debate

At the end of last month, for example, Francis Hunt and myself enjoyed what could be described as a “spirited exchange” with Henrik Zeberg, who, like Brent Johnson, makes a credible case for at least one more great DXY spike in the USD’s otherwise unlovable trajectory and profile.

Zeberg, like Johnson, legitimately reminds us of critical arguments in favor of a rising DXY (i.e., a USD growing relatively stronger than other key currencies), which I am unfairly simplifying here for reasons of word-count.

The crux, however, of the strong-dollar case hinges upon the fact that trillions (over $13T) in USD-denominated debt trading outside the US (i.e. “Eurodollar debt”) and over $90T in USD-based derivative transactions are perma-thirsty (and straw-sucking) for ever-more USDs to keep their credit and options markets forever dollar-greased and operative.

In times of crisis, this “thirst” for more USDs only increases in a backdrop for which James Rickards has warned there “won’t be enough dollars”, thereby sending the dollar relatively higher as: 1) demand for USDs to cover dollar-denominated (Eurodollar) debt skyrockets, and 2) global investors flock to the relatively safe-haven of the USD and UST.

The 2008 Dollar Template

Zeberg uses the Great Financial Crisis of 2008 as a critical template which confirms the foregoing argument.

During the GFC, for example, massive demand for USDs caused a 20% spike in the DXY and a short, but dramatic, fall in the gold price.

For Zeberg, the past is prologue.

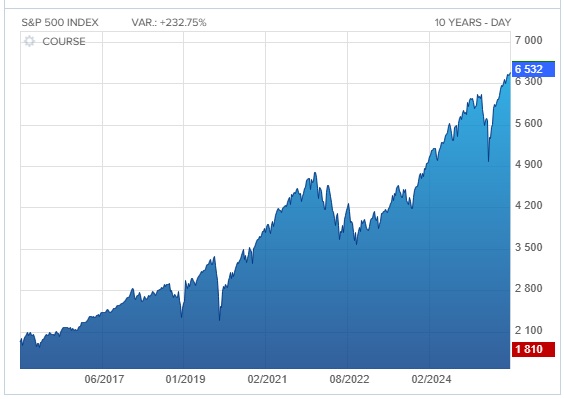

Soon, likely in 2026, his model sees a massive and deflationary “uh-oh” moment in what we all agree is a grotesquely over-valued S&P.

Fair enough.

In the wake of such a crisis, the otherwise unloved and debased USD will see what Zeberg predicts as its “last dance,” evidenced by a spiking DXY and gold dramatically retracing, as we all saw in the 08 crisis.

There is much to consider in this considerably logical argument.

Zeberg, like Brent Johnson, for example, argues (as do I and Francis Hunt) that we are marching toward a sovereign debt crisis/cliff.

In the chaos of such a crisis, Johnson (like Zeberg) argues that more USD liquidity will be the automatic re-cap model familiar to most of the world.

That is, the US will effectively have the biggest “straw” to draw capital in from that world, thereby sending the dollar up relative to other currencies.

In short, and despite its obvious flaws, the USD is presented as “the best horse in the glue factory.”

In times of crisis, the thirst for this key currency will spike. (Even when USTs lost their AAA rating, for example, investor money still flocked to USD.)

These are valid points, indeed.

More Reasons for the Dollar’s Last Dance

Johnson also reminds that in prior moments of a world on the edge of a credit crisis (such as the higher-for-longer, Powell-induced UST crisis, or the BoE-induced Gilt crisis of 2022), the USD reached a 30-year high.

This, alas, could easily happen again. In fact, for Johnson and Zeberg, it could be even more dramatic going forward.

Why?

Less Cooperative Swap Lines?

In such global inflection points (i.e., liquidity crises thirsty for dollars), the currency swap lines between global central banks traditionally helped buy time to keep USD-liquidity flowing without sending the DXY dangerously too high (because when the DXY rips, just about everything else – from local currencies to tech stocks – tanks).

But today, in a Trump world where global cooperation (and hence central bank currency swaps) could take a second seat to national protectionism, Johnson rightfully wonders if the DXY could spike dramatically higher in such a less-coordinated/cooperative backdrop.

Carry Trade Failures?

There is also the greater risk of carry-trade failures, which could limit liquidity in the next debt crisis and thus send the dollar much higher.

We all saw, for example, how the once reliably weaker/cheaper Yen, traditionally used to create USD liquidity via the arbitraged “Yen Carry Trade,” unwound last August, sending the USD higher.

For Johnson, a simultaneously strengthening Yen and USD could add fire to a percolating global liquidity nightmare in which the DXY could easily hit 150.

This would cripple local currencies, threaten credit markets (via rising rates), crush any chance of a US export revival and potentially trigger an equity market sell-off.

Again: When the DXY rises, just about everything but the dollar falls…

For Zeberg, this includes gold.

A Great Gold Fall?

Although Zeberg, like Johnson and myself, are ultimately bullish on gold, he sees a 2008-like pullback in gold once the last DXY dance/spike takes stride.

Thereafter, and once the Fed resorts to extreme QE to weaken the dollar and monetize otherwise openly unpayable debt levels, Zeberg sees gold racing to astronomical highs as the dollar comes down from its last dance.

These, again, are admittedly simplistic summaries of the strong-dollar case.

An Alternative Take on the Dollar

Which brings me to my counter-argument, or at least counterpoints.

Ultimately, I don’t see a dramatically spiking DXY, a temporarily tanking gold price, nor even a dying dollar.

Instead, I see a dollar being slowly but deliberately re-priced (rather than immediately de-levered) in a backdrop where its role relative to other currencies maintains some supremacy but far less hegemony.

In other words, the dollar won’t vanish, but its historical respect, use and influence will continue to weaken in a world openly moving away from it.

No Rubel, Yuan, Euro or Yen, however, is going to replace the otherwise unlovable USD anytime soon. These currencies don’t want or need to seek global reserve status.

Instead, they are openly reaching trade deals in regional currencies which are net-settled in gold, not USDs or USTs.

This is also why I do NOT see a dramatic or lasting pullback in the gold price during the next deflationary credit-crisis/S&P implosion.

Gold’s Role Has Changed

The current stock market bubble, credit crisis and gold backdrop are objectively different from the 2008 template/example cited above.

Stated more simply, gold won’t act like it did in 2008 (i.e. retrace by > 30%), because the gold of 2025 and beyond operates in a dramatically different landscape and role today than yesterday.

The strong dollar case underestimates the open de-dollarization movement, which came in the wake of the 2022 weaponization of the greenback; it also assumes smooth and continuous dollar hegemony in a new “Game of Thrones” setting by which the dollar is not the same dragon it used to be…

With those broad statements thus made, let’s dig a bit deeper to make this case.

The US Doesn’t Want a Stronger USD

First, and as I argued with Brent Johnson back in 2023, one of the primary arguments against a dangerously spiking DXY/USD is the simple fact that the US doesn’t want, nor can it afford, a DXY ripping North.

The aim of the US, both for trade deficits and debt monetization, is a relatively (as well as absolutely) weaker (not stronger) USD.

Of course, this alone is no defense. Not wanting a stronger USD doesn’t mean it can’t happen.

But should the DXY start climbing into the 130’s or higher, there would be an immediate, and yes, desperate, series of foreseeable and unforeseeable (and rocky rather than smooth) policy moves (with admittedly less effective “tools”) to slow any further spike.

This is because a dangerously rising DXY destabilizes the world.

Such desperate “reactions” would and could take any number of forms, from a sudden Plazza Accord 2.0 or Bretton Woods 2.0 event to a global scrambling of central bank demands for emergency swap lines, YCC and extreme Fed QE to the moon – all in order to prevent a rising USD from crushing local and global debt markets, spiking US trade deficits and gyrating global equity markets.

Any such messy “solutions” could protect the USD’s relative strength from spiking the DXY, but naturally and simultaneously destroy its absolute purchasing power, which is now beyond current or even future dispute.

This is because the US, at current and historically unprecedented debt levels, is out of currency options: It’s now inflate or die.

In other words, the FED and US Treasury will continue to debase (weaken) the USD and run negative real rates to “save” its debt market by further destroying its paper dollar.

This template of currency destruction in a debt crisis is as old and predictable as history itself.

It is thus critical to understand that even a rising DXY does not protect the dollar from being inherently debased.

Gold Rising in the Next Crisis

As for gold retracing ala 2008 in the next deflationary credit implosion, Zeberg’s argument assumes that the world still sees gold as a speculation or liquidity asset (as it did then) rather than as a strategic global reserve asset (as it does now).

The evidence of gold replacing the UST and USD as a far greater (and strategic) store of value since 2008 is no longer a conspiracy theory or “gold bug spin.”

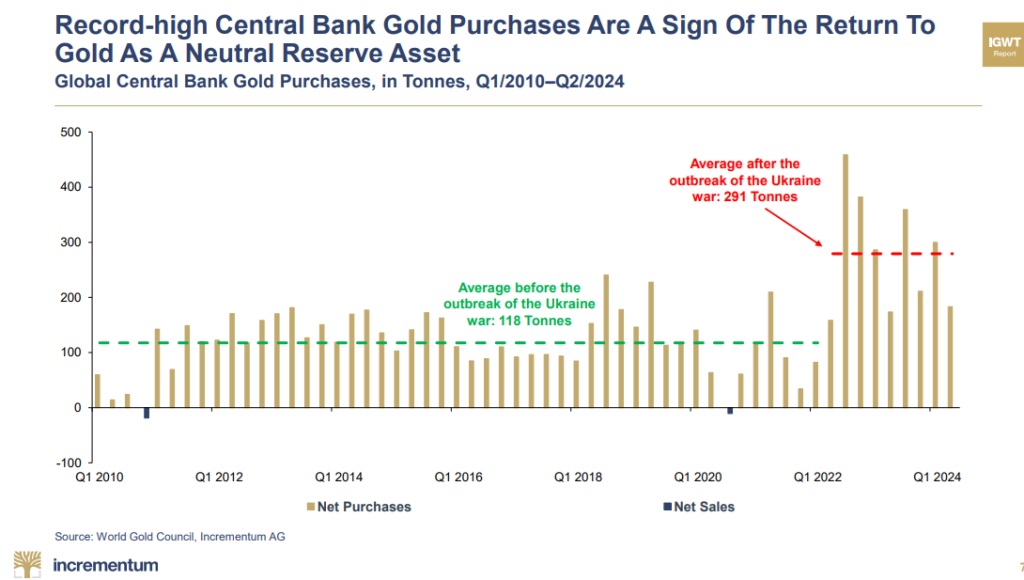

Instead, the evidence of gold’s rising status and role is literally all around us – from: 1) the rise of gold as a net-settlement asset within the ever de-dollarizing BRICS+ coalition, 2) the weakening petrodollar and rising Yuan/Russia oil trade, 3) the IMF’s confession of gold being critical to any reset to come, 4) the 3X expansion of central bank gold stacking since the US weaponized the USD in 2022, and 5) the BIS openly granting gold aTier-1 status to 6) the embarrassing repatriation of physical gold off the London and New York exchanges.

In other words, and contrary to Zeberg’s argument of the USD and UST as a “safe-haven” in the next deflationary crisis, I (and Francis Hunt) would argue the very opposite.

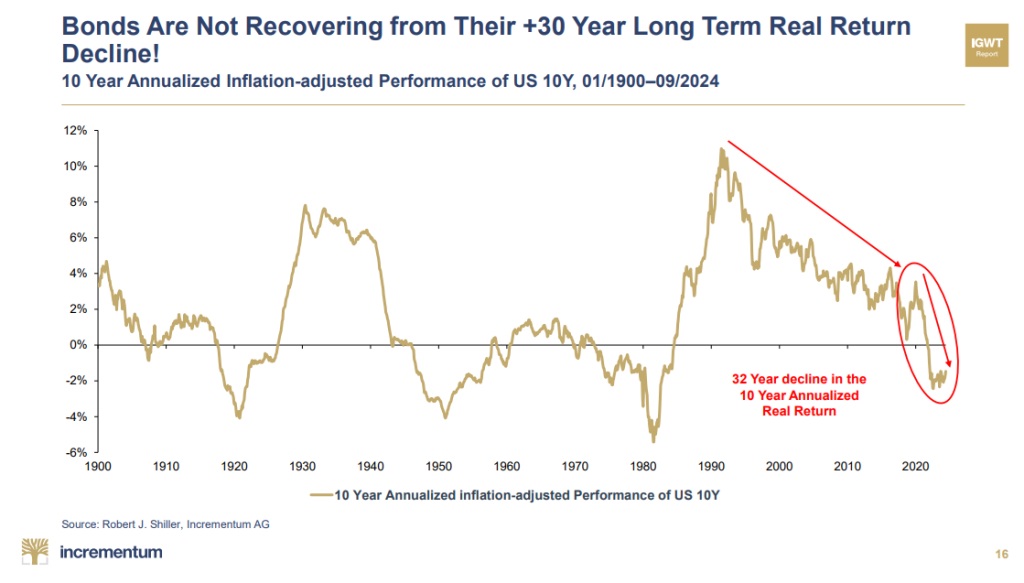

Why, after all, would the world seek a “safe-haven” in a UST (the worst performing asset in the last 5 years with a 50% loss of value) and hence USD, when gold, the new Tier-1 asset, is an objectively, monetarily and mathematically superior store of value?

Rather than dump gold in the next “08 moment,” the world will instead be racing toward it.

A Mug’s Game, A Critical Asset

Again, a deeper dive into the nuances of these otherwise complex yet broadly stroked arguments is not my aim here.

Predicting precise scenarios and DXY directional percentages is ultimately a mug’s game in a sea of volatility.

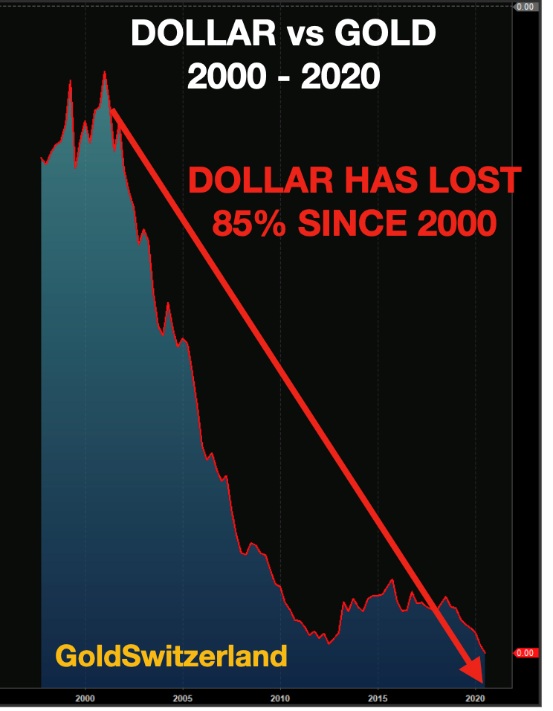

Nevertheless, tracking the empirical decline of the USD’s absolute purchasing power is no debate, but an empirical fact.

As for the USD’s relative moves in the DXY and against other currencies, that is admittedly, and in all fairness to Brent Johnson, harder to “win” or predict in the near-term.

There is much to his and Zeberg’s arguments, though Johnson, like me, does not believe that the gold price will fall even if the DXY should spike.

Gold and the USD can rise (and have risen) together.

And to repeat: Even a rising DXY does not mean the USD is protected from a debasement of its absolute purchasing power.

This is why gold will outperform rather than retrace in the next crisis, regardless of the DXY’s relativity theory…

It is equally worth noting that despite the necessary and important differences in opinions as to the great dollar/DXY debate outlined above, all of us – Hunt, Zeberg and Johnson – do agree on this: In the end, gold will continue to be an essential, if not THE essential, asset in the years ahead.

Regardless, then, of the DXY’s debated direction, gold’s finest hours are yet to come.

********