Breakouts and Breakdowns in Gold

Since this gold bull market began six years ago, we have seen our shares of spectacular breakouts, and also a few breakdowns. Some of these breakdowns occur shortly after a breakout, which I label as "fakeouts". With our trading models, we never have to suffer these breakdowns, because we are out of the market long before the breakdowns are confirmed.

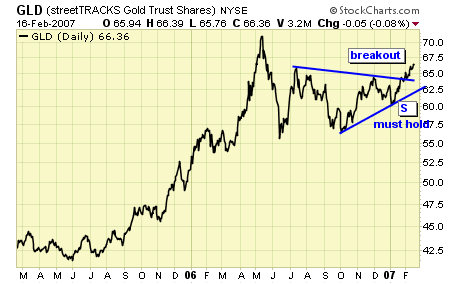

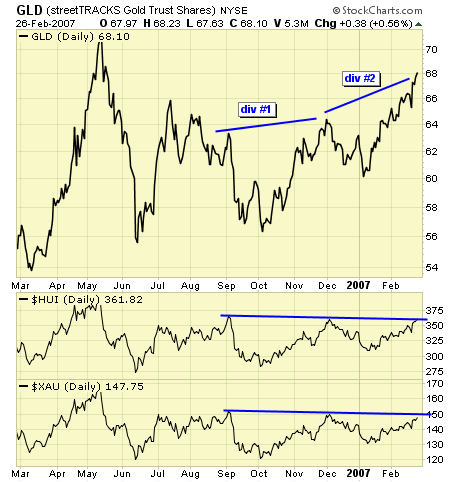

Gold has broken out, it is now common knowledge. In order for this breakout to be legit, any pullback cannot violate TL support (S) currently at 62.50 and rising. A close below TL support and we will have a breakdown, with downside target at 57.

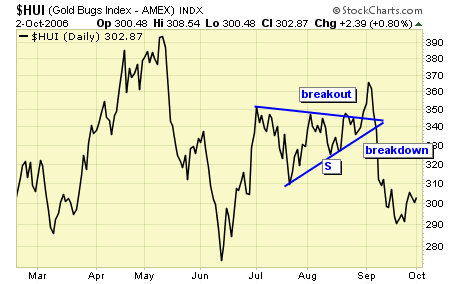

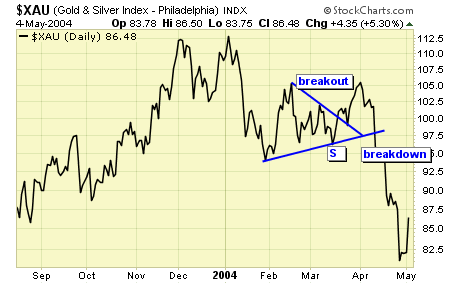

The most recent "fakeout" in the gold sector occurred in early September 2006, and most of you may recall that we exited our positions long before the point of breakdown. We were able to do that because it was almost identical to a previous "fakeout" we had in April of 2004.

April 2004 was memorable because I urged all members to exit upon a TLBSS, but I kept my positions because gold itself was breaking to a new high, and I was very bullish and ignored the sell signal on the $XAU. That was the last time I traded against my own signal. The lesson was well worth it, because an existing divergence between gold and gold stocks should not be ignored….

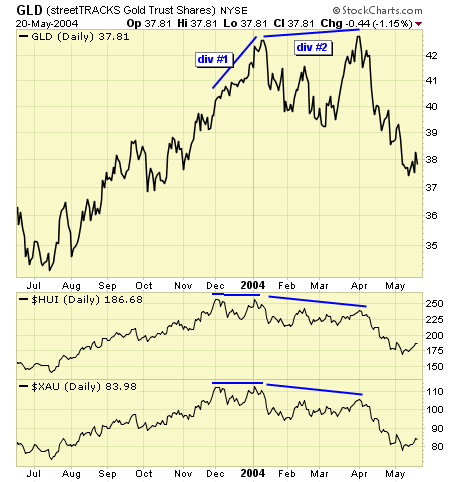

The most memorable divergence took place at the end of 2003 and early 2004 after the spectacular run up from our March 2003 buy signal, which some of you still fondly remember.

Div #1 led to a sharp sell off, with gold losing about 7% and both $HUI and $XAU losing about 14%. Then a recovery rally followed by yet another divergence with gold making a nominal new high while both indexes struggled below the highs from Div #1. Div #2 led to a much deeper sell off, with gold losing 13% and both $HUI and $XAU losing double of that, more than 25% before bottoming.

Folks, its déjà vu time.

Div #1 resulted in a 6% drop in gold and 13% drop in both the $HUI and $XAU. Gold has since recovered and rallied to a higher high while both $HUI and $XAU are struggling below both the September and December highs, thus providing us with Div #2. To negate this double divergence, both indexes must break above their Dec highs and then their Sep highs.

Summary

Gold is at a very critical stage, it must continue up pulling gold stocks with it in order to negate this double divergence. A pullback in gold must not violate TL support and gold stocks must stay firm. These next two weeks will be a make or break for the gold sector, and traders should not be caught on the wrong side.

To get a perspective of a 25% sell off, $HUI would drop to 260 from the current 350. A 13% drop in gold brings gold down to $580. I'm not suggesting it will happen, but none of our subscribers will suffer such a drawdown if we simply follow our signals and set ups, and execute accordingly.

********

Disclaimer: Words of caution: public readers of my commentaries should exercise their own judgment as to whether to buy or sell anything. Never trade based on other people's analysis. Knowing which way to place our bets is only half of the formula to success. Wishing you peace and profits......................................