Buy The Dip: Top 10 Gold And Silver Miners

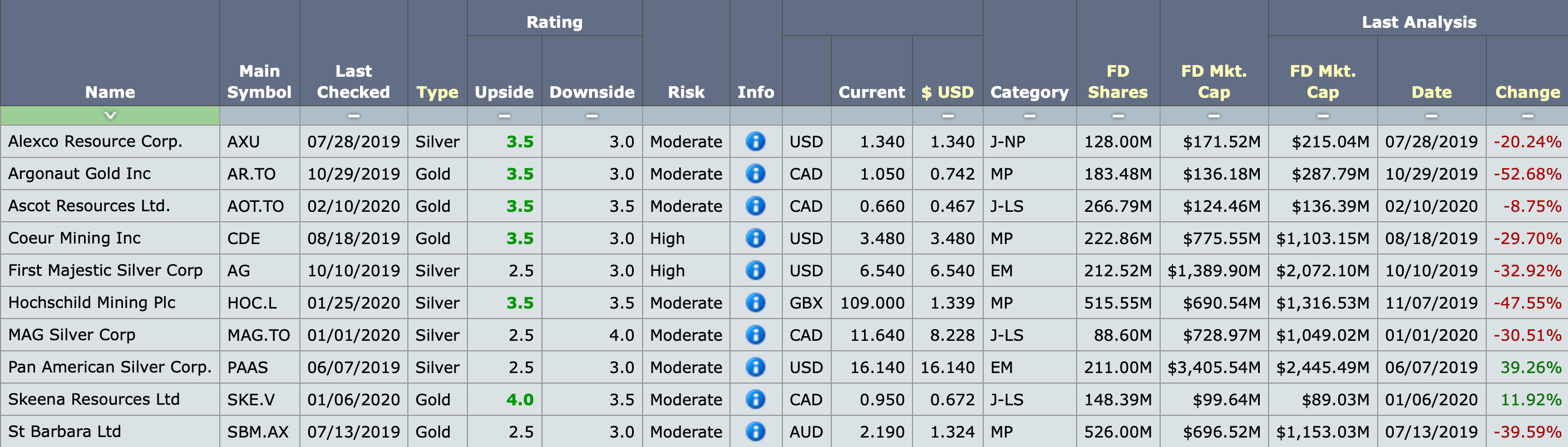

Here is my list of 10 gold and silver miners that I like a lot and have recently dropped in price due to this sell-off in stocks. Looking at the Upside Rating column, you will see that 2.5 is the lowest number. That means I expect these stocks to have big upside potential. All of these stocks are estimated to be at least 3 baggers at higher gold/silver prices. The other reason they are on this list is that I like their risk-reward and the quality of their properties.

Here are my rating definitions.

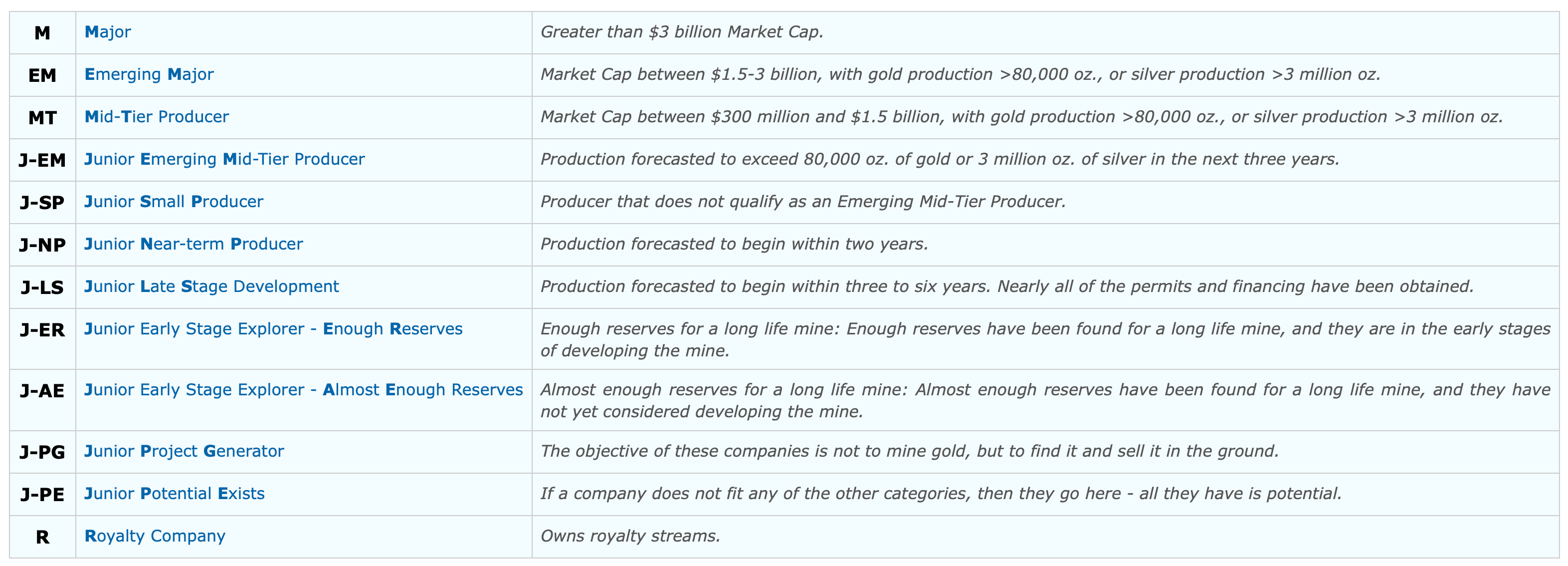

Here are my category definitions.

If you are a member at GSD or read my articles, you know that I follow all of the miners. So, when a sell-off occurs it gives me an opportunity to take a look at the miners I like and see which ones sold off and became attractive. Above is a list of ten stocks that look attractive at current valuations.

The key number I am looking at here is the current FD market cap versus there recent FD market cap. These are not super cheap stocks and could easily get cheaper if the gold/silver prices drop. But if you are bullish on higher gold/silver prices, these stocks should all perform well. And in the long term, they look really good because of their quality properties.

Most of these stocks are at excellent entry prices at the moment. Some of them, I would prefer to get a bit cheaper. For instance, I would prefer Alexco under $1, Coeur under $3, Pan American under $15, MAG under $7, and First Majestic under $6. We could see those prices if the markets sell-off, but perhaps not.

The analysis of companies below is from GSD and are all done by me. I only analyze stocks one a year or once every 9 months. So, these analysis are not up to date. However, the mining business is fairly static and not a lot occurs during a year's time. For this reason, most of my analysis is still relevant. However, only use it as a starting point and do your own DD.

Alexco Resources (Analysis from July 2019)

Alexco Resources was a silver producer in the Yukon until 2014. They were producing 1.5 million oz annually at their Bellekeno mine. High costs forced them to put it on care & maintenance. They have an excellent 55,000 acre property (Keno Hill) located in Canada. It is a 100 million oz resource at 500+ gpt, plus lead and zinc offsets.

They are projecting all-in costs (free cash flow) around $13 to $14 per oz after expanding annual production capacity to 4 million oz. The capex is about $23 million for the expansion, with a 70% after-tax IRR at $16 silver. They have about $10 million in cash and no debt, so it will be easy to finance. In fact, they already have a $15 million loan agreement. They should begin construction for their expansion in 2019. It is a 7-month project. They should begin production in 2020, as long as silver prices are above $16.

Their FD market cap has jumped to $215 million, but it appears to still be cheap. The one red flag is their streaming deal with Wheaton Precious Metals. They are obligated to give 25% of their Keno Hill production to Wheaton for the life of the mine. Wheaton pays them a calculated amount until silver prices reach $25, then they pays them nothing. Alexco gets more money if silver is cheaper. Basically, Alexco is protected for silver prices under $17. However, after silver gets above $20, they get very little money from Wheaton and zero after silver reaches $25.

One positive about this stock is their exploration potential. The grades on this property are excellent. I'll be surprised if they don't reach at least 5 million oz of production. Another thing to like is their cash flow at higher silver prices. Also, without any debt, they will be in a position to grow via acquisitions once silver prices rise. While it does look a bit pricey today, if they build or acquire another mine, it could become a big company.

Argonaut Gold (Analysis from October 2019)

Argonaut Gold is a mid-tier producer. There is a lot to like about this company. Their production is currently 200,000 oz. They have three producing mines in Mexico with all-in costs (free cash flow) around $1200 per oz. They have three more mines to build (two in Mexico and one in Canada) and all of them are similar. This is a very smart company that purchases economic projects with solid resources, low capex, and moderate cash costs. All of their mines should produce 60,000 to 150,000 oz at moderate cash costs.

They have $24 million in cash and $14 million in debt. It’s amazing that a growth company that has purchased 2 companies (Pediment Exploration and Prodigy Gold) and a large project (San Agustin), and built three mines, has very little debt. They need to build 3 more mines, so that will take some debt. The projected cash costs per oz for their next three development projects are $600, $600, and $700. Thus, they are all economic at $1300 gold.

Their largest mine (Magino) has not been built yet. It has 4 million oz and $320 million capex. Plus, it is in Ontario, Canada. Cero Del Gallo is a 900,000 oz (.6 gpt) open pit in Mexico. It probably needs higher gold prices to get built. San Antonio (1.7 million oz at .8 gpt) that is currently being permitted.

Anyone who analyzes gold mining stocks has to be impressed with this stock. Management has done a good job building and operating mines. They now have 8 million oz of M&I and a nice pipeline of projects to develop. The only question to ask is how big is this company going to get? Their target is 300,000 to 350,000 oz. My guess is that they will continue to buy projects and build mines. With an FD market cap of $287 million, the upside potential is significant. My only concern is that they get taken out by a larger company, or higher taxes/royalties in Mexico.

2/24/2020: They recently released their financials and their costs have increased. This caused their share price to drop. Their all-in cost is currently about $1300 to $1350 per oz.

4/4/2020: They recently announced a merger with Alio Gold in a merger of equals with no premium. This makes Argonaut a much stronger company by acquiring two quality projects for the cost of Alio Gold's current market cap, which is very cheap. Excellent accretive acquisition.

Ascot Resources (Analysis from February 2020)

Ascot Resources has a large high-grade gold project in Canada (British Columbia). They have four deposits (Premier, Silver Coin, Big Missouri, and Red Mountain) with 3.5 million oz (7 gpt). Plus, they have a mill that needs to be refurbished that can fed by all four. They have done extensive drilling and are now ready to move forward with development. A feasibility study is due in Q2 2020.

It's a past producing mine and they think it will be easy to permit. The EIS is already approved, which takes the longest to permit. The location is the golden triangle, where infrastructure is always a challenge. However, they claim to have good infrastructure in place from past mining.

We won't know the capex until the feasibility is released. However, I expect it to be around $100 million, which is low for their expected 200,000 oz annual production (if Red Mountain is included). Plus, they are not expecting high costs. My guess is that it will be around $700 per oz for cash costs and $1,100 per oz for all-in costs (free cash flow).

Premier also has a large open pit deposit. Recent drill results (572 meters at 1 gpt) point to a large open pit mine. All four deposit areas have extensive exploration potential on 25,000 acres and 15 target areas. They expect to find a lot more high-grade underground and low-grade surface gold.

Their other project is Mt Margaret in the US (Washington). It has 500 million tons of mineralized ore. It is primarily a copper project, but will also produce around 1.5 million oz of gold (.25 gpt with perhaps 60% recovery rates). They are drilling it and have a target of 4 billion lbs of copper and 4 million oz of gold. I expect them to sell Mt Margaret if they get a good offer.

The red flag for Ascot is that they are a takeover target. My experience is that once large projects get de-risked and are near production, they get taken out for a small premium. Thus, likely you aren't buying Ascot, but some unknown larger company. One of these days companies will realize that gold is going to $2,000 per oz. and they will stop giving their companies away.

Coeur Mining (Analysis from August 2019)

Coeur Mining has underperformed since 2006. They have to reach $70 per share just to get back to where the share price traded in 2006. However, they have been aggressive, purchasing Orko Silver, Paramount Gold, and a mine from Gold Corp. In 2019, they will produce about 12 million ounces of silver and 350,000 ounces of gold. That is substantial and with rising gold and silver prices, cash flow could reach $1 billion annually at higher gold/silver prices. At 10x cash flow, they could reach a $10 billion market cap. That would make them a potential 5+ bagger from their current $1.1 billion FD market cap. The stock had been surging, rising from $2.48 to $14.94 in 2016, but is now back to $4.95 because of high costs.

They are currently producing about 35 million oz of silver equivalent (including gold), with all-in costs (free cash flow) around $16 per oz. So, they are a high-risk investment at low gold and silver prices. However, if gold and silver prices take off, they will benefit big time.

I look for this stock to do well, although they need to find some production growth. Their new management team has focused on improving their balance sheet. However, they still have $370 million in debt and only $38 in cash. With more free cash flow, they can clean up their balance sheet.

They have become mostly a gold producer, with 68% of revenue from gold and only 28% from silver. However, that could balance out if silver outperforms gold.

First Majestic Silver (Analysis from October 2019)

First Majestic Silver is a large silver producer in Mexico. Until recently they were a very strong company with a clean balance sheet and low costs. Now they have $150 million in debt and lost money last quarter (June 30th), although they do have $94 million in cash. Their all-in costs are around $17 per oz (silver equivalent). Hopefully, that will drop when their next quarter financials are released.

They will produce 25 million oz of silver equivalent in 2019 (93% of their revenue comes from silver and gold). With this much production, they have huge leverage for higher silver and gold prices. They have 6 producing mines in Mexico.

They have the potential to create over $1 billion in free cash flow at $100 silver prices. At a 10x free cash flow valuation, FM should be worth at least $10 billion at $100 silver. That is my expectation as long as Mexico doesn't increase taxes and royalties, and FM hits their production and cost targets.

The red flag for this stock is their high all-in costs, but they have one of the best management teams in the business and should survive a downturn. Their other red flag is their resource total. They only have about 170 million oz (silver equivalent) of reserves. That seems like a lot, but they plan to increase production beyond their current 25 million oz (silver equivalent) per year. That is only 7 years of current reserves. Thus, maintaining production could be an issue down the road and could hurt their share price. After all, there are not very many large silver mines left to develop.

The good news is they want to become the world's largest silver miner. That is an aggressive goal. They have will need to get lucky with exploration and acquire a few projects. With that aggressiveness, I would expect this company to do well. If they can grow their resources and production, then my future valuation for them (around $10 billion) is too low.

1/4/2020: I was informed that FM has a large potential tax liability from their Primero acquisition and the way the silver stream is taxed (from 2010 until current). On their most recent MDA on Sedar.com, they list a potential $185 million tax liability and that it does not include interest and penalties. Ouch. I doubt they will have to pay the entire amount, but the liability appears to be growing because they have not changed their accounting to match what the Mexican tax authority deems appropriate. Currently, they are in negotiations with the Mexican tax authority regarding this liability and it appears they have refused to pay it.

Hochschild Mining (Analysis from November 2019)

Hochschild Mining is a large silver/gold producer in South America. They will produce 38 million of silver equivalent (including gold) in 2019. All-in costs per oz are about $14 or $15 (silver equivalent, including gold). They currently have 4 operating mines in Peru and Argentina (16 million oz of silver). They are also doing exploration in Chile and Mexico. They plan to increase production to 40 million oz of silver equivalent in the long term and have a good pipeline.

This stock was cheap in 2015, but has since risen in value from 71 cents to $2.55. Their FD market cap is now $1.3 billion. I don't think it is too pricey and still has 5 bagger potential at higher silver prices. It's a potential cash flow machine, with a very good management team. Also, the dividend is currently 1.6%, which could explode as they increase in value. The only thing I don't like is that it is based in London and only trades OTC in North America.

Hochschild has about $95 million in cash and $157 in debt. That's a pretty good balance sheet, and all they need are higher silver prices, and their balance sheet will look much better, driving their share price higher. One family owns 54% and controls the company. They are highly motivated to build this into a large company and likely won't sell to a major.

They have a large gold project in Chile (9 million oz Volcan deposit) that they obtained from Andina Minerals for a very cheap price. It is low grade, but once gold prices rise, this project will get built.

MAG Silver (Analysis from January 2020)

MAG Silver has an excellent silver project in Mexico. Their Juanicipio project is a JV with Fresnillo and they have a 44% interest. Production should begin in Q4 2020 and it has a 19-year mine life (likely to be increased). Mag's share will be about 5 million oz of annual silver production (more the first 5 years) at close to zero cash costs.

At $16 silver, they will have about $70 million in free cash flow. At $50 silver they will have $200 million in cash flow. The zero costs are from offsets in gold, zinc, and lead. Juanicipio is very high grade (10 to 15 opt) and a high silver recovery rate (94%). The capex is only $300 million and Fresnillo will pay for 56% and is the operator. Mag's remaining share of the capex in 2020 is $126 million and they have $94 million in cash. So, there will be a little bit of dilution in 2020.

Juanicipio is growing in size and they already have several additional discoveries. This mine is going to grow in size. They also have an extensive pipeline of projects and are drilling several: Salamandra, Cinco de Mayo, Pozo Seco, Jose Manto, Mojina, and La Esperanza. The odds are good they will build a few more mines. MAG Silver has the potential to be a very large company.

This stock has exploded to an FD market cap of $1 billion. That's one of the highest market caps for a non-producer. It seems pricey, but I like it as a combination of an income and growth stock. What are they going to do with all of that cash flow? They likely will have a high dividend. Plus, they could acquire additional producing mines and become a growth stock.

The red flag for MAG Silver is they are not building or operating Juanicipio. This means we have no idea if they can build an operate a second mine (or want to). For this reason, my concern (and worst fear) is they will spin-out Juanicipio and remain an exploration company. That would be the easy road for their management team.

Pan America Silver (Analysis from June 2019)

Pan American Silver is one of the best silver producers. They get about half of their revenue from silver production, about a quarter from gold, and the rest in base metals (zinc, lead, and copper). They recently acquired Tahoe Resources. Amazingly, their FD market cap is about the same as it was prior to the acquisition at $2.5 billion. In my opinion, it is extremely undervalued. I’m amazed that investors don’t like it, but then silver prices are under $15, which is also shocking.

The combined resources of Pan American and Tahoe are huge. They have about 1.5 billion oz. of silver and 25 million oz. of gold. In 2019, they will produce about 25 million oz. of silver and 450,000 oz of gold. Plus, this does not include their Escobal mine in Guatemala that has had political issues. If Escobal resumes production, that adds 20 million oz of annual production at low cash costs. Even without Escobal, this stock is very cheap versus their potential cash flow at higher gold/silver prices.

Investors are being very conservative. They don’t like the debt that was assumed from Tahoe, which now gives them $360 million in debt and only $121 million in cash. They don’t like the fact that Escobal is an unknown. And they don’t like the some of the locations, such as Guatemala, Bolivia, Argentina, and Peru. They also have producing mines in Mexico and Canada.

Cash costs for silver production are about $7 per oz, which isn’t super low, but it is very profitable. Cash costs for gold production are about $800 per oz, which is profitable at $1300 gold. We won’t know the free cash flow of the combined companies until they report next quarter. My guess is that it will be around $100 million at $15 silver and $1300 gold.

Investors can say that it is selling at around 25x free cash flow, which is not cheap. But in my opinion, the real value is in the upside potential for the long term. If silver mining stocks come into favor for investors, this stock could do really well. It's trading at $11 today, but reaching $50 would not be that big of a surprise at higher gold/silver prices. At its current valuation, Pan American might be the best silver miner from a risk/reward standpoint.

Long term at $100 silver and $2,500 gold, you could get 45 million oz. (if Escobal is re-started) x $75 per oz free cash flow = $3.3 billion in cash flow. Plus, 500,000 oz. x $1,000 = $500 million. That is nearly $4 billion in free cash flow. If they get valued at 10x free cash flow, that will make them a potential $40 billion market cap. The FD market cap is currently $2.5 billion.

Skeena Resources (Analysis from January 2020)

Skeena Resources is a development company focused in the Golden Triangle in British Columbia. They obtained the Eskay Creek mine from Barrick Gold in December, 2017. It produced 3.3 million oz of gold and 160 million oz of silver. Amazingly, two years after the acquisition they have already released a PEA.

They plan to produce 300,000 oz annually (including silver). The capex is $233 million, with an after-tax NPV around $500 million. The IRR is very high, around 50% at $1,300 gold. This project is heading to production. It’s a high-grade open pit, with $750 cash costs per oz and a grade of 4 gpt (including silver).

They are cashed up, with more than $10 million and will advance the project. The need to complete a feasibility and permitting. I don’t know how much permitting is required since it is a past producing mine. Share dilution will be required, but I expect the share price to rise, making it easier to finance development.

In addition to Eskay Creek, they have two additional projects. Their GJ-Spectrum project (100,000 acres) is a 1 billion lb copper project with about 2 million oz of gold. They released a PEA in 2017 and it isn't quite economic at $1300 gold, with a 20% after-tax IRR to finance a $170 million capex. But this is a pretty good project, with 65,000 oz of annual gold production and very large copper offsets. I would expect it to get built at $1600 gold. They are looking for a JV partner to advance while they focus on Eskay Creek.

Their last project (Snip) produced 1 million oz at 27 gpt from 1991 to 1999. If they can find another million oz of high-grade gold, this could be their third mine. Hochschild has an option to acquire 60%. They appear to be making good progress identifying new areas to mine.

I expect this stock to go up in value significantly because of Eskay Creek. I’m not sure why it is so cheap. Part of the reason is the CEO has not built a mine before and investors are skeptical that they will build and operate the mine. Plus, because Barrick has a 51% option, which will reduce their upside potential if they take the option. Barrick has until December 2020 to acquire the 51% option. They will have to pay Skeena 3x their costs to date, which will be around $75 million.

2/4/2020: Sold their GJ property for $6 million. They kept their Spectrum property (next to GJ) which has 1.4 million oz (about .7 gpt)

2/19/2020: Spoke to their Investment Relations person. She said they do not believe they have any environmental issues and plan to permit the project while they do infill drilling and the feasibility study in 2021. If all goes well, they could complete infill drilling, the feasibility study, and permitting in 2021.

St. Barbara (Analysis from July 2018)

St. Barbara is a mid-tier gold producer based in Australia. They have four producing mines. Gwalia/Leonora in Australia at 250,000 oz, Simberi in Papua New Guinea at 100,000 oz, and Touquoy in Canada (90,000 oz). Cash costs for the last quarter were about $650 per oz (because of the strong dollar versus the Australia dollar), with all-in costs under $900 per oz.

They acquired Atlantic Gold in 2019 (it is supposed to close in July). I'm assuming the deal closes. This makes them a low-cost 450,000 oz producer with zero debt. They aggressively paid down their debt and now have no debt and about $100 million in cash after the Atlantic deal closes.

Investors have liked their execution, sending the stock from 20 cents in 2015 to $2.19 today. The FD market cap has exploded from $88 million to $1.1 billion. They have significant exploration potential. Their only red flags are high share dilution at 700 million shares and it is no longer cheap. However, with their cash flow, I expect them to grow. It might be a good income stock as gold prices rise.

Now that they have shown a strategy of growth via acquisitions, they could be a growth company. Also, if they triple in value, the dividend will be very good at today's entry price.

For more visit Don's Durrett's website: Goldstockdata.com

*********