Gold And Silver Price Forecasts: The Direct Cues From the Silver Chart And Gold Seasonality

Even though the topic and the main goal of today’s article is to describe what is likely to happen on the gold market, we will start it with a chart featuring something else – it’s sister metal – silver. The reason is that the triangle-vertex-based reversal points are clearest in case of silver and since the entire precious metals sector is likely to move together, the above has implications for gold’s and mining stocks’ outlook as well. The above will be supplemented with gold’s seasonal analysis. Together, they’re forming a coherent picture of what awaits gold in the coming days.

Let’s dive into what silver is telling us right now.

Silver Throws Its Two Cents In

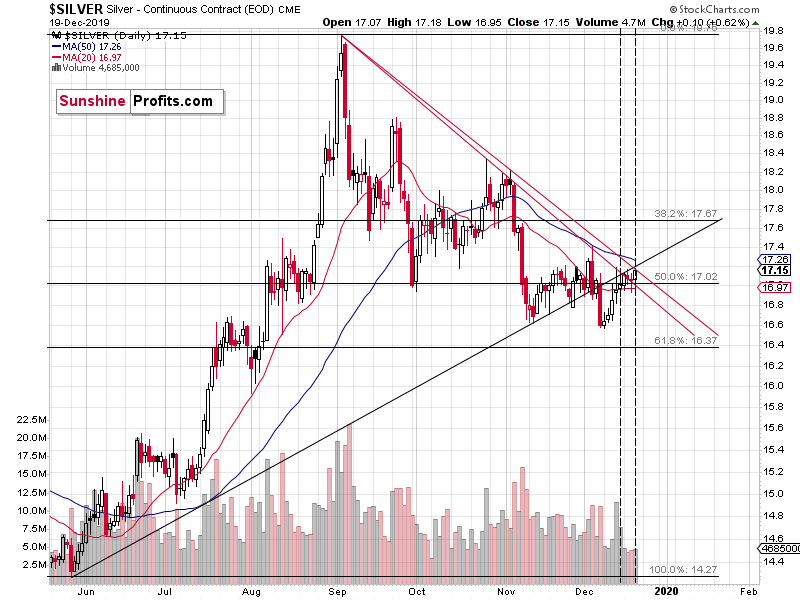

Silver confirms that it’s time for a change in the short-term trend. Silver has been moving up for several days and it approached its two triangle-vertex-based reversals. Silver formed an intraday high almost right at the first of the reversals and it matched this high during yesterday’s session. Silver also closed at a new very short-term high yesterday – it didn’t move to a new December high, though.

Silver is moving lower today (at least at the moment of writing these words), which suggests that both reversals indeed worked.

Reversals plus low volume could equal a big move lower shortly. There’s not much time for the decline to take place – probably next week – because of the current True Seasonal pattern and the long-term triangle-vertex-based reversals that we discussed previously.

The Seasonality’s Perspective

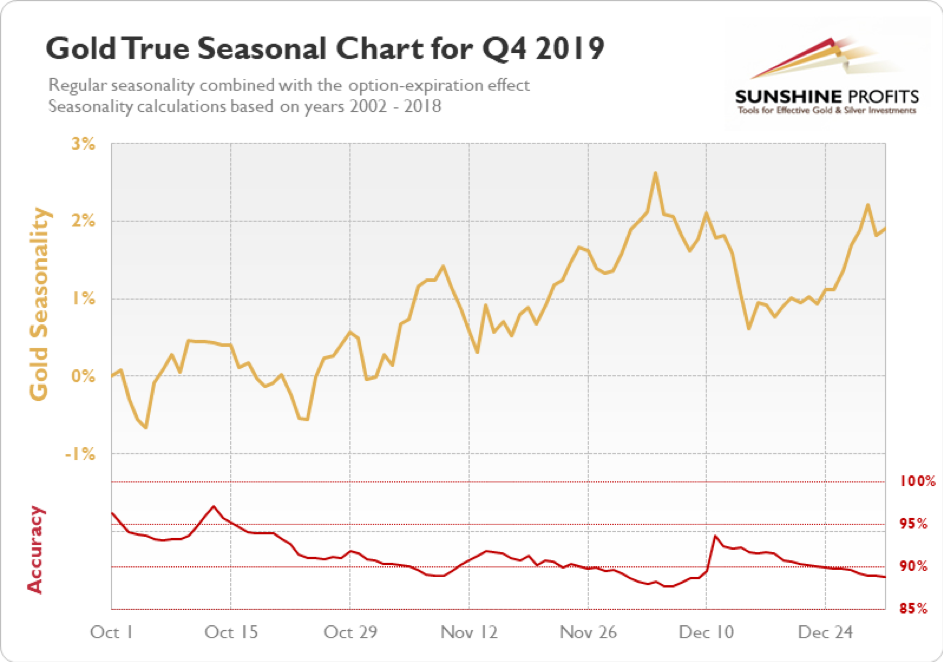

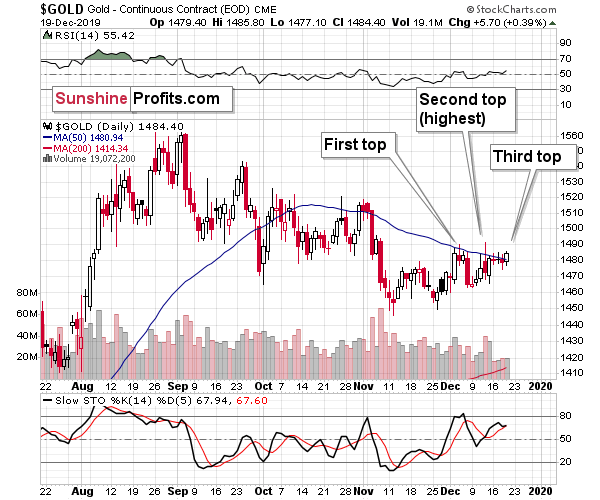

Usually, gold reports higher prices in the final quarter of the year, and if we consider the fact that gold closed September at $1,472.90, we see that it’s been true at least so far. Based on the seasonal tendencies, the yellow metal was supposed to decline in November, and that’s exactly what happened. Gold was supposed to then move higher and it did. It didn’t move above the November high, though. That doesn’t mean that the seasonality is useless – it simply means that since gold is now in a medium-term downtrend (considering highs, lows, and for instance the declining 50-day moving average), the implications might have a bit shifted, but they aren’t necessarily totally absent.

The above chart suggests three tops in the head-and-shoulders form, and that is indeed what gold formed.

What we just saw could have been the final of the three tops that is then likely (based on the seasonality alone) to be followed by the biggest decline of the quarter.

Now, taking seasonality at its face value, this is the time of the year when gold should be bottoming and preparing for its year-end rally. However, it seems that the patterns were delayed and since we have indications of upcoming reversals at the end of the year, it seems that we are still likely to see quite a volatile move lower before the next short-term corrective rally starts.

Summary

Summing up, the silver moves’ analysis doesn’t support higher gold prices immediately ahead. Neither the gold seasonality does. Actually, the very short-term outlook for the precious metals sector is bearish for the next week or so. Then, the year-end reversal becomes likely based upon the indications we have right now. Before then, buckle up for a potentially quite volatile move lower.

The following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. Predicting gold’s rally without a bigger decline first is likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,