Gold Price Forecast: The Key Role USDX Is About To Play Soon

Our contributions most of the time deal with the long-term gold price path. Today though, we’ll shine the spotlight on the USD Index as that’s the key for unlocking gold price path just ahead. Precious metals investors are well aware of the inverse correlation between the two, and the strength of this link. On one hand, it’s the confidence in the fiat dollar, on the other stands an asset that is nobody else’s liability. What is the greenback telling us about gold right now?

The USD Index Assessment

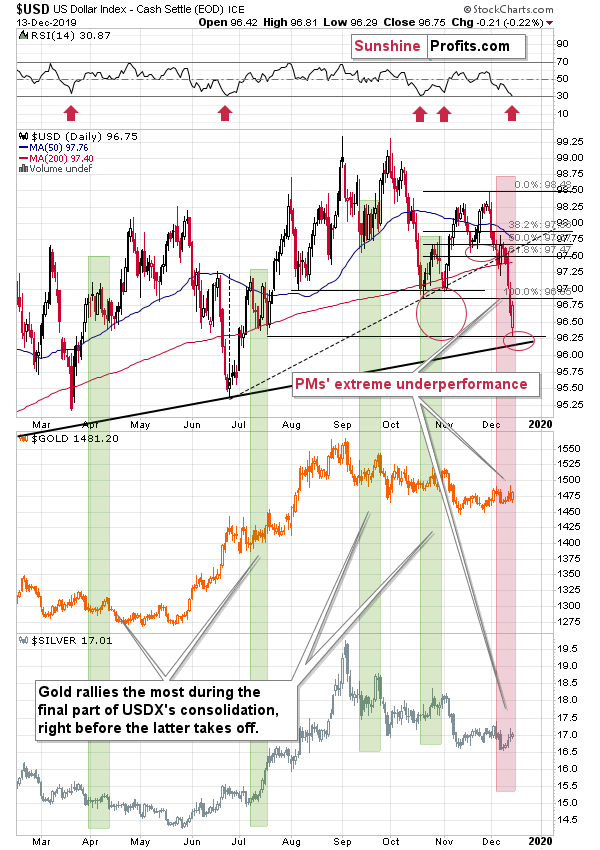

Earlier in today’s trading, the USDX futures moved to a medium-term support line, tried to break lower and invalidated this breakdown almost immediately.

This could be the end of the short-term decline and the start of a new short-term uptrend. Such an uptrend could trigger a sharp slide in the precious metals market.

And the Consequences for PMs

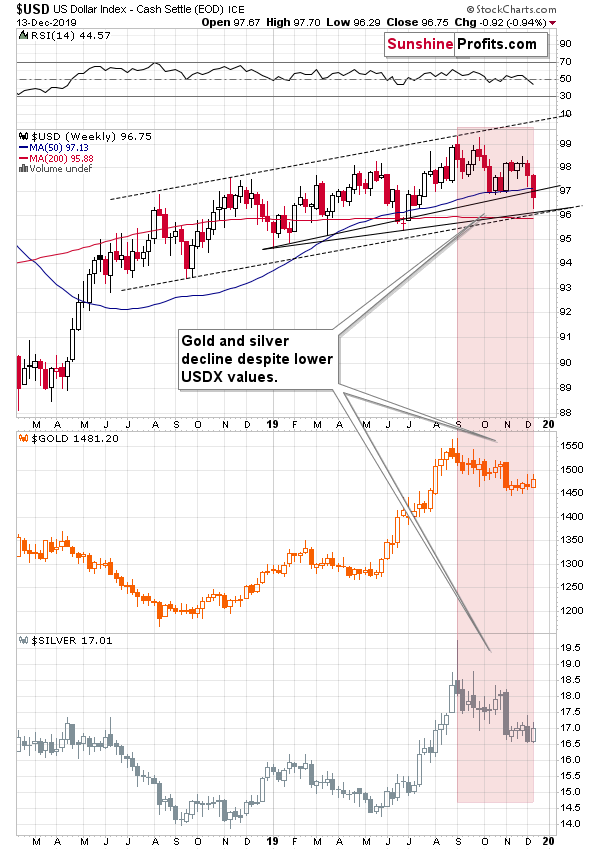

As you can see on the above chart, the potential for the rally is big even within the rising trend channel. Of course, the USDX is likely to break above this trend channel, but even before that happens, we’ll have a sizable upswing – likely to the 100 level or so.

This may not seem like much on the above chart, but it definitely does look this way once we zoom in.

The 100 level is above the previous 2019 high and definitely higher than the USD Index is trading right now. In fact, a move to 100 would erase all its decline since early October. This means that the entire bullish force that should have caused gold market to rally, would turn into an even bigger – and bearish – force. Now, since gold didn’t rally despite the above, and even moved below the October low, this means that gold would likely truly plunge once the USDX supports that.

If gold didn’t do anything during USD’s slide, it would most likely decline even if the USD Index simply stopped declining (without rallying). An USDX rally means gold trading not only lower, but much lower. It also implies that gold’s move lower would be quite fast.

Summary

Summing up, gold and silver’s failure to rally in the face of declining USD Index is a strong sign in itself. The metals went lower just as the USD did. As the greenback is testing its support, we can thus expect a sizable precious metals’ reaction once the dollar rises again. And it’s not likely to consist of gold going higher.

The following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. Forecasting gold’s rally without a bigger decline first is likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,