Gold Traders Bullish For Fourth Week In A Row

Strengths

· The best performing metal this week was platinum, up 1.40 percent as hedge funds cut their bearish outlook in the futures market. Gold traders and analysts were bullish for a fourth week in a row, as measured by a Bloomberg survey. Gold futures had their biggest gain in two weeks after almost 22,000 December contracts changed hands on the Comex in New York in only 10 minutes as inflation data came in weaker than expected. Bloomberg writes that this is more than 11 times the 100-day average for that time of day. Spot gold nearly finished the week with a gain but prices drifted lower on Friday afternoon.

· U.S. job openings rose in July to a new record and the largest share of workers since 2001 quit their jobs. Job postings exceeded the number of unemployed people in July, which helps explain why wages rose subsequently in August at the fastest space in almost ten years. This labor market strength could push wages even higher, which typically leads to rising inflation – something that can be positive for the price of gold.

· According to the Perth Mint, demand for Australian bullion products rose in August for a second month in a row. Sales of gold coins and bars totaled 38,904 ounces last month, representing a 30 percent gain from the prior month and an increase of 68.2 percent from the same time last year. The Perth Mint also sold 520,245 ounces of silver in August, posting an increase of 6.9 percent from July and a 32.7 percent increase from August 2017.

Weaknesses

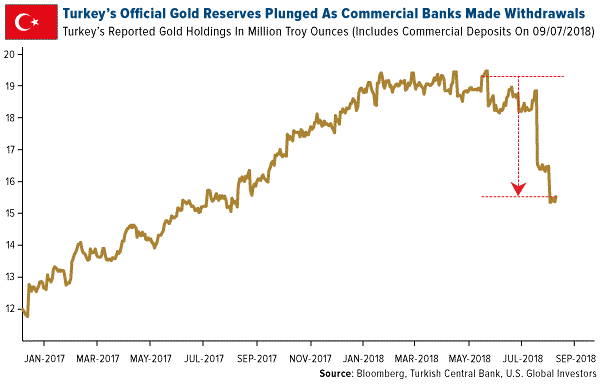

· The worst performing metal this week was silver, down 0.85 percent despite hedge funds cutting their bearish wagers on both silver and gold. As the lira continues to fall, commercial lenders in Turkey have withdrawn as much as $4.5 billion in gold reserves in an effort to avert a liquidity crisis. Bloomberg writes that weekly holdings, as reported by the Central Bank of Turkey, have fallen by almost one fifth since June 15 to 15.5 million ounces. Perhaps the selling from Turkey has dampened the seasonal fall rally in gold.

· Reuters reports that dealers in India have been offering gold at a discount for the first time in over a month, as an uptick in local rates moderated demand. India, the world’s second largest consumer of gold, saw the yellow metal being sold at up to a $2 per ounce discount over official domestic prices this week, compared with a premium of $1 last week. There is a 10 percent import tax on the yellow metal in India.

· U.S. core inflation, CPI, unexpectedly slowed in August as apparel prices fell by the most in seven decades and medical care costs declined. Inflation slowed to a 2.7 percent annual gain, down from 2.9 percent in July. Kevin Cummins, senior U.S. economist at NatWest Markets, said that “the broader trend in inflation is that it’s moved higher from where it had been, but any worry of an outbreak or idea that inflation will break out – this data casts some doubt on that.” U.S. producer prices also fell unexpectedly last month, for the first drop in 18 months, according to a Labor Department report this week. Bloomberg’s Katia Dmitrieva writes that the data suggests inflationary pressures may be taking a breather even as most signs of economic growth remain strong.

Opportunities

· The timing could be right for several Australian gold companies to look into acquisitions. Bloomberg notes that Australian gold stocks have outperformed their Toronto-listed peers by 23 percent over the last 12 months due to their wide operating margins and strong cash positions, among other factors. Analysts at Ord Minnett wrote in a note this week that Newcrest Mining, Evolution Mining and Northern Star Resources are the most likely to be looking at potential acquisitions in North America in the next year. Northern Star recently acquired the Pogo Mine in Alaska. Ramelius Resources made an all-share takeover offer for a smaller rival and is on the lookout for more asset acquisitions, according to its CEO and Managing Director Mark Zeptner.

· Shandong Gold Mining, a Shanghai-listed producer and China’s second-largest gold miner by market value, is offering 327.7 million new shares for a first-time share sale in Hong Kong that could raise as much as $767, reports Bloomberg’s Crystal Tse. Rival gold producer Zhaojin Mining Industry is one of five companies who have agreed to buy stock in the offering. This comes as the Hang Seng Index has entered a bear market and Shandong’s shares having fallen 24 percent year to date. Proceeds from the offering my allow Shandong to purse an acquisition. Canadian miner New Gold is working with BMO Capital Markets to find a buyer as they’re exploring selling and other options, reports Reuters.

· The ratio of Comex paper claims to physical gold continues to rise, currently at 325 to 1 versus the average of 152 to 1 year-to-date. The percentage of gold available for delivery as a percentage of total COMEX gold inventory is down to 1.73, versus 12 percent at the beginning of the year and the five-year average of 9.82 percent. With such a limited supply of physical gold to potentially settle trades, a short squeeze could materialize.

Threats

· South Africa’s gold mining industry continues to hit speed bumps. More than 50 people have died in the country’s mines so far this year, similar to the levels seen in 2017. Although far below the 615 deaths recorded in 1993, 2017 marked the first rise in deaths in a decade. Most gold mining fatalities are due to workers being crushed under falling rocks, which can be caused by more frequent tremors as companies dig deeper to find more gold. The government is investigating Sibanye Gold operations, as over half the gold mining deaths have occurred at their mines this year. Production of the yellow metal has contracted 15 percent from a year earlier, according to Statistics South Africa. This represents a tenth consecutive monthly drop in production in South Africa. Platinum-group metals production has also fallen 6.2 percent from a year earlier and total mining output is 5.2 percent lower, reports Bloomberg’s Renee Bonorchis.

· Well-known hedge fund manager Ray Dalio said in an interview on Bloomberg TV this week that the U.S. is probably two years away from its next downturn. Dalio said that the current tax cut-driven stimulus will begin to fade in 18 months around the same time when the U.S. will increase borrowing to help pay off pensions, healthcare and other unfunded obligations. “Two years out is when I’m worried about. It’ll be more of a dollar crisis than a debt crisis, and I think it’ll be more of a political and social crisis,” said Dalio.

· The S&P 500 has gained 41 percent since the first post-economic crisis Federal Reserve rate hike in December 2015. This marks the longest rally ever during a tightening cycle, writes Bloomberg’s Sarah Ponczek. The downfall that often follows these rallies historically could be of concern as the second strongest rally came before the crash of 1987.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of