The Golden Rise

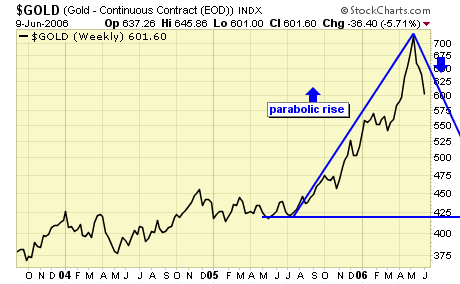

Thank you for your feedback and comments in regards to my previous commentary, "A golden opportunity?" In reaction, many readers have asked me why is it that after having been a consistent buyer of the gold market for the past five years, now am a seller of gold? I have a simple answer: opportunity.

History often repeats itself to those who fail to learn from the past. And history is unfolding, six years after the last lesson. But judging from the opinions of the general consensus, not many are seeing what is unfolding.

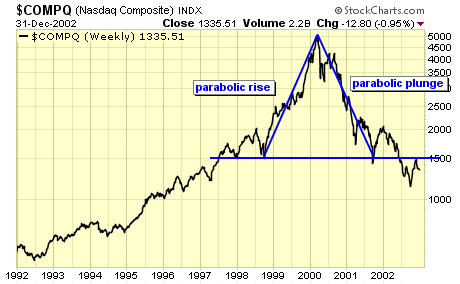

A parabolic rise is always followed by a parabolic plunge, a logical process in the market place to aid the transfer of wealth. Our job as traders is not to try to pick a top during the parabolic rise but to get the hell out of the way when that rise has rolled over. It does not require any special training or skill to spot a parabola, but it helps when you are not biased one way or another. The Nasdaq meltdown was only six years ago, and those who recognized the parabola escaped relatively unharmed, but many were caught and a great deal of fortune was transferred.

I know many gold bugs would be irate and hate mails will soon fill my mailbox, and frankly, I don't really care. I would not be doing my paid subscribers a favor if I do not disclose what I clearly see. I'm hoping my analysis is very wrong, because I much prefer to be a buyer than seller, and so are most of my subscribers. Gold's parabolic rise from $420 to $720 may seem like peanuts in the overall picture if those $5000 gold targets are realized one day, but a rise of this nature is unsustainable and the subsequent plunge almost always wipes out the entire gain. Not a big deal if you began buying gold at $275 as we did, but disastrous if you bought within the past few weeks.

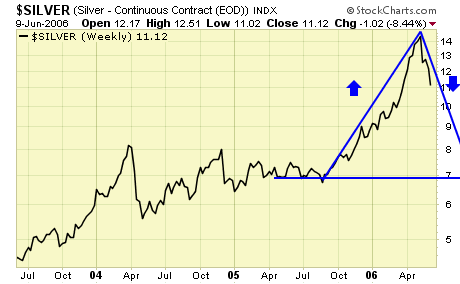

Silver is losing its lining…

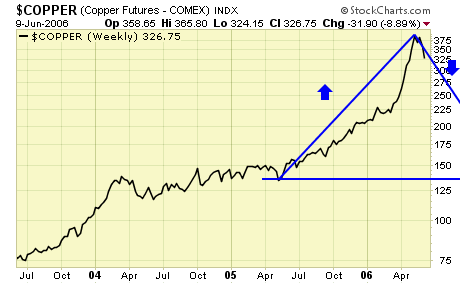

Copper has made a copper top….

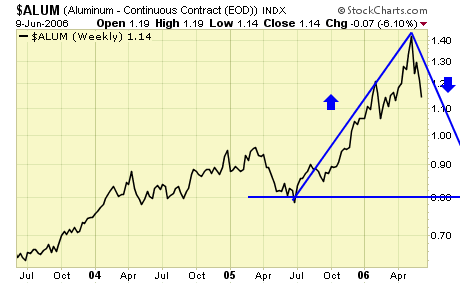

Aluminum's parabolic rise is foiled…….

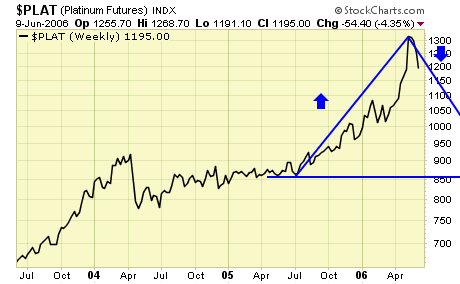

Platinum is also plunging….

Summary

From a pure technical stand point, there is nothing bullish about the current price action. Those who suggest the markets can only go higher from here are simply refusing to see what is. Sure, we can debate over China, India, and a whole lot of reasons why metals should go to the moon sooner or later, but the fact is, a lot of hot money was required to propel these markets to the current great heights. Perhaps this is no where near the eventual ultimate height, but much of these hot monies can only be converted into profits if they take exits. Momentum players are capable of driving the markets to extreme levels, up and down. Folks, we are witnessing another great transfer of wealth in progress, and the process has just begun.

As always, we trade our signals and set ups, not our analysis.

Jack Chan at www.traderscorporation.com

13 June 2006