How To Value Gold And Silver Mining Stocks

This is a long article. It's an educational article and a must read for anyone who invests in gold and silver mining stocks. If you have been analyzing gold and silver mining stocks for more than five years, then perhaps you can skip it. For the rest of you, put in the time. It is the final chapter in my well received book, How to Invest in Gold & Silver: A Complete Guide With a Focus on Mining Stocks.

The difficulty investing in gold and silver stocks is understanding how to value a mining company. I know, because when I started out I didn’t have a clue and made many investment mistakes. Now I make fewer mistakes and I am much more confident that I am making the right choices. Moreover, my understanding of risk has increased dramatically, which is an important component in valuing a stock.

The starting point for valuing a stock is collecting and analyzing data. You need a checklist of information that you are interested in knowing. This is how you find the red flags which nearly every company has to some extent. A short list of these data points includes the stock price, market cap, share structure, location, amount of resources, ore grade, recovery rate, management, the timeline to production, company guidance, growth potential, cash/debt situation, cash costs, and valuation. You need these data points and information to utilize a systematic approach to valuing a company. Moreover, you need to look at all of the data points before you understand the valuation of a company.

There are only two things to do when you analyze a company. First you want to identify any red flags, and second, you want to give it a future valuation. You then combine these two factors to arrive at a rating, which becomes the risk/reward profile of the stock. The purpose of looking for red flags is that you will use them to adjust down the future valuation. The red flags are essentially increased risk.

In this chapter, I will show you how to find the red flags and how to value a stock. I will also show you how to arrive at a rating, which you then use to identify the true value of a stock. I invented this rating system through years of experience, and it works very well at finding undervalued stocks.

My system is a ten-step approach, with the first eight steps analyzing data to find any red flags. The ninth step is to check if a stock is undervalued, and the last step is to give the stock a rating.

When I analyze a stock, I use my systematic approach to determine the true value, which is defined by a rating. If you use this ten-step method, you will have a good way to filter out stocks that you don’t want to own. Also, once you use this system, when you analyze a company, you will know what to look for.

This system is aimed at identifying highly undervalued gold and silver mining stocks. My personal goal is to find highly undervalued stocks with ratings of 3 or 3.5. A 3.5 rating is currently the highest rating. It is for stocks with five-plus bagger upside potential, and an ideal risk/reward profile. A 3 rating is for five-plus bagger upside potential, but not quite the most ideal risk/reward profile. A 3 rated stock has more risk than a 3.5 rated stock, and potentially significantly more risk.

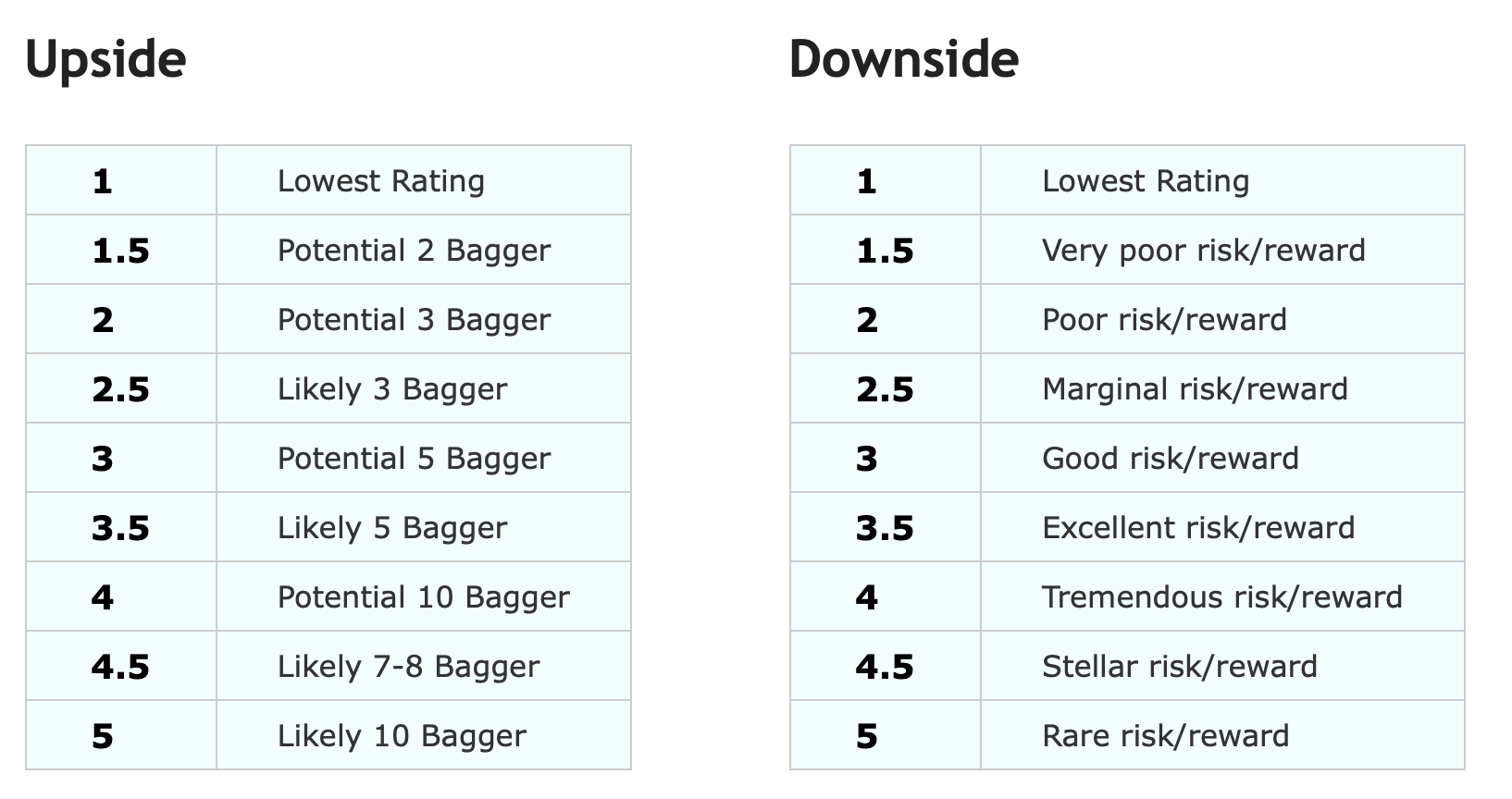

Note: I stopped using my 4 and 5 ratings because everyone thought these must be the best stocks. I am planning to implement a two-factor rating system, with the first number for the upside potential and the second number for the risk. Once that is implemented, I will be able to use 1 to 5 ratings for upside and risk.

I currently don't use ratings that capture ten bagger or higher upside potential, because those kind of gains are nearly impossible to predict. My website does provide a list of stocks with 20+ bagger potential. However, many of these stocks have ratings below 3 because the risk/reward profile is much less than ideal.

A 2.5 rated stock is a likely three-bagger with a good risk/reward profile. A quality producer with a 2.5 rating could become a growth stock and become a five-bagger. I used to believe that it was better to invest in ETFs, such as SIL for silver miners or GDXJ for gold miners, than companies with ratings of 2.5 or less. However, I have come to believe that I would rather pick my own Mid-Tier Producers than own ETFs. It’s okay to also own these ETFs, but I would not rely on them.

I never envision investing in a producer or developer with a 2 or lower rating, but you may for high-quality income-producing stocks. I do sometimes invest in exploration stocks with 2 ratings because nearly all of the Project Explorer stocks in my database have a 2 rating. The complete rating chart is presented at the end of the chapter.

Okay, let’s begin.

1) Properties / Ownership

You want a company with at minimum a potential flagship property (2 million oz. gold, or 40 million oz. silver). This is the most important criteria for picking stocks. Most of your mistakes are going to be from companies that do not find flagship (or potential flagship) properties. If you invest in undervalued companies with flagship properties, you will likely be rewarded.

It’s okay to invest in a few companies that have small properties if the valuations are attractive and they have exploration potential, but don’t make it a habit. Focus on flagships, because you are after growth and small properties are not generally conducive to growth.

The reason why we look for properties with 2 million oz. of gold or 40 million oz. of silver is for the future cash flow potential. At these levels, the cash flow is sufficient to grow the company. For instance, a 2 million oz. property will likely produce about 80,000 to 120,000 oz. per year for 12-15 years. That is both solid cash flow and a long life mine. Anything less, and the potential for growth is limited.

The other benefit of a flagship property is its potential value. Let’s use a hypothetical scenario:

Gold Price: $2,500

Production: 100,000 oz.

All-In Costs: $1,200 per oz.

Cash Flow: $1,300 x 100,000 oz. = $130 Million

Valuation at 10x Cash Flow = $1.3 Billion

Only a high-quality company is going to get valued at 10x cash flow, but the potential exists for flagship properties to have very high valuations. This requires two things: cash flow and higher gold prices.

The first thing I always do is check the properties for cash flow potential. Ideally, you want to find a growth-focused company that will leverage cash flow from a flagship property to expand production. Future cash flow is what we are after, and large properties have the potential to provide high cash flow. Properties that can add production ounces and resource ounces are what create increased cash flow. This is what will drive the stock price higher.

It’s okay to invest in a company with only one property if the valuation is attractive. However, for a company to have significant growth potential, it will need to have a pipeline of projects or exploration potential. If you can find a company that is highly undervalued and has several pipeline properties that are usually better than a single property. This gives them a pipeline of potential future mines that are likely not valued into their current stock price. This increases the upside potential of the stock.

When you analyze a company’s properties, you want to look at several things. How many ounces are in the ground? What percentage is inferred? What is the ore grade? What is the cash cost of mining the deposit? What is the recovery rate? Where is it located? What is the impact of the location? What is the current exploration program? What is the potential resource size? What is the company’s plan for this property? Are they giving guidance of production? What is the size of the mineralization zone (exploration potential)? How much of the property has been explored? Does it have a PEA? If so, what is the after-tax IRR? As you can see, there are a lot of questions to ask, and you need to answer them all to get a clear picture.

In addition to checking out the properties, always check to see if they own them 100%. It’s not a requirement that they own 100%, but if it is less, then you need to reduce the valuation. I check their website or regulatory reports to find out their ownership stakes.

It is quite common in the mining business to option properties as joint ventures. Ideally, you want companies that own their properties and can leverage the increasing gold/silver price for substantial profits. I generally am comfortable if they own at least 75% of their properties. Anything less than that and I feel like the upside potential is constrained.

One final comment on properties. You want long life mines because once a mine stops producing, cash flow dries up. This will have a deleterious effect on the stock price. For this reason, you need to check the mine life of each project/deposit. Ideally, you want to have at least a remaining ten-year mine life. This will ensure that the expected future cash flow is not impacted.

2) People / Management Team

There are two types of management teams. The first type is an exploration team. This is a company that only knows how to find gold. These are Project Generators. They are called that because they find mines and generate projects for other companies to develop into a mine.

Exploration companies call themselves different names and use a variety of different mission statements. Often they will call themselves exploration and development companies, but their intent is to either option a discovery or sell it. They usually have no intention of building and operating a mine. In essence, these are Project Generators, but they do not call themselves that.

There are two types of Project Generators, those that have very few properties and those that have many properties. In my opinion, there is no difference between them. The only thing that matters is who finds a large mine. I used to think that a company with more properties had a higher chance of finding a large mine, but I no longer believe that. For this reason, I simply wait for a discovery and then decide if I want to chase the drill results.

Some Project Generators will attempt to acquire a number of properties and then find partners to drill their projects. Some investors like this type of strategy, because share dilution can potentially be minimized. At one time, I found some merit in this strategy, but I have come to the conclusion that the risk/reward is not that good unless there has already been a discovery. Any company without a discovery, no matter how many properties they own, will have a hard time finding a large mine.

The other management type is an exploration and development team. These are the management teams that build and operate mines. These teams come in all sizes, from very small to very large. The key is identifying the ability and quality of the management team. A small team can be just as effective at execution as a large team. That said, the larger teams tend to have more experience and better quality teams.

When you look at management teams, you want to check if they have the ability to build a mine and if they have done it before. You want to check the experience of all members on the team. This will often be available on the company’s website. One thing I have learned is that teams with a lack of experience tend to sell their projects right before it is time to build the mine. This is a big letdown for investors because instead of a potential 500%+ return, you end up with around 50%, which is about the going premium for takeovers.

I prefer management teams with good reputations and track records, and who are investor friendly. To identify companies that are investor friendly, first check the share structure (I will be discussing this in step 3). Low share dilution is a telltale sign that companies are looking after shareholder interests. Note that if a company is not a producer with cash flow, then they will likely be diluting the share structure to raise cash to fund exploration or development. The second thing to look for is the percentage of ownership in the company that management owns. A percentage of at least five percent will ensure they are shareholder focused.

Management experience isn’t as important for micro-cap exploration companies (under $20 million market cap). For these companies, you just want good drill results and a smart geologist. However, once a company decides to build a mine, or is already a producer, then the management team is vital. The reason why is because it is such a difficult industry. It is very easy to make mistakes in this business. Smart management teams are not easy to come by, and you cannot expect all of your stocks to have one.

One of the most surprising things I have learned about this industry is that even good management teams can get into trouble. It’s amazing how many companies with quality projects have either went bankrupt or watched their share price crash from 2012 to 2018. It seems like only the best management teams seem to know how to stay out of trouble.

It is a good idea to do some research on the management team and CEO before investing in a stock. Listen to an interview with the CEO and see if you get a good feeling. If they have a good management team, they usually will brag about their people. Also, if the CEO is excited about their company’s potential (and they should be), it will be apparent in the interview or presentation. I prefer companies that have a CEO who is passionate about their prospects.

Try to find a strong management team to go with excellent projects in an ideal location. Then you have the trifecta. These are the stocks you look for, and when you find them, you invest. People and projects are excellent starting points for analyzing stocks, but not the end all. You still have to look at all of the data points to get a clear picture.

3) Share Structure

The share structure is broken into three parts:

Outstanding Shares

Outstanding Options

Outstanding Warrants

Outstanding Shares are what you see published when you get a stock quote on Google Finance. These are the common shares that have been issued.

Outstanding Options are stock options given to employees, contractors, or others who are affiliated with the company. Each option has a specific price threshold (strike price), along with exercise and expiration dates, which must be met before the stock can be issued. Legally, stock options must be granted at or above the current stock price. If an option exceeds the strike price, they are usually exercised (purchased) by the option holder and become common stock, thereby increasing the number of shares outstanding.

What makes stock options valuable is that you usually get to purchase stock below the current market price. This usually creates instant profit for someone holding an option that is in the money (above the strike price).

Outstanding Warrants are options that investors hold to purchase common stock at a specific price for a certain period of time. These are generally given to investors when they participate in a private financing. These are used to entice investors to participate in a financing. They can be very valuable if the stock price increases because of leverage. If you own a warrant, and the stock price appreciates in value, you have essentially been given money. You can then either sell your warrant for a profit, or buy the stock at the warrant price, and let your profits ride.

Because warrants and options generally turn into common stock, it is suggested to use fully diluted shares (common stock, plus warrants and options) to do your stock valuations. I always use fully diluted shares for stock valuations on my website. One lesson that all mining investors learn is that stock prices drop as the stock becomes diluted. Also, stock prices tend to reflect fully diluted shares, as investors anticipate options and warrants turning into common stock.

Anything that increases the number of Shares Outstanding is called dilution. This can happen by private placements, public share offerings, exercised options, and exercised warrants. You will learn very quickly that in the gold/silver mining business that dilution is quite common, especially for Juniors.

I prefer to own companies that have less than 150 million fully diluted shares, although it is more realistic to average around 250 million fully diluted shares in your portfolio. Note that if you purchase a company with low dilution that does not mean it will remain that way. A company’s current fully diluted shares can only remain static if they have cash flow, a large cash position, or plan to issue debt to obtain cash.

Companies without cash will either have to add debt or issue more shares to raise funds. The reason for this is because the mining business is cash intensive. Exploration, development, and production require cash. For most exploration companies, their only option is usually to issue more shares and dilute the share structure. Investment banks are not going to loan them money unless a project is significantly advanced. There are occasions where exploration companies carry debt, but it is the exception.

Try to avoid companies with over 400 million shares (unless it is a large company), because the share price will not have explosive potential to rise. For instance, if a company has 100 million shares outstanding with a $1 stock price and the market cap rises to $1 billion, then the stock price will rise from $1 to $10. Whereas, if the company has 400 million shares outstanding, the stock price will rise from 25 cents to $2.50. On a percentage basis, the increase will be the same, but psychologically it will appear to be rising faster because of the tighter share structure, and more investors will jump in.

It isn’t only psychology that favors tight structures, because each share will be more valuable for tighter structures. For instance, if a company has 100 million ounces of silver in the ground and 100 million shares outstanding, then each share will be worth one ounce of silver. Whereas, if there are 400 million shares, each share will only be worth one-fourth of an ounce. This valuation difference can impact the stock price and is attractive to investors.

While you want to avoid stocks with over 400 million fully diluted shares, it is okay to invest in a few highly diluted stocks, if the valuations are very attractive. Just don’t make it a habit. My upper limit is about 400 million, although I do own many stocks above this limit. Sometimes the valuation is extremely attractive, even with high dilution. The key for highly diluted stocks is what happens if they stop diluting. If a company has high dilution but is beginning production, then it might be a good investment.

One thing I have noticed is that with non-producers, dilution can severely impact the share price. If you purchase a non-producer with over 300 million shares, then it could easily become 600 million shares or more before they reach production. The reason for the increase is that it costs money to develop and build mines. For a non-producer, you want to start with low dilution, otherwise you will end up with very high dilution.

Another reason investors loath highly diluted share structures is because of the potential for a reverse stock split. For instance, once stock dilution reaches 500 million shares or higher, companies often do a 5 to 1 or 10 to 1 reverse stock split in order to raise the company’s stock price. This happened a few years ago with Coeur Mining. If you adjust their stock price for the 10 to 1 reverse split, it would be trading today under $1. That is substantially below their all-time high. From my experience, a reverse stock split never seems to be good for shareholders. Although it is good for investors who purchase after the reverse split, because they get a tighter structure.

Always check to see how many fully diluted shares are outstanding. The market cap is calculated using shares outstanding multiplied by the current stock price. However, if a company has a lot of warrants and options, the true current valuation is much higher when you include fully diluted shares. When you buy a share of stock that has a lot of warrants or options, you are paying closer to the fully diluted price, because those warrants and options eventually dilute the stock price. The invisible hand of the market tends to account for that valuation.

Another invisible hand valuation that can impact the market cap is called the EV, or Enterprise Value. This is the market cap plus net debt. This also known as the true value of the company. I like to think of it as the effective purchase price.

Let me try to explain the EV because it is somewhat confusing. When a gold/silver company is acquired, the selling price is usually the market cap plus a premium of about 50%. Thus, the only thing that comes into play is the equity value, which is the market cap. But what if the company has a lot of debt or a lot of cash?

Often the cash and debt are not reflected in the market cap. Instead, the market cap is usually a reflection of the cash flow or gold/silver in the ground. The EV tries to give an investor or buyer a better picture of what they are buying besides the equity. Let’s look at an example.

Let’s say a company has $50 million in debt and $100 million in cash. Thus, the net debt is negative $50 million. This cash becomes a valuable asset for the buyer. For this reason, the effective purchase price is the market cap minus the net debt. Make sense? In effect, they are paying an implied discount to receive that cash. As an investor, you want to acquire companies with an effective purchase price below the market cap (with negative net debt). Conversely, you want to avoid buying companies with a lot of net debt, because debt eventually has to be paid.

All the EV does is gives you a better picture of the true value of a company. A company with a lot of net debt is worth less (on a true value basis) than the market cap, and the one with a lot of net cash is worth more. Ironically, in the mining business, I rarely see the EV come into play for acquisitions. I think this is because a company’s gold/silver resources play such a dominant role in their valuation, which is reflected in the market cap.

4) Location

I prefer locations that are mining friendly. This can be defined as the ease of obtaining permits; the tax structure; environmental laws; ease of getting claims approved; ability to get infrastructure developed; and overall political resistance.

Ideally, you want to invest in Canada or Australia where existing mines are operating. Why? Because they treat mining as a national priority. Those are the two countries that are likely to support their mining industry in the future. However, if it is a new mine that is being developed, then the risk is much higher (unless it is in an established mining district). Currently, the U.S. and Mexico are mining friendly for established mining districts. But I am not confident that it will remain that way for many more years.

Below is my ranked location risk from safest to extreme:

Safest: Canada, Australia, New Zealand, United States, Finland, Sweden, Norway, Ireland.

Moderately Safe: Brazil, Guyana, Mexico, Argentina, Peru.

Moderate Risk: Chile, Panama, Nicaragua, Colombia, Fiji, Mongolia, Papua New Guinea.

High Risk: East Africa, West Africa, Russia, China, Russian Satellites (e.g. Kazakhstan), Ecuador, Turkey, Eastern Europe, Indonesia, Philippines, Middle East, Spain.

Extreme Risk: Bolivia, Venezuela, South Africa, Central Africa.

As the price of gold rises, it is going to be a lightning rod for political foes of mining. Rising taxes and potential nationalization are real threats for long-term investments in many countries. If economies struggle, gold and silver can be perceived as national resources that belong to the people. If South America turns left politically (and potentially other countries in Africa), this creates more political risk towards mining.

After checking whether the location is in a mining friendly place, the next thing to look for is infrastructure. I prefer to invest in companies that have a project in a mining district that has infrastructure in place. If a project is not in an established mining district that is not a deal breaker, but it has significant advantages. Mines in mining districts tend to get built. Moreover, properties with no infrastructure can mean waiting years until production begins, or capital costs that are beyond a small company’s means.

If you analyze a small exploration company and they are exploring a project that does not have road access and is in the middle of nowhere, think twice. The capex capital requirement is going to increase dramatically, as will the cost of mining the project. Also, they likely will not be able to get financing for the large capex requirement and will have to either JV the project or sell it.

One of the first things to consider about the location is if there is a mine nearby and if it has had any political issues. If there is a nearby working mine without any political issues, then that is normally a green light another mine can be built. In the United States, this does not necessarily apply because the permitting process can be highly contentious and litigation is common.

Always consider the political and environmental risk of a location. There are many factors that can impact mining: taxation, royalties, potential nationalization, permitting, native issues, worker relations (unions), litigation, ecological resistance, etc.

Do not underestimate the impact of local native issues. This is what caused Bear Creek to lose their mining rights at one of their mines in 2011. Recently in Mexico, Indonesia, and the Philippines, companies had exploration drilling temporarily shut down due to onsite protestors. Resistance to mining is common throughout the world and appears to be increasing. The protests are primarily ecological, although sometimes it is about economics (who gets the money for the natural resources).

The key to finding a good location is to try to limit your exposure to political risk and avoiding infrastructure issues. Depending on how many stocks you end up with in your portfolio, you can expect to lose money in at least one stock because of political issues. And it is highly likely that infrastructure issues will end up costing you money at some point. This will likely occur when you own a stock with infrastructure issues, and other investors avoid it, leaving you holding the bag.

I do not completely ignore stocks in politically unsafe locations. For instance, in West Africa today there are many Mid-Tier Producers that are highly undervalued. Buying a few of them probably outweighs the risk. And having a few stocks in Peru, Argentina, and Chile does not create huge risk. I am leery of Ecuador, but I it seems to be getting a lot of activity.

5) Projected Growth

Projected growth refers to production growth and resource growth. Without growth in these two areas, we are wasting our time. Why? Because production growth and resource growth are vital for stock appreciation. These are the two most important factors that drive a stock price higher, after the price of gold/silver. For clarification, let me explain resources. Resources are composed of three parts:

Inferred Resources. These are resources that have been identified by drilling. Sometimes they are validated with a 43-101 report (if the stock trades in Canada), and sometimes they are estimated by companies. The bottom line is that inferred resources are not guaranteed to ever be mined and should be looked at as potential reserves. Moreover, these are resource estimates that are considered to be unreliable and can be considered speculative resources.

Measured and Indicated Resources. These are resources that have been confirmed to exist. These have been identified with drilling results, and if they are a Canadian traded stock, a 43-101 resource estimate. This is an accredited report by an independent company. These are resources that exist, but cannot necessarily be mined economically.

Proven and Probable Reserves. These are resources that not only exist but can be mined economically. This is proven using a feasibility study (or pre-feasibility), which is published publicly. Once a study is completed, mining companies can announce to investors how many reserve ounces they have.

To arrive at total resources, you add up all three parts. However, this is where you have to use your judgment and confidence in the management team. It is not always prudent to rely on inferred resources. You have to use your judgment when you value a company. Sometimes I will count the inferred and sometimes I will not. One thing that we know is that Measured and Indicated resources, and Proven and Probable reserves exist.

On my website, I use a concept called plausible resources. I count 100% of the P&P, 75% of M&I, and 50% of Inferred to get a total of plausible resources. This is a handy way to get a fairly accurate view of future reserves.

One final point on resources and reserves. Usually, a company will list the proven and probable (P&P) totals separately, but then they will include them with the measured and indicated (M&I) totals. You have to be careful to check if the P&P reserves are included in the M&I totals. Otherwise, you can mistakenly count the P&P reserves twice.

Projecting growth coincides with their properties. What are their projections and guidance for increasing production and resources in the next few years? I like to invest in undervalued companies that are forecasting growth in these two areas. For instance, back in early 2009, First Majestic Silver stated clearly in their company presentation that they were forecasting to produce 10 million ounces of silver by 2012. At the time they were producing about 3 million ounces and were undervalued. I bought it. Why? Because of the forecasted growth. Growth means a higher valuation down the road (as long as gold and silver prices don’t drop).

If a company is not giving guidance for future production ounces or resource ounces, then you have to forecast it yourself. For instance, if a company has a 1 million ounce resource and is planning to aggressively drill several known mineralized targets. The odds are good that they will increase their resources. We can make two forecasts from their drilling program: 1) They will likely increase their total resources, and 2) They will likely produce more ounces in the future. If we assume a 50% increase in both, then the upside potential can be huge. As a long-term investment, a small market cap company can have the potential to be a 20+ bagger, if they can grow their resources and make it into production.

Growth is what creates upside potential, and what creates growth (increased production and resources) is often not valued into a stock until production approaches. Currently, investors tend to ignore pipeline projects that are on the horizon. Until these projects get close to production, the production ounces and resource ounces are not valued into the stock price. Generally, there is a spike in the stock price when the final permit is granted to build a mine. Then there is another spike when financing is obtained. Finally, there is a large spike a few months before or when production begins.

There are several factors that can hurt a company’s valuation even if a company has potential growth in production and resources. These are the location (perceived political risk), infrastructure issues, hedging, high production costs, high energy prices, financial weakness (debt or cash issues), permit issues, environmental issues, native issues, and unexpected events (flooding, mining accidents, legal issues, etc.).

Note that many of these factors are red flags that you can account for when you do a company’s valuation. Be aware that some of the factors are unexpected events that add to the risk of mining company investments. While we can try to project growth, in many respects, it is speculation, because we cannot always account for unexpected events that can occur.

When you are looking at projected growth, you need to consider the FD market cap of the company. Why? Because size matters. A company with a large market cap will not have the same upside potential as a smaller company. For instance, I generally only look at Mid-Tier producers with market caps under $500 million, and preferably closer to $150 million. Why? Because I am looking for big returns and larger cap companies are likely not going to have explosive growth.

You need to determine your own market cap preferences and your investment goals. I suggest avoiding very large companies and very small companies. The question you need to answer is what is too big and too small for your investment goals. These answers will vary with every investor.

I prefer companies with market caps below $2 billion and above $20 million. I have found that companies with market caps below $20 million tend to have extensive risk and are highly dilutive. Ideally, I like to invest in companies with fully diluted market caps between $50 million and $150 million. This is a high-risk range, but there are a lot of high-quality companies in this range with high upside potential. This is where you find companies with significant growth potential and very low valuations.

6) Good Buzz / Good Chart

Always check the chart before you buy a stock. How does it look? Is it trending up or down? Is it flat lined? Is it coiled (ready to breakout)? After reading a few charts by following companies, you will know what to look for. For instance, I watched First Majestic’s chart from 2005 to 2009. It was coiled and ready to break out. How did I know that? Because it was undervalued versus its projected production growth and the stock price had not broken out. It continually traded under $3, with a market cap around $200 million. Even the CEO at the time said he was puzzled at the low stock price.

When a stock is undervalued and has not broken out, that is an opportunity. You can either buy it or wait for the breakout. Sometimes it is smart to wait because there is always the possibility of a market correction (which seems to happen every year for mining stocks) and you can get a better entry price. For instance, if you find a stock you like, and the chart is flat-lined, why buy it? Why not be patient and see which direction it goes? If you are going to make a long-term investment, it is smart to be patient for your entry point.

When you look at a chart, you will begin to see a good chart and a bad chart. A good chart is an undervalued stock that has not yet had a parabolic move. You want to catch stocks before they make big moves. If you see a stock that has already made a parabolic move, then you want to wait for a major correction to get a better entry point. Sometimes you have to admit that you missed the move and that most of the value has already been built into the stock price.

Stock charts are a handy way to determine a good entry point. Often the stock will show a series of peaks and valleys and will usually trade back to the trend line. Rarely do stocks go straight up after you buy them. For this reason, it is always smart to be patient and wait for a better entry point than on the day you decided to buy it.

In addition to the chart itself, there are other things to check. Does the stock price rise consistently with the gold price? Has the stock price outperformed its peers reflecting investor interest? Are other investors talking about it? In other words, do other investors like it?

I like to buy stocks that other people are buying and talking about. This confirms my valuation and analysis. If I think a company is highly undervalued, I don’t want to be the only person who likes it. I want the stock to be desired and people in chat rooms excited to own it. It makes little sense to invest in a company that is severely undervalued if no one agrees with you (this is one of the reasons I avoid stocks in high-risk locations). There has to be a reason why people want to own it. If you find a highly undervalued stock, the odds are good that other people have already found it (and are shouting it to the world somewhere on the Internet).

My favorite places to find buzz about a stock are www.CEO.ca, www.Stockhouse.com (Bullboards), and www.Hotcopper.com.au (Australian stocks). Also, the Stateside Report (www.StateSideReport.com), Gold Report (www.TheAuReport.com), Kitco News Releases (www.kitco.com), and Bob Moriarty's website (www.321gold.com) are good sources.

The Stateside Report is a podcast that covers the hot stocks. The Gold Report has daily interviews with mining analysts. These interviews are read by thousands of mining investors, so what they are recommending is being researched by many people. Kitco News posts the daily news releases by miners. 321Gold has daily posts of gold-related articles. Between these four news outlets, many companies get a lot of buzz, and the good ones get their story out.

Other websites to find buzz are the stock forums on Google Finance and Yahoo Finance.

7) Cost Structure / Financing

The cost structure is the cash cost per ounce and the additional operating costs. To simplify how to calculate cash flow, all you need are three numbers: all-in cost per ounce, production ounces, and the gold price.

Simplified Cash Flow Calculation:

Cash Flow = Production Revenue minus All-in Costs

(Production oz. x Current Spot Price) - (Production oz. x All-in Cost Per oz.)

A typical gold mining company today will have an operating cash cost of $800 per oz., plus additional non-operating costs of $400 per oz. Thus, their breakeven point (all-in cost per oz.) would be a $1,200 gold price. A low-cost producer would have a breakeven point below a $1,000 gold price.

I consider the additional non-operating costs as a method of identifying free cash flow. I calculate a company’s non-operating costs because the reported AISC (all-in sustaining costs) is always below the breakeven cost per oz. The ASIC excludes many hidden costs, such as depreciation, amortization, taxes, royalties, finance and interest charges, working capital, impairments, reclamation and remediation (not related with current operations), exploration and development and permitting (not related with current operations).

Identifying the non-operating cost per oz. is not always easy and requires experience with reading financial statements. The key is identifying the cost level that produces free cash flow. As long as you can get close, that is all that is important. You don’t have to be exact. In Chapter 6, I go into more detail on how to identify all-in costs.

Ideally, you want companies that have a low-cost structure and are highly profitable. However, most companies fall into the moderate cost structure category. The companies you want to avoid are those with high costs (which create low profits and high insolvency risk).

An easy way to determine the cost structure of a gold mining company is to divide their cash cost per ounce by the current price of gold. If it is near 1/3, then it is a low-cost producer. Conversely, if it is near 2/3, then it is a high-cost producer. If we use a gold price of $1,500 (for round numbers), then 1/3 is $500, and 2/3 is $1,000. Any cash cost below or near $500 is a low-cost structure, and any cost near $1,000 or above is a high-cost structure. However, I consider a cash cost over two-thirds the gold price to be a red flag. Unless the cash cost is forecasted to come down, I will likely avoid a high-cost structure (as will other investors).

Note: This same one-third and two-third method works for silver miners.

Items that can impact non-operating costs include debt payments, exploration (new mine), development (new mine), and permitting, depreciation, royalties, and taxes. Some companies seem to have a hard time accumulating cash, even if they have significant free cash flow. This can happen for a variety of reasons. The two biggest reasons are debt and development costs. If a company has a lot of debt, they might need all of their free cash flow to pay back the bank. This is not good for investors in the near term, but once their balance sheet is cleaned up, their share price will likely jump in value.

We want free cash flow to improve a balance sheet. What makes companies valuable is the combination of free cash flow and a good balance sheet. You need both for the share price to constantly rise with the gold/silver price. The ideal situation for an investor is a clean balance sheet and large free cash flow, in conjunction with rising gold/silver prices.

The second big reason a company has trouble accumulating cash is development costs. This can be frustrating as an investor because as a company builds mines, they not only spend all of their cash on development costs, but they nearly always add debt to the balance sheet. Thus, a company that is constantly growing can have a hard time cleaning up its balance sheet.

I don’t mind it when a company is growing, which costs money to achieve, but ideally, I want them to pay attention to their balance sheet. Every company will use a portion of their cash for exploration and expansion, but we want them to do it diligently.

Often companies are more growth-focused than cash focused. When that happens, shareholders are never rewarded. A good example of this is Hecla Mining. They had a stock price of $12 in 2008 and today it is $2.63. What happened? They took on debt and focused on expansion instead of cash. Hopefully, their awful performance as reflected in their share price will change their strategy toward being more cash-focused (and investor friendly).

How a company finances its mines can impact the cost structure and profitability of the mine. Debt financing, streaming deals, and hedging can impact the cost structure. Often companies are forced to hedge portions of production to receive financing. Another common method is when lenders demand to be paid a portion of production at a set price. These are called streaming deals, whereby the lender receives a stream of production. The lender will get a sweetheart deal where they only have to pay a low fixed price for each ounce. Then the lender can sell the gold/silver at the market rate. These can be considered outstanding debts and will impact the cost structure and reduce profitability.

When I own a development stock, I always worry about how they will finance their mine. I have my fingers crossed that they do not use hedging or streaming deals. I prefer two-thirds debt and one-third equity for initial mines. For subsequent mines, I prefer two-thirds cash (organic growth) and one-third debt. A little bit of debt is good, which can be paid back quickly.

Often a gold or silver mine will produce more than one metal. These extra metals can be counted as cost offsets (lowering the cash costs) when they are sold. These offset metals can have a significant impact on lowering the cost of production. You have to be careful expecting these offsets to be in demand in the future. Often companies rely on offset metals, such as copper, lead, and zinc to lower their costs. Sometimes these offsets determine if a company is profitable or not. I like to know the percent of revenue from each metal that they produce, but it is not always reported by companies.

When I do my valuations, I do not include the base metals as part of resources and reserves.

However, I do reduce the cash costs somewhat when there are significant offsets. I tend to be conservative when adding value for offsets because I don’t think that base metals will be in high demand in the future due to potential economic issues. If global economic growth decreases, then base metal demand will also decrease.

* * * * *

One factor that needs to be included somewhere in your analysis is the timeline risk. This is the amount of time until production begins. After a company reaches production (or gets close), the risk level for the stock drops dramatically and simultaneously the stock price increases. I always consider the timeline risk for companies that are non-producers. I try to use a limit of five years until production, although I can be flexible and go to six or seven years on occasion. As a general rule, if I think production is more than five years away, I will not invest.

Ideally, for development stocks, you want to have confidence that there is a path to production within five years. If a company is not giving guidance of this outcome, then the risk is probably too high versus the reward. I have broken this rule of thumb several time, and so far it has not paid off. Most of these stocks have languished and still do not have a path to production.

Timeline risk can be different for each investor. How long do you want to wait for your investments to pay off? For me, I don’t mind waiting five years, but I don’t want to wait much longer than that. You may have a shorter timeframe in mind and want to see returns in three years. If that is the case, then your timeline risk is shorter. Some of you may not mind waiting up to ten years and thus have a longer timeline risk. Based on your timeline risk horizon, invest accordingly based on when you can expect future cash flow.

Two other factors to pay attention to for non-producers that are building their first mine are the project’s NPV (Net Present Value) and IRR (Internal Rate of Return). Ideally, you want the NPV to be significantly higher than the current market cap. A good ratio would be 5 to 1. Secondly, you want the after-tax IRR to be above 25%. If the after-tax IRR is below 20%, then that is a red flag. There are exceptions to this rule of thumb for large projects, because of the high potential cash flow. I can go as low as 15% if the market cap is very low and the potential cash flow is very high.

The NPV and the IRR identify the economics of the project. If they are both not solid, then the odds of obtaining financing are not good. Conversely, if they are solid, then the project is likely to get built. The one exception are very small companies. I have found that companies with very low market caps have trouble raising money for the capex. Banks are generally not comfortable lending more money than a company is currently worth.

Another thing to compare is the NPV to the capex. You do not want the first mine to have an NPV that is close to or less than the capex. If they are close, then the project likely won’t get financed. You want the ratio to be at least 2 to 1.

All of these variables can seem confusing, but after you analyze a few stocks and buy a few stocks, they become much easier to understand. There is a learning curve, but after some time you will quickly catch on. Knowing if a project is economic; if the grade is good; if the stock is highly undervalued; if it is a good location; if there is a likelihood of financing issues; or, other factors, will become clear to you after spending some time as a gold/silver mining investor.

8 ) Cash / Debt

Cash is king in the mining business, and there are several reasons why. The first is that cash allows for organic growth, whereby a company can self-finance exploration and expansions programs. This can be highly valuable to investors because gold can be found in the ground for about $25 per ounce (at an existing discovery) and then sold for $2,500 (in a few years). When a company self-funds its growth, it is like manna from heaven for investors. What happens is that growth in resources leads to growth in production, which leads to an increase in the valuation of the company.

The second reason cash is king because if a company has cash in the bank, this reduces the likelihood of dilution. If a company has a lot of cash, then there is no reason to issue more shares. They can now leverage their cash and issue debt to build another mine. As long as the debt is manageable, then leverage is a wise thing to do. Ideally, you want companies with lots of cash and no debt or have a plan to pay down their debt quickly after building a mine.

A company that is investor friendly understands what impacts the share price, and understands the value of cash. Often they will state publicly their desire to pay down existing debt and increase their cash. Watch how companies manage their cash and debt. You will find out quickly if they are investor friendly and cash focused. Moreover, you want a company that always maintains a significant cash position.

A weak financial position of low cash and/or high debt will hurt the stock price. Often a company will use too much debt to build a mine, and the stock price will drop. This is from the near-term focus of investors today. However, once the debt is paid down, the stock will roar back. The thing to understand about debt is the burden. Can the company manage its debt? Is it a problem? How much is it impacting profitability? Using debt to build a mine is not a problem as long as the debt is manageable.

Another thing to be aware of is that mining companies without cash flow will often burn through their cash and constantly have to go back and issue more shares to raise money. The amount of cash that is used on a monthly or annual basis is called the burn rate and can lead to high dilution in the share structure. Companies need cash to fund exploration, development, and expansion. If they can’t get a loan, then they are forced to issue more shares and warrants. This is quite common in the mining business.

Today, mining stock prices are down, and many junior stocks are down 80% or more from their all-time highs. For this reason, many of these stocks are going to require large share dilution to raise money. Keep this in mind when investing in a company with a low share price. If a company has a share price below 20 cents, it will require significant dilution to raise money. It’s always painful to own a penny stock, and then they do an equity financing to raise money. Sometimes the dilution is more than 25 percent of their shares outstanding.

As companies add cash to their bank account, it improves their balance sheet. When they are doing this on a quarterly basis, it tends to steadily increase the value of the stock. There is a strong correlation between increased cash and an increase in the stock price. This is especially true in growing companies. As cash accumulates, it gives them opportunities to purchase other companies and to increase production and add resources.

Today financing and raising money is becoming a significant issue for small mining companies. There are rumors that hundreds of small mining companies could go bankrupt soon because they won’t be able to raise financing to fund exploration projects. This is a significant investment risk and is quite real. This is one of the reasons many small mining/exploration companies are so cheap today. Are they good investments or fool’s bets? From my viewpoint, unless a company already has the goods (existing flagships or significant discoveries), then the risk/reward is not worth it.

One question to ask yourself is when is debt a problem. Most companies with debt problems are producers. They obtained their large debt to go into production. For these companies, you can check their debt coverage. This is a simple calculation of debt to cash flow:

Cash Flow = Production Revenue minus All-in Costs

(Production oz. x Current Spot Price) - (Production oz. x All-in Cost Per oz.)

Debt = Debt - Cash

(Always subtract cash, since it could be used to pay off debt.)

Debt Coverage = Cash Flow / Debt

If the debt coverage is less than 20%, then you could have a problem if gold prices fall or cash costs increase. It’s always nice to see a debt coverage over 50%. Another number that investors use to identify debt problems is a company’s working capital (current assets minus current liabilities). A company’s working capital is also a measure of its liquidity (the ability to pay short-term debts). Large companies try to have at least $100 million in working capital. Medium sized companies are probably okay with at least $50 million. If a company does not have adequate working capital, then its share price will be impacted negatively.

One issue that has been occurring recently is that development companies have been borrowing money before they have financing for production. This is very risky and has caused several companies to go bankrupt. Once a company gets into debt and does not have a path to production, they are at the mercy of investors to help them pay off the debt. If they cannot raise more money, then they are faced with bankruptcy. Be wary of investing in development companies that have any debt. If they are wise, they will wait until construction begins before assuming any debt.

9) Low Valuation

If you did not identify enough red flags in Steps 1 through 8 to reject a stock, then it is time to check for a low valuation. (Note that step 9 is only for producers and Late-Stage Development stocks).

My favorite valuation method for finding undervalued stocks is Market Cap Per Resource Ounce. I like to use the current fully diluted market cap divided by future reserves. I estimate future reserves based on the number of ounces that I think they will produce in the future. My future reserve estimates are usually close to their current M&I ounces (inclusive of P&P), although this can vary by company. I use future reserves because I’m more concerned with the future valuation of the stock rather than the current valuation. I want to buy future reserves cheap today. Then I will wait for those reserves to get revalued much higher in a few years.

Low Valuation Formula:

Fully Diluted Market Cap / Future Reserve Ounces.

For gold mining companies, you want future reserves to be valued under $50 per ounce. For silver, under $2 per ounce.

These are general guidelines. For gold mining companies, you can go as high as $100 per ounce (if you think the company is going to grow), although I would only invest in a few over $50. For silver mining companies, you can go as high as $10. The reason why I am more flexible for silver miners is that I think the price of silver is going to reach $150 per ounce.

If a gold mining company has a current valuation under $50 per ounce for their future reserves, then there is a good chance that those reserves will get revalued in the future much higher, perhaps more than $250. This, of course, depends on the future price of gold. A solid Mid-Tier gold mining company today can expect their reserves to be valued around $300 to $500 per oz. What will they be valued at if gold reaches $2,500?

Many of my gold investments are in companies with valuations below $50 per oz. However, I have become more aware that Mid-Tier Producers have an excellent risk/reward profile. For this reason, I have purchased many Mid-Tier Producers above $50 per oz. For development stocks, I tend to always invest below $50 per oz.

Today you can find a lot of gold mining companies with future valuations under $50 per ounce and silver mining companies under $2 per ounce. Once you find these low valuations, check the red flags. Which companies do not have any red flags and have low valuations? Which companies have great properties, are located in safe locations, have good management teams, a nice share structure, growth prospects, low costs, a good chart, and good buzz? As you add up all of the factors, you begin to find your favorite stocks.

Finding stocks with a low valuation is not that difficult. What is more difficult is finding a stock with a low valuation that does not have any red flags and passes all of the checks. This chapter helps you to identify what to look for by using a ten-step systematic approach.

* * * * *

Another low valuation method is the future cash flow multiple. This is the future cash flow versus the current fully diluted market cap. If a company is undervalued, then the future cash flow should be more than 1x the current fully diluted market cap.

Example:

Current Fully Diluted Market Cap: $20 Million

Future Cash Flow:

Future Production oz. x (Future Gold Price - Future All-in Cost Per oz.)

100,000 x ($2,500 - $1,500) = $100 Million

In this example, the future cash flow is above the current fully diluted market cap. That is what you are looking for. In this example, the multiple is 5x, which could lead to a potential 20+ bagger. If the projected $100 million in cash flow occurs, the company could get valued between $500 million to $1 billion (5x or 10x cash flow).

10) High Rating

The rating is a two number system that I have devised. The first number is the upside potential and the second number is the risk-reward. Here are the definitions for each:

Upside / Downside Ratings

Ideally, I am looking for companies that have both high upside and high downside numbers (the higher the better for both). The ultimate stock would have a rating of 5/5. I have never found a 5/5 stock before. The highest rated stock in the GSD database is 4/3.5. If you can find a stock with at least a 3 for both the upside and risk-reward, you have found a stock worth analyzing further. There are currently 38 stocks in the GSD database with a 4 upside rating, but most of them have a poor risk-reward rating below 3.

The upside rating is a combination of a formula and a final analysis. The analysis is a judgment call on your part and will decide how much you like a company. Generally, a low valuation (step 9) and relatively few red flags (steps 1-8) should lead to a high upside rating.

The downside rating is the analysis of the risk-reward and is heavily weighted towards risk, but also encompasses all of the factors you have looked at, such as management, property quality, exploration potential, location, grade, etc. It includes everything that you analyzed prior to this step.

You can use this ten-step system to rate all of the companies that you analyze. However, if you cannot estimate future reserves, then you have to use a different method for obtaining a rating. I have devised my own method using my experience. For companies for which I cannot estimate future reserves, I do not use any valuation formulas. Instead, I use steps 1-8 and estimate a rating. These ratings are nearly always below a 3 for companies without estimated future reserves, although not always. Some drill stories get higher ratings even without estimated reserves.

Ratings are a snapshot in time, reflecting the moment when an analysis is performed. They should be updated at least annually, or when a significant event occurs, such as an updated resource estimate, a feasibility study is released, production begins, or an unexpected event that impacts that value of the stock.

Theoretical Market Cap Growth:

Future Market Cap Method #1 (Resources)

Future Reserves x Future Gold Price x Resource Multiplier = Future Market Cap

Future Market Cap Method #2 (Cash Flow)

Future Cash Flow x Cash Flow Multiplier = Future Market Cap

Cash Flow = (Future Production Oz. x Gold Price) - (Future Production Oz. x All-in Cost Per Oz.)

(Future Market Cap - Current Market Cap) / Current Market Cap = Future Market Cap Growth

For the future market cap, I use two methods and compare them (see formulas above). If they are both similar values then I have more confidence. I tend to trust the cash flow method as being more accurate. I usually use 5 for the cash flow multiplier, unless is a large company, then I will use 10. Future production is my expectation for production in 3 to 5 years. All-in costs are my estimates for future costs in 3 to 5 years.

For the resource multiplier, I normally use 15. Future reserves are estimated based on current resources unless a company provides guidance for future resources.

I divide the current fully diluted market cap by the future market cap and arrive at potential market cap growth as a percentage.

Note: While I currently use a future gold price of $2,500, a future silver price of $100, a resource multiplier of 15%, and a cash flow multiplier of 5 (or 10 for larger companies), you can be more conservative or more aggressive. It’s easy to do these calculations with other defaults based on your expectations. There is a cash flow calculator on the GSD website that is very handy.

Using this theoretical market cap growth, I combine it with my analysis to give it an upside rating. The upside rating is a combination of the upside potential and various red flags that could impinge on that upside.

My future time horizon is 3-5 years. Thus, I am expecting the theoretical growth to occur during this time horizon. However, there are many factors (red flags) that can impact this potential growth target. For instance, some of the red flags include location issues (such as a lack of infrastructure, political risk, permitting, native issues, etc.), weak management, legal issues, timelines issues, financing issues, production costs, debt/cash issues, hedging, share dilution, and a lack of growth potential.

One part of the final analysis is to reduce the upside potential by using red flags. If a company has a potential growth of 500%, but has a few red flags, then you can’t give it a 3 or 3.5 rating as a potential five-bagger. The question becomes, how much are you going to reduce the rating? Are you comfortable that it will become a three-bagger? If so, then you can give it a 2.5 rating. Otherwise, give it a 2 rating. After you begin rating companies, it becomes fairly easy to determine what they should have.

After you have a list of companies with ratings, you will have to decide which companies you like the best. Sometimes you will prefer a company with a 2.5/3.5 over a company with a 3.5/2.5 rating because of a better risk/reward profile. It is smart to have a portfolio that is a mixture of strong 2.5/3.5 and 3.5/3 rated companies, along with a few more speculative 4/2 and 4/2.5 rated companies.

Let’s do an example:

Current Market Cap Fully Diluted: $50 Million

Projected Future Reserves: 3 Million oz.

Projected Future Production: 200,000 oz.

Projected Future All-in Cost Per Oz.: $1,200

Projected Price of Gold: $2,500

Projected Future Market Cap Method #1 (Resources)

Future Reserves x Future Gold Price x 10% = Future Market Cap

3,000,000 oz. x $2,500 x 15% = $1.1 Billion

Projected Future Market Cap Method #2 (Cash Flow)

Future Cash Flow x Cash Flow Multiplier = Future Market Cap

$260 Million = (200,000 x $2,500) - (200,000 x $1,200)

$260 Million x 5 = $1.3 Billion

Projected Future Market Cap Growth

($1.1 Billion - $50 Million) / $50 Million = 2,100%

Final Analysis:

The theoretical market cap growth target is 2,100% or a potential 21 bagger. That is well above a five-bagger. It's likely at least a 4 upside rated stock, or else you would have kicked it out before step 10. This upside rating can be impacted by red flags. The key here is a path to production. If they are a producer or have a clear path to production, including financing, then you should give it a 4 upside rating. Without financing, a company might not make it into production and reward you with the high return you are expecting.

The downside rating is the overall analysis of the risk-reward. It encompasses everything you have already analyzed. If you give a stock an upside rating of 3 or higher, then you need to be very careful with giving it a downside rating of 3 or higher. It needs to earn it. For instance, a stock with a 4/3 rating is a rare stock. It's a quality ten bagger, and those are not found often.

My contact information is available on my web page (www.goldstockdata.com). If you would like a two-week free trial, send me an email. Thanks for reading, and good luck with your gold and silver investments.