Platinum Was the Top Commodity in H1

Gold outperformed every major asset class in the first half of the year, but it wasn’t the top commodity. That honor goes to platinum.

Platinum charted a 49.8 percent gain through H1, rising from around $900 an ounce in January to $1,360 at the end of June. That compares with a 25.9 percent increase in the price of gold and a 24.9 percent rise in silver.

In the second quarter alone, platinum jumped over 35 percent, closing H1 at a price not seen since 2014.

Supply constraints seem to be the primary driver behind this platinum rally.

The global platinum market charted its third straight significant structural deficit last year, and we should expect these supply shortfalls to continue into the foreseeable future, according to the World Platinum Investment Council (WPIC).

Platinum demand outpaced supply by 995,000 ounces last year. That was 46 percent higher than forecast.

The WPIC expects a market deficit of around 848,000 ounces in 2025.

Above-ground stocks of platinum fell by 23 percent last year and are expected to drop another 25 percent this year. This represents less than four months of demand.

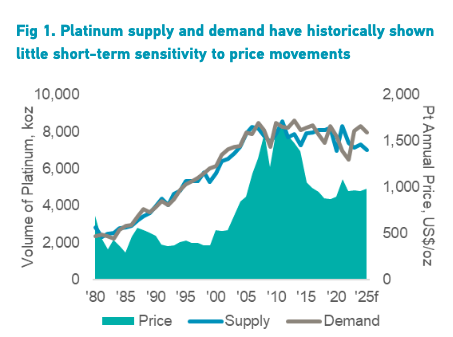

The supply deficit isn’t likely to ease soon. The WPIC notes that the metal is historically price inelastic in the short term, meaning supply and demand don’t quickly respond to price increases.

“Despite this rally, we do not anticipate any meaningful supply or demand response in the near term. Our May 2025 Platinum Quarterly forecast a -4 percent year-on-year reduction in both total platinum supply and demand in 2025, and this view remains unchanged.”

Platinum is an important component in automobile catalytic converters. Auto demand for the metal hit a 7-year high in Q1, and that pace is expected to continue through the rest of the year.

A rotation from electric vehicles to hybrids is boosting demand for platinum in the auto sector, according to the World Platinum Investment Council.

“Platinum demand is bolstered by stricter emissions legislation, increased hybrid vehicles that contain an internal combustion engine, and growth in the substitution of platinum for palladium. It is important to note that once platinum is substituted for palladium in specific vehicle platforms, this demand for platinum is likely to remain constant throughout the platform's seven-year lifecycle, even if platinum prices rise to, or exceed, those of palladium for an extended period.”

Platinum jewelry demand also saw a healthy increase in the first quarter, rising by 5 percent year-on-year, driven by a 53 percent increase in Indian jewelry buying.

Before 2011, platinum was generally more expensive than gold. In 2015, this historical trend reversed with the spread between gold and platinum growing wider.

Platinum hit an all-time high of $2,213 an ounce in March 2008. This was higher than the record price gold hit in 2011.

It remains to be seen whether platinum will regain the price parity with gold we saw before the mid-2010s, but given the supply and demand dynamics, it is reasonable to be bullish on platinum in the near to mid-term. Given the price disparity with gold, this may signal a buying opportunity.

********

Mike Maharrey is a journalist and market analyst for

Mike Maharrey is a journalist and market analyst for