Precious Metals & Bonds

Inter-market relationship is very complex , and like price itself, is dynamic and subject to constant change. One of the most influential factors in the financial markets is interest rates. And the market which is more affected by interest rates is the precious metals market. In recent years, the PM market tends to rise and fall opposite to bond prices, not to the exact day, but generally speaking. I am not smart enough to tell you why that is, but until this inversed relationship ends, it provides clues as to how far we are from a major turning point in the PM market.

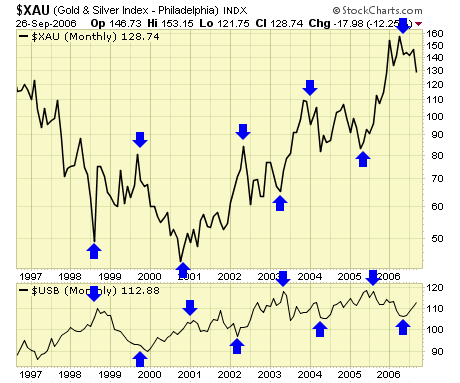

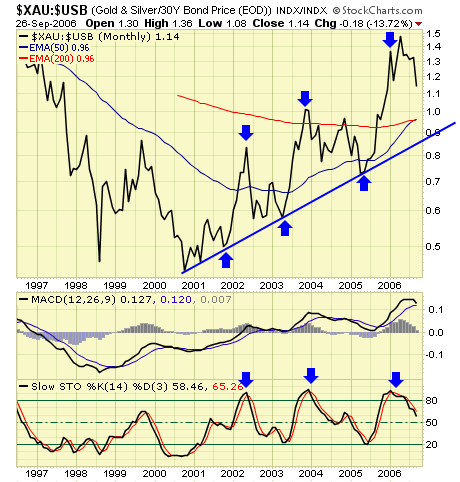

Bonds have been in a long term bull market since interest rates topped in the early 80s, and gold's bull market began in late 2000. Generally, gold stocks as represented by the $XAU tend to rise strongly when bonds are falling or consolidating. And when bonds are rising, gold stocks tend to fall or consolidate. Because both bonds and $XAU are now in a long term bull market together, a ratio chart between the two can yield some very helpful potential major turning points.

When we map the two together on a long term ratio chart, the major turning points are obvious. Both are in a bull market, but one will outperform the other at any given time. However, there are two school of thoughts, and we must be aware of them at all times.

#1 - this is a monthly chart, and a lot can happen during the days and weeks around these major turning points. Such was the case this past spring. This ratio chart topped in late December 2005 and early January 2006 and began to turn down. Many gold analysts took exits around that time and missed the great run from March till May. I did not miss because…

#2 - nothing lasts forever. Sooner or later this inversed relationship will end. Therefore, although I was cautious that prices were possibly peaking, I did not hesitate when we had a good set up in March, and was rewarded handsomely for it. But then I also got whipsawed this summer, as I did not want to miss another great run in case there was one more push to the upside, just like the March to May rally.

Summary

Trading and investing is all about risk and reward. We must risk in order to be rewarded. But that risk must be acceptable and manageable, because while some risks could lead to riches, some risks do result in losses. I do what I preach: trade the set ups and not the analysis. Sometimes I pay a small price, and sometimes I'm richly rewarded.

********