Profiting On Gold Tops, Reversals And Turnarounds

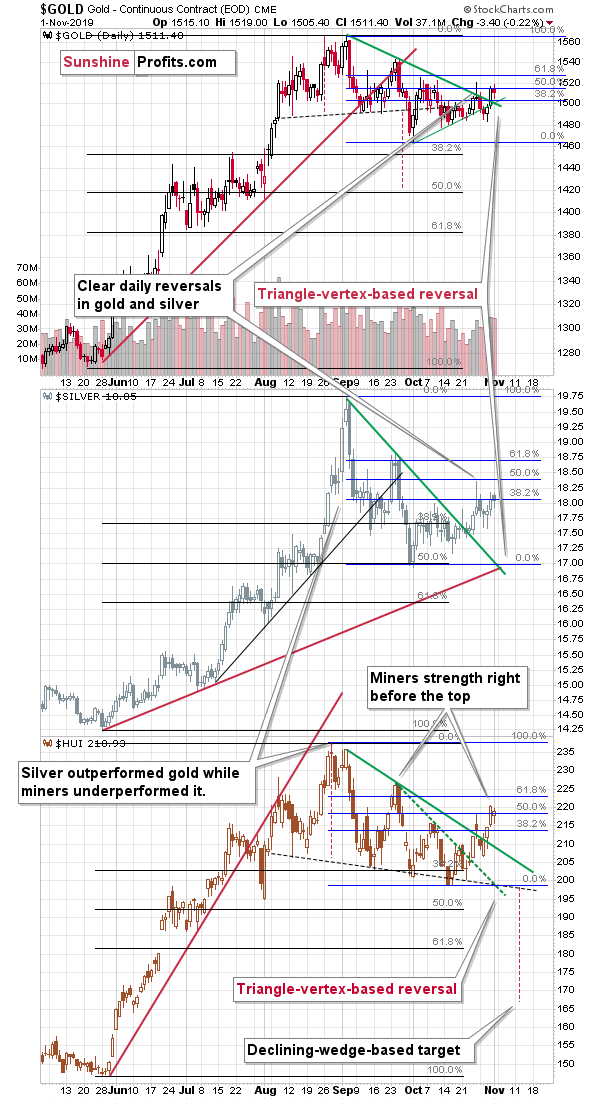

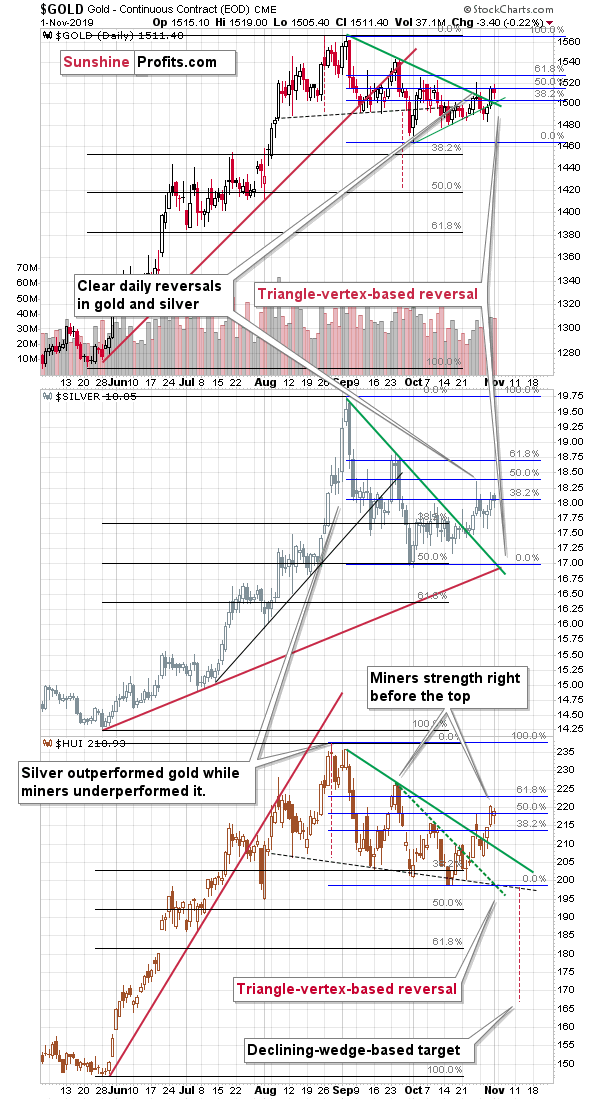

Gold price action in November 2019 is likely to take most investors by surprise. There are two ways in which gold is likely to move in the first part of the month. It could slide right away based on the triple triangle-vertex-based reversal patterns that we see in gold, silver, and gold miners. However, there’s also the possibility that gold will rally along with the Japanese yen (as it often does) and move close to its late-September high. These two scenarios are interesting, but they are neither the most appealing, nor most important thing that we’ll explain today.

In case of technical analysis, it is usually the case that one never asks the W question. There is no WHY in the technical analysis. Or more importantly, they usually don’t matter. There are tens, if not hundreds, of news releases each day and markets can rally or decline on all or any of them. It’s impossible to pay attention to everything that each market is doing (some analysis can help, though), and it all boils down to whether a given support or resistance was reached, whether the turning point or cycle is nearby, if we see an analogy to the past to any significant extent. In other words, there are multiple tips for trading gold that are not concerned about the WHY.

Today’s analysis is different from other ones that we wrote recently. Today, we’re going to focus on the why behind the two short-term scenarios from the opening paragraph. The reason is that the implications of the reply to the W question extend way beyond the next several days. These implications made us supplement the target prices for our trading position with additional details, making it much more short-term oriented, but even that’s not the most important thing. The key implication is that based on the reply, the likelihood of seeing a major turnaround in 2020, and its combination with True Seasonal patterns for gold, we adjusted the likely gold price path for the following 12 months.

Let’s start with the tip of the analytical iceberg.

The Short-Term in the PMs

Gold broke above the declining green resistance line and is confirming the breakout right now. Just one more daily close above the green line (currently at about $1,500) will mean that the breakout is verified, making a short-term rally more likely. Gold stocks have already broken above their declining green resistance line and they verified this breakout by closing above the line for three consecutive trading days.

So, did the short-term outlook just become bullish? Not really. The rallies do appear bullish, but the triple triangle-vertex-based reversal means that any rally that took place recently is actually bearish news for the following days. After all, if the price is likely to reverse (again, it’s not just one market that points to a reversal, it’s all three of them), then it’s likely to decline only if it moved higher before. And that’s exactly what happened.

Then again, keeping in mind that the reversals can work on a near-to basis, it means that we could first see one or two days of higher prices before the precious metals market slides next.

If gold moves higher instead of declining, then how far can it go? To the next resistance level. Since gold moved above the 50% Fibonacci retracement level on a day-to-day basis, it could move to the 61.8% Fibonacci retracement at about $1,530. Alternatively, gold could move even higher and rally to approximately the late-September high at about $1,540.

Of course, we’re writing “gold”, but what we really mean is gold futures prices as that’s what the above chart is showing. Friday’s intraday high was $1,519, so the above means a possibility of moving beyond it by about $10-$20.

That’s it? I was expecting to see something groundbreaking here, and the above seems relatively normal…

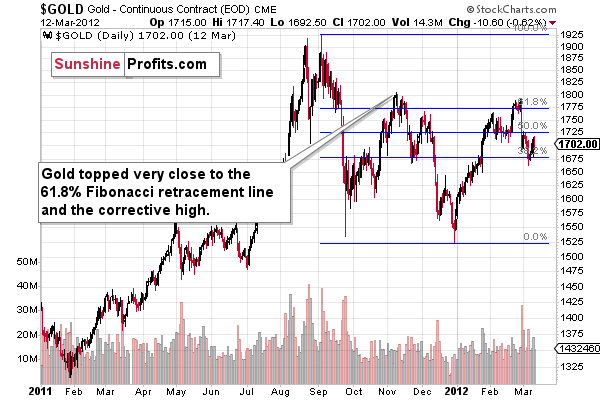

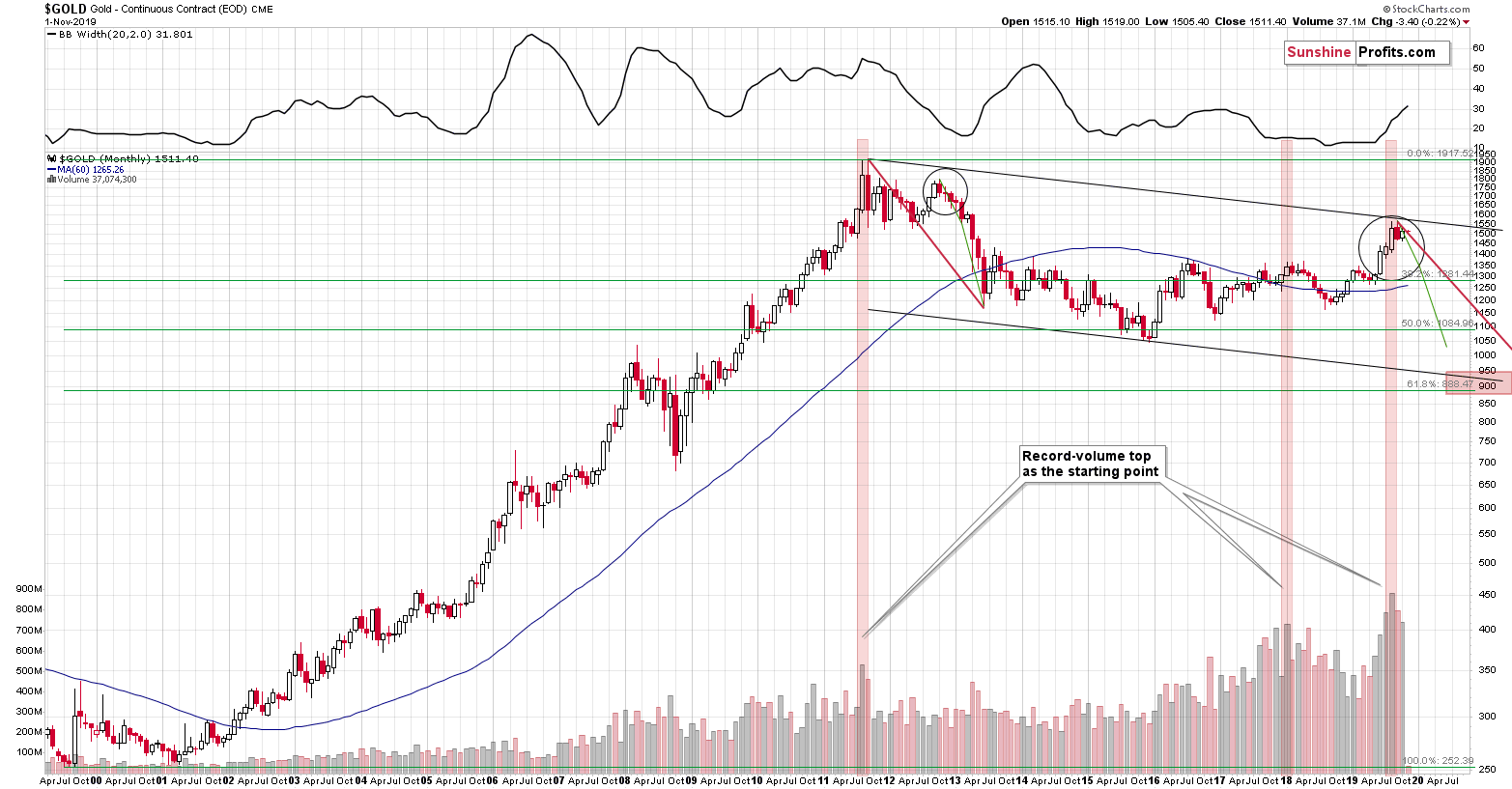

Don’t worry, that was just a warm-up, and something that needed to be covered anyway. What is the most important detail here is the shape of the recent gold price movement. We’ve already seen it before. In all likelihood, unless you’ve become interested in gold only recently, you’ve already seen it before too. It’s not that obvious at first sight, because the time scale is different, but… The way gold is topping right now, it’s an almost exact copy of how it topped in 2011.

Let’s take a look at the above chart one more time, but this time, we will put gold’s 2011 performance before it (so that it’s easier to compare it with gold that takes the upper part of the triple chart).

The Anatomy of Gold Tops

The similarity may not be obvious at first sight thanks to the different time span, but please focus on the following facts:

-

Both rallies in gold (2011 and late-2019) had a short-term consolidation in the middle of the rally.

-

Both rallies had an initial (early August 2011 and early August 2019) tops, which were followed by a double-top pattern in which the second high was a bit higher.

-

The initial declines (late September 2011 and early September 2019) were quickly followed by counter-trend rallies (November 2011 and late September 2019 tops) and then additional declines to new short-term lows (December 2011 and early October bottom).

What followed about 8 years ago was yet another upswing that ended a bit above the 61.8% Fibonacci retracement and very close to the initial high (November 2011). The history has been repeating itself to a considerable degree, which means that gold might rally to $1,530 - $1,540 once again).

It is not carved in stone, though. The history might rhyme instead of being repeated to the letter, which means that this time, the upswing might be smaller (or higher, if gold really wants to trick a lot of people in a late-Halloween fashion).

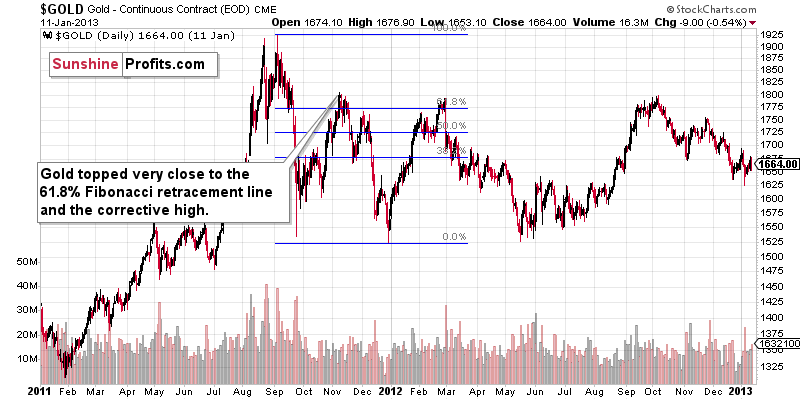

If the history is indeed repeating here, it’s necessary to ask: What happened next?

Gold declined to the previous lows once again, and then launched yet another counter-trend upswing from there. The most recent decline ended at about $1,460, so it might be the case that this level will provide gold with strong support once again, and that we’ll see yet another counter-trend rally.

And what if gold declines right away from current price levels? Then it changes absolutely nothing with regard to the above. The 2011 topping pattern and what we’ve seen in the past several months would be similar nonetheless, with the implication that we’re likely to see a counter-trend rally once gold moves to about $1,460 anyway.

Hmm, is there any other reason, besides the price shape, that makes this year similar to 2011?

You bet! The most important similarity between the two years is the record-breaking monthly volume that ended both rallies. We saw something similar also in January 2018 (that was the yearly high in terms of the monthly closing prices). The implications of the big volume spike are bearish, as they emphasize the importance of the reversal that took place during a given month. As far as the similarity is concerned, out of these two cases that are similar volume-wise, only the 2011 top was preceded by a rally that was similarly sharp to what we saw in the middle part of this year.

Consequently, it’s not just the shape of the price during the 2011 topping process that makes both situations similar – volume readings confirm it too.

All in all, gold’s price in November 2019 might move higher initially, only to disappoint shortly thereafter. Gold could move to its recent lows in November, or this short-term decline could end closer to mid-December. The latter seems more likely.

Today's article is a small sample of what our subscribers enjoy on a daily basis. For instance today, it also covers the USD Index and Japanese yen's message for gold and silver investors. Don’t miss the discussion of the detailed gold price path - the looming triple (!) reversal clearly confirms it. We can't give out all the details, but they’re literally worth their weight in gold and you really want to know them. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,