Gold and Silver Expose Stock Market’s Phony Gains

Wall Street is ecstatic after the Dow Jones Industrial Average (DJIA) hit 40,000 for the first time ever. The nominal record makes for plenty of pithy headlines.

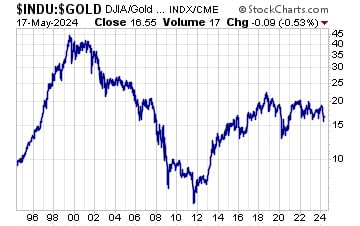

The Dow is indeed racing higher in terms of depreciating U.S. fiat dollars. But what about in terms of real money – gold and silver?

The headline news not being reported in the mainstream financial media is that the stock market benchmark just fell – yes, fell – to a two-year low in real terms.

It may seem hard to believe that the stock market is losing value at the same time as its gains are being widely celebrated, but the charts don’t lie.

The DJIA:gold ratio peaked all the way back in 1999.

It’s been 25 years since stocks have made new highs in terms of gold.

The DJIA is also starting to lag behind silver. The Dow:silver ratio suffered a significant breakdown last Friday – the very day the Dow closed above 40,000!

A stealth bear market in stocks appears to be underway.

Few investors are aware of it. Their brokerage account statements still show gains being registered. But those gains exist only in terms of phony, funny money.

********

Stefan Gleason

Stefan Gleason