Gold Forecast: The Turnaround Is Almost Here

Gold and USDX move in opposite directions and the end of the consolidation in the latter is important for the former.

A Trend Reversal or a Temporary Spike?

Given how gold price is behaving recently, I’d like to start today’s analysis with the chart featuring the price of the yellow metal. Especially that I just received a question about it:

Dear Mr. Radomski,

Gold is rallying significantly from Friday until now..

Is the trend direction might be changed already? Due to the price is almost reach the same price as before CPI news happened..

Thank you..

Let’s take a look at gold’s chart.

The price of the yellow metal has indeed moved higher, and it erased the post-CPI daily slide. It formed a local bottom close to its previous 2024 lows. However, the size of the current rally is actually similar to what we saw shortly after the first 2024 low. Back in mid-January, gold price jumped to more or less the same price levels that we have right now, only to then decline to a new (slightly lower) low in the following days.

Is this really a new rally in gold here?

Let’s take a look at the other side of the mirror – at the USD Index.

After all, if the USD Index was about to fall, gold would most likely be about to rally. Quoting my yesterday’s reply to one of the questions about it:

In general, the USD Index and the precious metals sector move in the opposite directions, so one way in which analyzing the USDX is useful is through this simple mechanism. If the USD Index is likely to go up, gold, silver, and mining stocks would be likely to decline, and vice-versa.

However, the strength in which the above mechanism happens is informative also on its own.

If the USD Index moves up significantly, but gold declines just a little (and nothing major happened in the Eurozone and in Japan), then we see that gold doesn’t full react to a bearish indication, which in turn means that gold doesn’t want to decline. This would be a bullish / buy sign for gold.

One needs to be careful while applying the above, though, because every now and then this link goes sideways. For example, gold could be reacting to something that happened in Europe that was bullish for gold, and bearish for the euro. In this case, both gold and the USD Index could move up and it wouldn’t necessarily be a meaningful bullish sign for the USDX.

Is the USD Index about to move lower from here?

That appears unlikely.

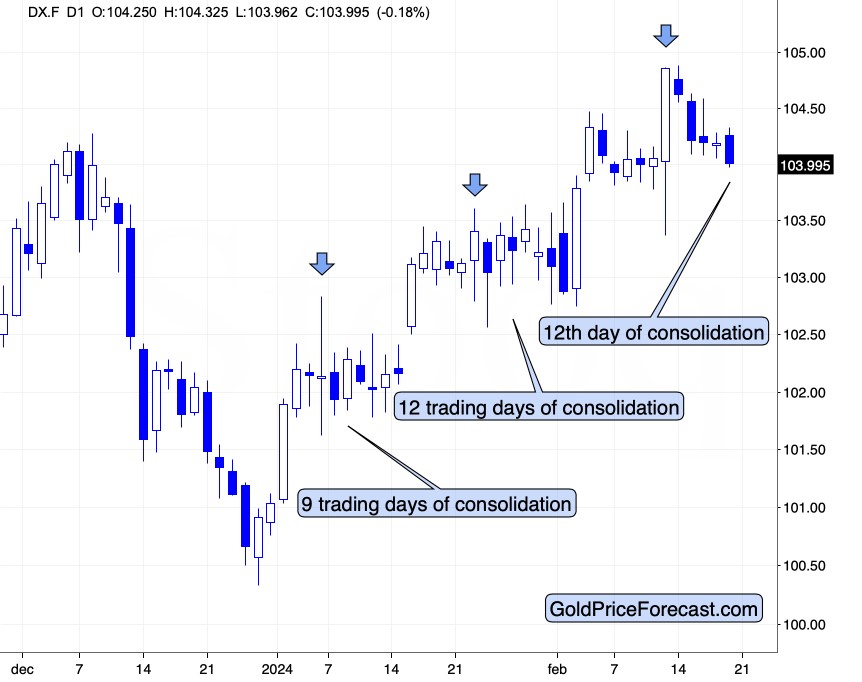

This medium-term rally in the USD Index has quite specific corrections. The pauses that we saw since this rally started took between 9 and 12 trading days and there was a distinct volatile intraday action close to its middle. We saw this kind of action also recently – I marked all of them with blue arrows.

The history appears to be rhyming and… Today is the twelfth day of the decline. We already saw the analogy in terms of the intraday volatile spikes. If the analogy in terms of time also continues (and it’s likely to) then today or tomorrow could the final days of the decline and ones that start another move higher in the USD Index.

USD Index's Consolidation

Please note that the USD Index used to end the consolidations with a fake decline - especially the early-Feb. bottom formed in this way. This means that today’s move lower is not as bearish as it might seem at first sight. Conversely, it looks like the consolidation is getting over and that another move higher in the USDX might be just around the corner.

This, in turn, means that the price of gold would be likely to get back to the decline mode shortly.

That’s what miners’ and silver’s relative performance to it already indicate. Quoting my yesterday’s analysis:

Gold moved somewhat higher, silver soared, and miners were pretty much flat.

In other words, silver outperformed gold on a very short-term basis, while gold miners lagged.

Both types of performance: miners’ weakness and silver’s “strength” are things that we tend to see before prices in the precious metals sector decline.

This means that the short-term bottom that I’ve been writing about in my recent analyses is most likely still ahead. In other words, Friday’s session confirmed what I’ve been writing previously.

It seems that the profits on our current position in mining stocks are going to increase shortly.

Thank you for reading today’s free analysis! The full version of today's analysis includes comments on the second invalidation of breakout above 5,000 in the S&P 500 and the comments on perhaps THE key stock for the entire market - Nvidia. The latter is at a critical juncture, and it can shake the stock market, the currency market, and also the precious metals market. Please remember that with the FEBRUARYLONG coupon you can join my premium subscribers with a $200 discount for the first payment. I'll be very happy to welcome you aboard. Join us at those preferred terms today.

**********

Przemyslaw Radomski,

Przemyslaw Radomski,