What You Don’t Know About Gold’s Relationships Might Hurt You

Some are really simple and casual. Some are intense and intimate. Some blossom, while other deteriorate over time. Some make one a better person, and some drag one straight to hell.

Relationships.

And yes, we didn’t mix-up headers in today’s analysis. Relationships are the foundation of social life, and probably the single most important factor that impacts peoples’ happiness. And you know who ultimately creates markets? People. People are making decisions to buy or sell (or to program algorithms that do). Since relationships are so important and ubiquitous in each individual’s life, is it any wonder that we can spot them also in the markets?

In case of the precious metals market, we have quite a few such relationships, or how we quite often call them – links. Some market relationships are simple and straightforward. Senior mining stocks (producers) and junior mining stocks practically always move together, for example. Other relationships are inverse but not as straightforward, like the one between gold and the USD Index. Or the one between gold and silver.

Oh yeah, right, some markets move together and some move in the opposite directions, but so what? – one might ask, and rightfully so.

If one stops their analysis by simply acknowledging the above, it won’t matter much. It won’t help in determining the direction in which the market is likely to move. Those, however, who dig deeper in the way prices move relative to each other, might be able to discover some specific clues that will make one outlook much more likely than the other.

The real-world example would be a couple that mutually respect each other, and one can tell that by the way they are looking at each other and the words they use toward each other. That’s “bullish” for this relationship. On the other hand, one might detect tiny signs of contempt in the facial micro-expressions of one of the partners while the other talks or does something. That would “make the outlook bearish” for the relationship. And at first sight, both couples would just be talking and sometimes have better or worse days.

In today’s analysis, we’ll guide you through some of the most important relationships in the precious metals market. These gold trading tips are worth keeping in mind as they work on their own, as well as together with other techniques (in combination with them).

Let’s start with the relationship between gold and the USD Index. We previously wrote that this link is inverse, but not particularly straightforward. With regard to the inverse direction in which they move, the explanation is simple. Gold is generally priced in the US dollar, so it cannot move entirely independently from it. Of course, the link goes deeper than just that, for instance, a given move in interest rates usually affects the USD and gold adversely. Gold doesn’t pay interest by itself (not many people reported tiny bars popping up next to bigger bars just like that), but the USD does. If the rates go very low (or negative), there is little incentive to hold paper dollars, and there is a big incentive to buy gold, as it’s performing very well during hyperinflationary periods, and during stagflation.

On the short-term basis, however, things don’t have to work as outlined above. Traders might focus on something else than the above fundamental principles, like extreme fear of economic collapse – just like what we saw in March 2020 and in 2008. During such times, both markets are still likely to move inversely, but the moves might not match exactly.

Instead, on a very short-term basis, the markets might focus – and have been doing so – on technical developments, such as breakouts and breakdowns in the other market. In particular, gold has been more interested in USD’s breakouts and breakdowns, than it’s been in its price moves at their face value.

USDX Signs for Gold and the Miners

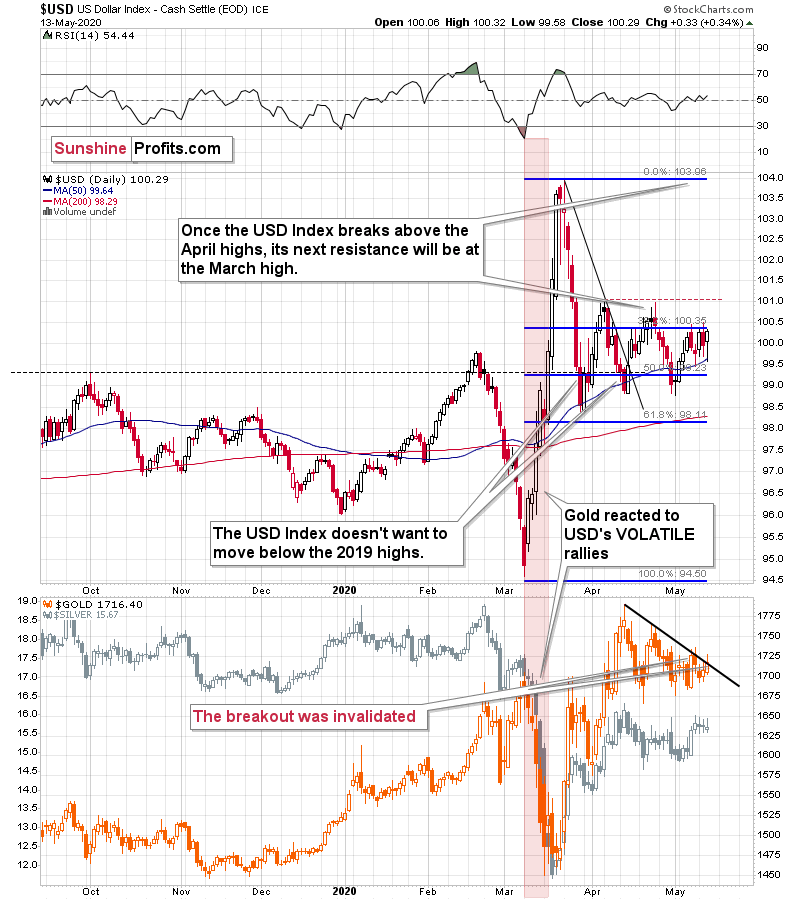

Please consider the last few (April and May) tops in the USD Index. Gold (in the lower part of the above chart) rallied particularly significantly right after the USDX topped – not during its declines.

The USD Index just seemed to have topped earlier this month, and what did gold do? It soared – quite likely based on the expectation that the USD is going to decline, just like what it did twice in April. When instead of declining, the USDX moved back up, gold erased almost the entire daily gain. As the USD Index consolidates without a breakout, traders seem to be increasing their bets on the downturn in the US currency.

Will they be proven correct? In our view, is likely that the USD Index will soar – if not right away, then shortly. It’s after major technical breakouts, and the Covid-19 situation is getting much worse for the developing / BRIC countries, which is likely to trigger demand for the US dollars.

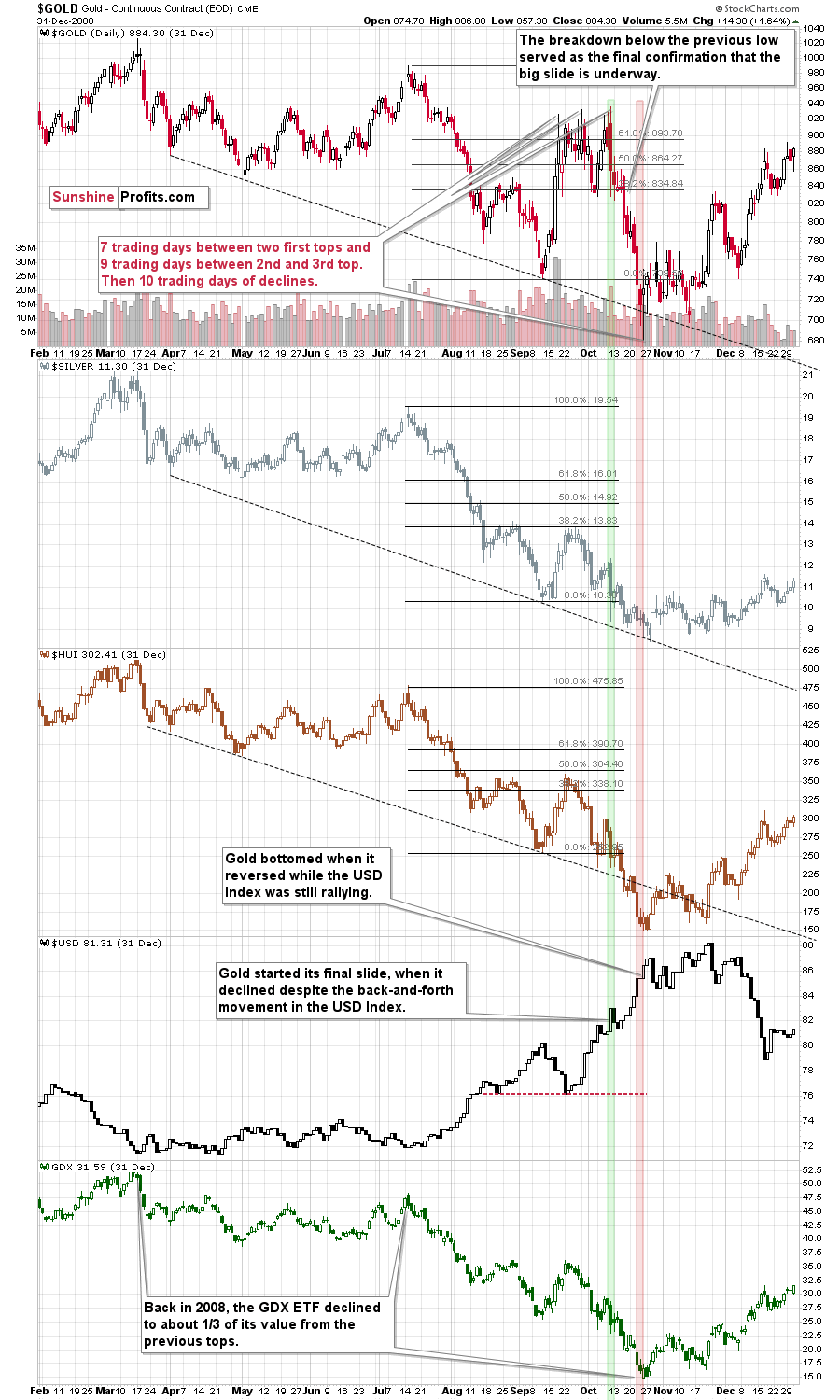

Let’s keep in mind that back in 2008 (and the current situation is still very similar to 2008 i.a. due to the sudden nature of the crisis) the final slide in gold started when the USD Index rallied decisively, breaking above the previous highs.

Back then, gold more or less ignored the earlier USDX gains, but when it finally broke higher, gold plunged, just as if it was catching up with the declines that it ignored previously.

The USD Index has been trading back and forth for several weeks now without a meaningful breakout whatsoever. Perhaps the confirmed breakout above the 101 level will be what triggers the first part of what we think is going to be the final washout slide in the precious metals market.

All in all, we can say that the implications of the relationship between gold and the USD Index appear bearish for gold at this time.

There’s one more relationship that we would like to feature today. It’s the one between gold and gold stocks. It should be really straightforward. Gold producers produce gold, so if the price of gold is going up, the value of the shares of said gold producers should move up as well. And it does work in this way, but it’s not that straightforward as one would think.

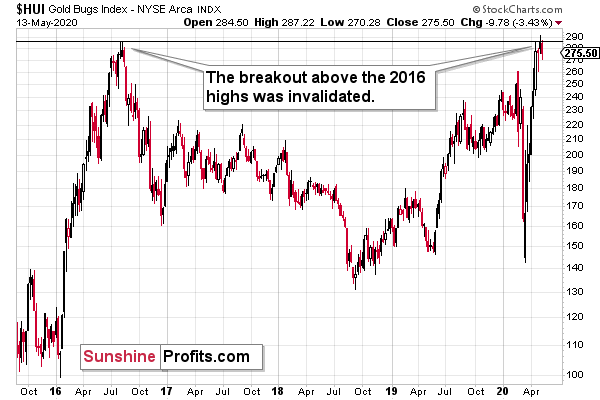

For instance, as gold is right now over $300 above its 2016 high, one would expect prices of gold stocks – on average – to be well above their recent 2016 highs as well, right? Especially that due to lower crude oil prices now vs. in 2016, their operational costs should be viewed as lower.

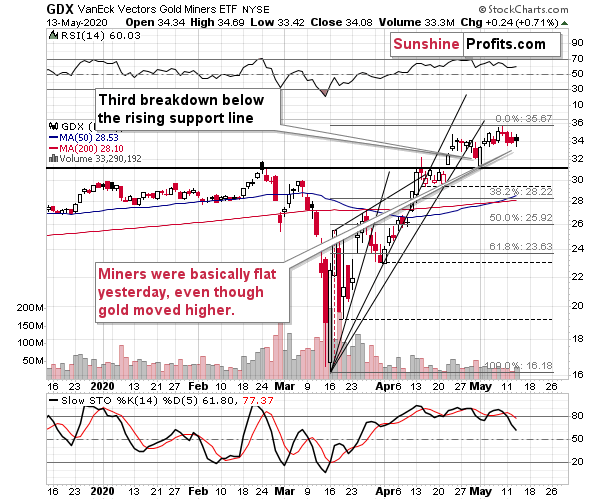

The chart below features gold stocks’ performance since late 2015.

Instead of rallying well above their 2016 highs, they recently attempted to just move above them… And – despite gold being above $1,700 – they actually failed to break higher. The small breakout was quickly invalidated, which shows that something might not be right in case of the precious metals market.

In case of gold – USDX link, we saw that gold reacts with particular sensitivity to USD’s technical developments. In case of the gold – gold stocks link we have a different kind of detail. This detail is that mining stocks tend to stop reacting to gold’s bullish (or bearish) lead before the trend reverses. This doesn’t happen in all cases, but it happens often enough to be viewed as very important detail for one to be on the lookout for.

Remember THE 2011 top in gold? The HUI Index formed the initial high in December 2010 (598) and moved only about 7% higher above this top in August 2011, despite gold’s 30%+ gain during the same time. This kind of link also worked on numerous occasions on a short-term basis.

What does this link tell us now?

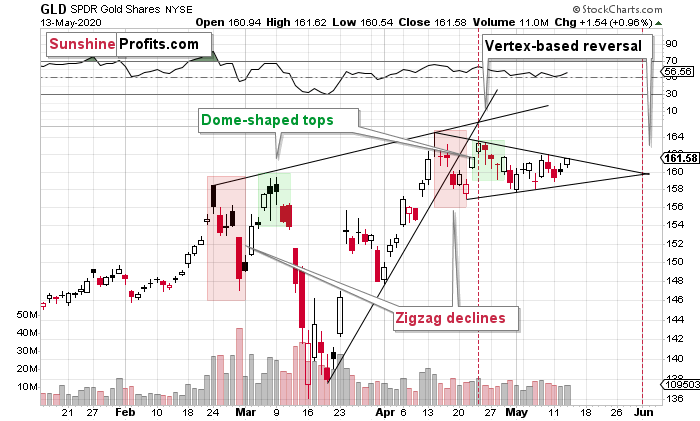

To make the comparison more reliable, we’ll use the GLD ETF as a proxy for gold and we’ll use the GDX ETF as a proxy for mining stocks – so that the opening and ending hours of the sessions are identical.

GLD just moved higher yesterday, and that was the highest daily closes of May.

And the GDX?

The GDX did almost nothing yesterday. It moved a bit higher, but yesterday’s close was still almost 3% below the highest close of this month. What does it tell us?

It’s a sign that gold is likely topping here. The 2011 example showed a much more profound top than the one that we likely see right now. After the 2011 high, gold declined for years, and given the looming stagflation, gold is unlikely to decline for long. If the upcoming decline is likely to be short, then a more short-term topping signal seems to be an appropriate trigger. And that’s what the very recent GDX performance provides.

Consequently, even despite the very positive outlook for gold for the future years, it seems that it will still decline in the following weeks. Naturally, this gold forecast is based on more factors than just the two intra-market relationships that we discussed today, but they serve as a good confirmation of the bearish outlook.

Thank you for reading today’s free analysis. In the full version of the analysis, we also feature our preferred way of taking advantage of the current situation and the analogies to the previous price moves. If you’d like to read those premium details, we have good news. As soon as you sign up for our free gold newsletter, you’ll get 7-day access of no-obligation trial of our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits: Analysis. Care. Profits.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,