Bulls Set To Be Tasered Again By Severe Down-Leg

The stock market is toxic! It’s very important that you don’t get seduced by the old siren song of Wall Street about “buying the dip” and other nonsense like “being selective”. While these strategies have worked up to now, they won’t any longer, because we are now in a bear market. Furthermore it looks like we are on the verge of another plunge.

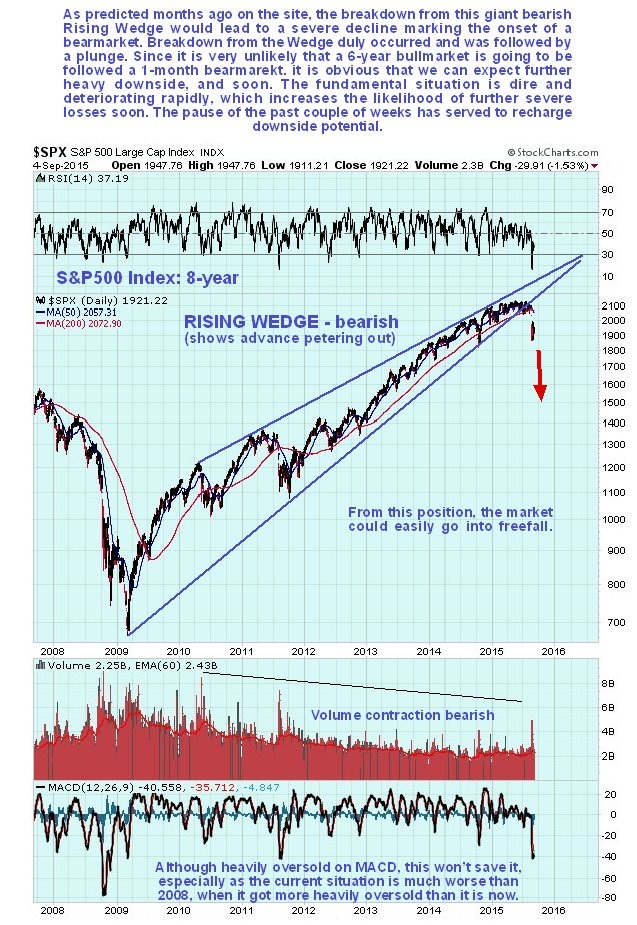

The past few weeks have been momentous. The stock market has finally broken down from the huge bearish Rising Wedge that we had delineated many months ago, as shown on the 8-year chart for the S&P500 index below. The validity and importance of this Bearish Rising Wedge is amply demonstrated by the fact that after the index broke down from it, it plunged.

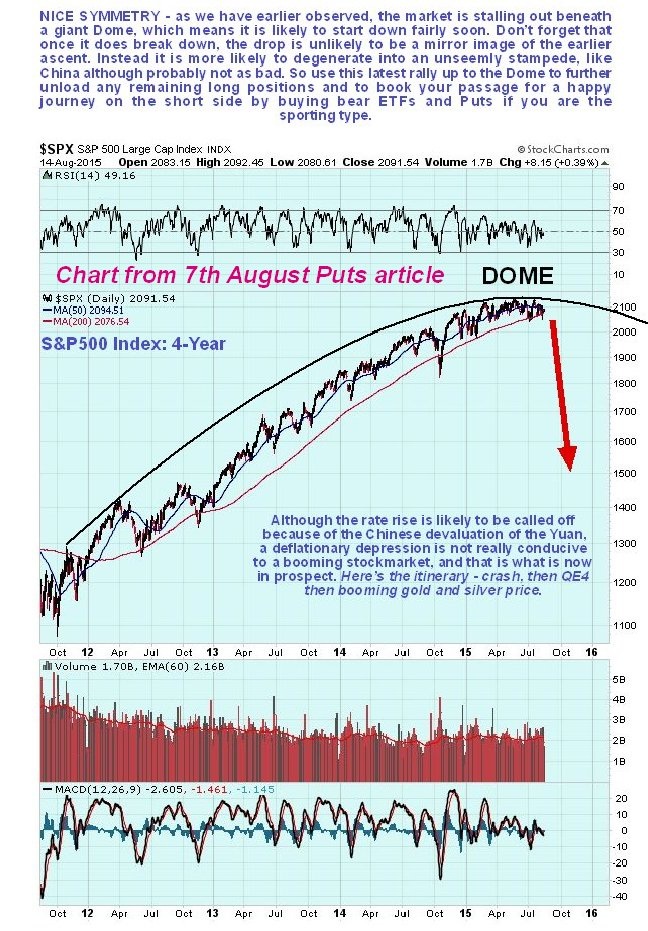

There’s an old saying that “they don’t ring a bell at the top”. Oh really? – they do if you are able to hear it. Witness the chart posted on clivemaund.com a week or so before it turned lower and proceeded to break down and plunge…

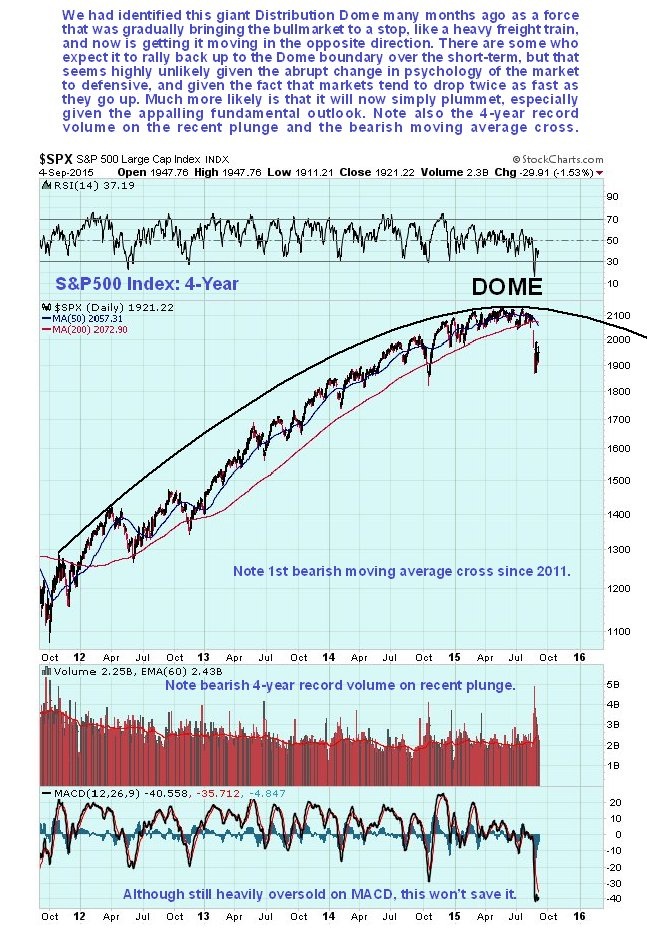

We had also correctly identified and delineated a massive Distribution Dome forming in the S&P500 index and how the market was topping out at the apex of the Dome during the summer. The market is now breaking lower, but don’t make the mistake of thinking that it will rally back to the Dome boundary again – it won’t because markets drop twice as fast as they go up, due to fear being a stronger emotion than greed. Before leaving this chart note that we have seen the first bearish moving average cross for 4 years, and volume on the recent plunge was the heaviest for 4 years, which is also bearish.

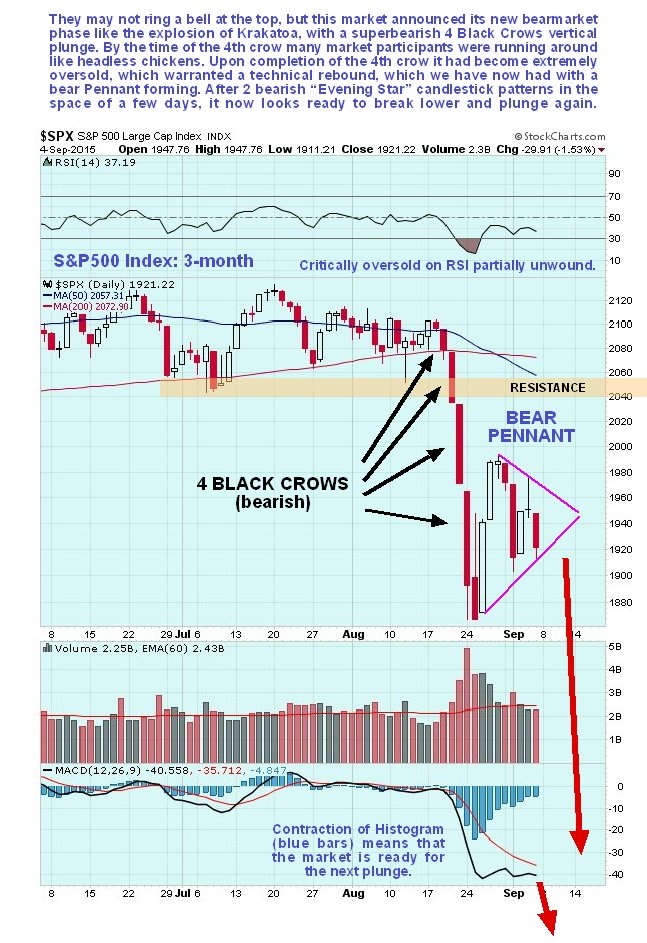

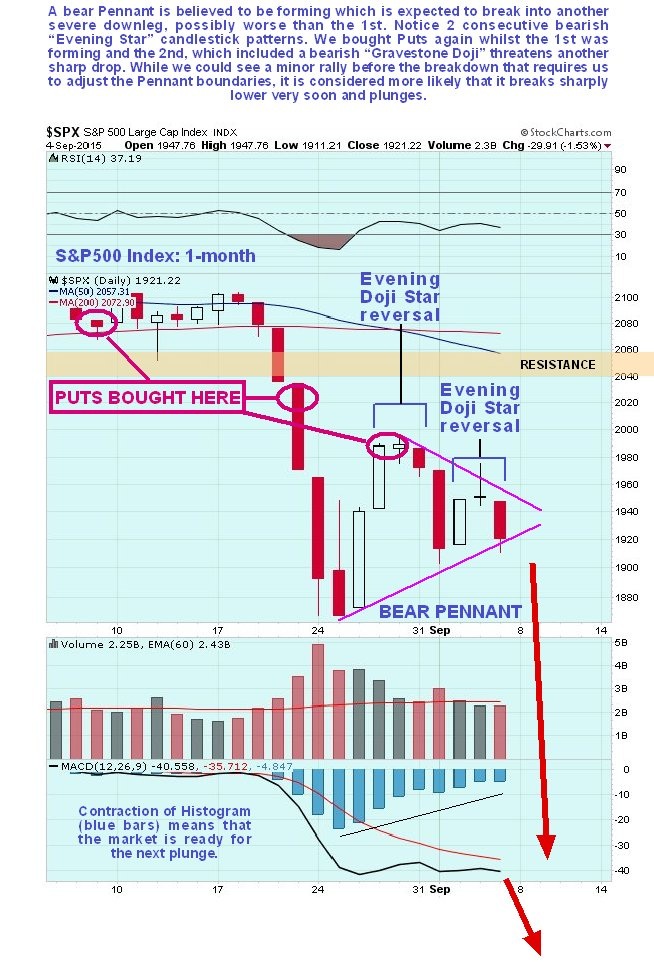

Now we turn to shorter-term charts to see what’s likely to happen next. On the 3-month chart for the S&P500 index we see that the bear market phase kicked off with a super-bearish “4 Black Crows” candlestick pattern. Although this pattern is very bearish indeed, by the time the 4th crow has completed the market is obviously heavily oversold and in need of a breather – hence the bounce-back and congestion pattern of the past 2 weeks, which most unfortunately for the bulls, looks like a bear Pennant. Although this Pennant may take a little longer to complete so that we have to adjust its boundaries somewhat, action in recent days suggests that the market will break lower again imminently into another plunge probably of similar magnitude to the 1st, and possibly worse, as the penny finally drops amongst the mob that this is not just a dip but something far worse.

To see in detail the bearish action of recent days which suggests that the market will break lower again imminently and plunge, we will now look at a 1-month chart, which opens out the congestion pattern of the past 2 weeks. On this chart we see that, in addition to clivemaund.com subscribers sitting on very large profits having bought Puts at the points shown, there were 2 bearish “Evening Doji Star” candlestick patterns in succession over the past 7 trading sessions. We spotted the 1st one forming which is why we bought more Puts, and the 2nd one, which included a very bearish “Gravestone Doji” at its high, suggests that instead of further flimflamming around, the market is going to break lower and plunge again very soon, and if the pattern of the past 2 weeks is indeed a bear Pennant, it means that the next plunge will be at least of the same magnitude as the 1st. This is important as it gives us an idea regarding when to ditch the Puts (and bear ETFs). The approach of the MACD indicator shown at the bottom of the chart to its moving average, and the contraction of the MACD histogram back towards the zero line are a further indication that the market is now ready to drop again.

Given the awful and rapidly worsening fundamental outlook, it is actually surprising that the market has held up as long as it has. We have global debt saturation, which is the core reason for the looming collapse, involving a festering Sovereign Debt Crisis in Europe, a hopeless intractable insoluble debt crisis in Japan, ballooning deficits in the US, an imploding Ponzi scheme debt bubble in China, a commodity market that has already collapsed, Emerging Markets that are collapsing, and to cap it all a world in denial. The Fed faces a desperate dilemma – it wants to start a rising interest rate cycle in order to eventually scale down its massive balance sheet and to head off a threatening collapse of the dollar and Treasury market, but if does so it will collapse the stock market and create a depression. It is raises rates at its next meeting on 16th – 17th markets will crash. If it doesn’t raise them, markets will probably crash anyway, because it will be interpreted as meaning that the economy is too weak to handle even a miniscule rate rise. Our interpretation is that the markets could collapse without waiting for the Fed, since the writing is already on the wall, because the Fed would willingly sacrifice the stock market in an attempt to save the more important dollar and bond market, as setting up a rate differential with the rest of the world will sluice a vast torrent of funds into the US and create a cushion – this could loop round and end up supporting the stock market again later, regardless of the state of the economy. The US has always been ahead of the competition when it comes to setting global economic policy to its advantage – you only have to look at the establishment of the dollar as the global reserve currency to see that. It leads and the others follow.

Related Articles

Global Stock Markets Are Between Apocalypse And Armageddon

Becoming Battered Billionaires

Preparing For The CRASH – S&P500 Index Analysis – Inverse ETFs & PUTs Timing

How Much Will The DOW Index Correct In The Developing 2015-2016 Bear Market?

Red Alert For Second Stock Market Crash Down-Wave

********

Here at clivemaund.com we have already racked up big gains on this collapse thus far, having bought a raft of bear ETFs on August 1st close to the market peak and Puts on 7th August and again on 21st as the crash started, and we are in position to make massive gains if the market proceeds to plunge further as expected and stand ready to exit our positions the moment it looks like the 2nd oversold trough is at hand.

Courtesy of Courtesy of http://www.clivemaund.com